Answered step by step

Verified Expert Solution

Question

1 Approved Answer

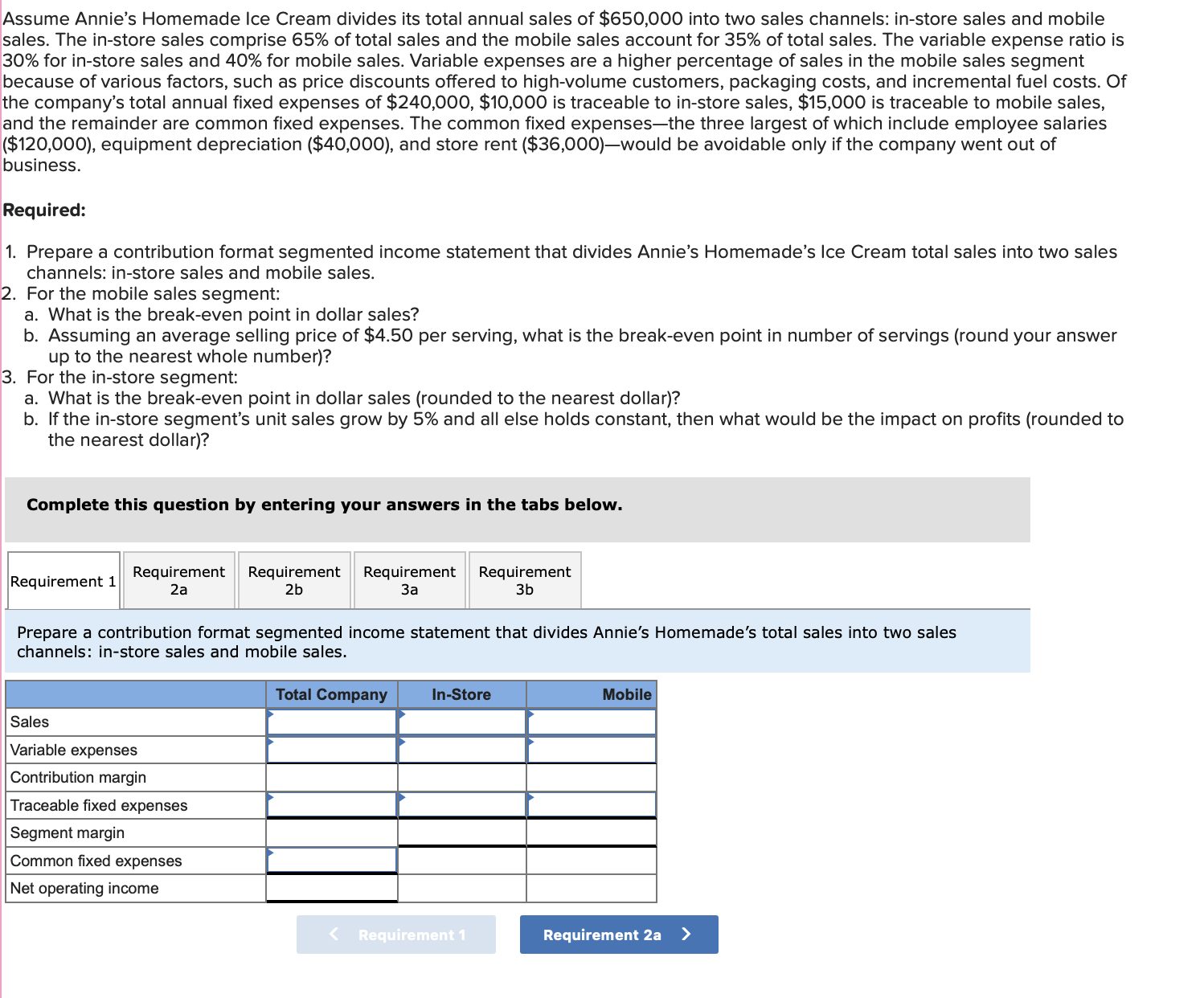

Assume Annie's Homemade Ice Cream divides its total annual sales of $ 6 5 0 , 0 0 0 into two sales channels: in -

Assume Annie's Homemade Ice Cream divides its total annual sales of $ into two sales channels: instore sales and mobile

sales. The instore sales comprise of total sales and the mobile sales account for of total sales. The variable expense ratio is

for instore sales and for mobile sales. Variable expenses are a higher percentage of sales in the mobile sales segment

because of various factors, such as price discounts offered to highvolume customers, packaging costs, and incremental fuel costs. Of

the company's total annual fixed expenses of $$ is traceable to instore sales, $ is traceable to mobile sales,

and the remainder are common fixed expenses. The common fixed expensesthe three largest of which include employee salaries

$ equipment depreciation $ and store rent $would be avoidable only if the company went out of

business.

Required:

Prepare a contribution format segmented income statement that divides Annie's Homemade's Ice Cream total sales into two sales

channels: instore sales and mobile sales.

For the mobile sales segment:

a What is the breakeven point in dollar sales?

b Assuming an average selling price of $ per serving, what is the breakeven point in number of servings round your answer

up to the nearest whole number

For the instore segment:

a What is the breakeven point in dollar sales rounded to the nearest dollar

b If the instore segment's unit sales grow by and all else holds constant, then what would be the impact on profits rounded to

the nearest dollar

Complete this question by entering your answers in the tabs below.

Prepare a contribution format segmented income statement that divides Annie's Homemade's total sales into two sales

channels: instore sales and mobile sales.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started