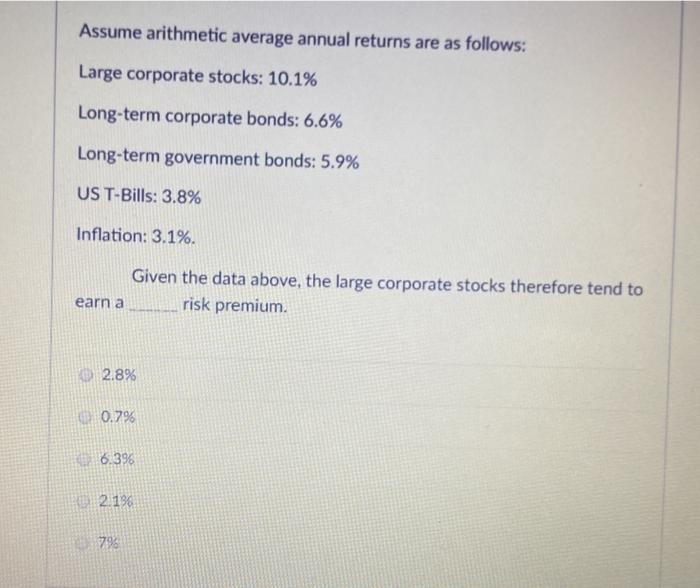

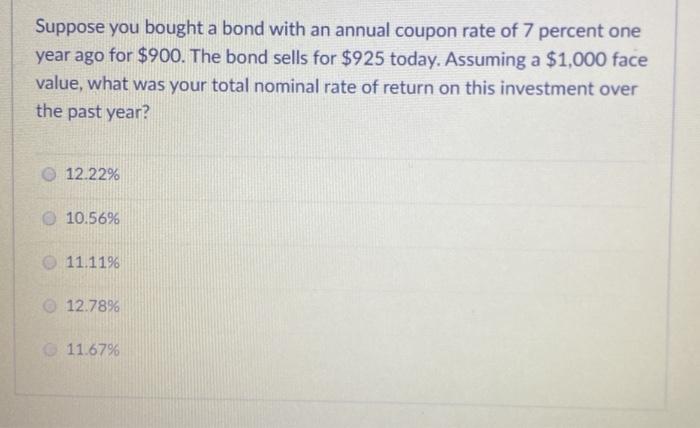

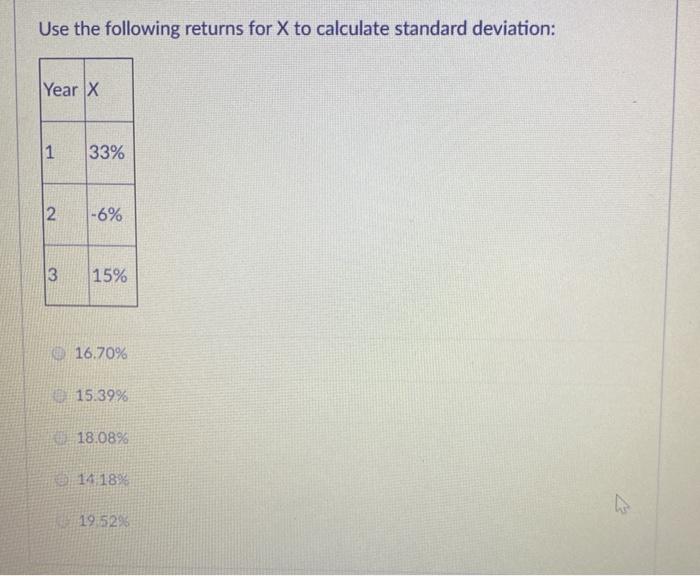

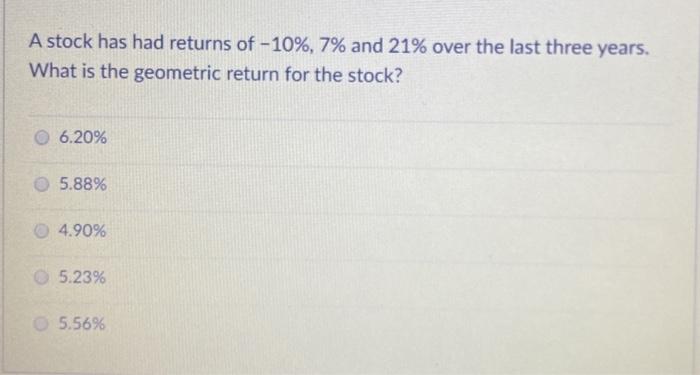

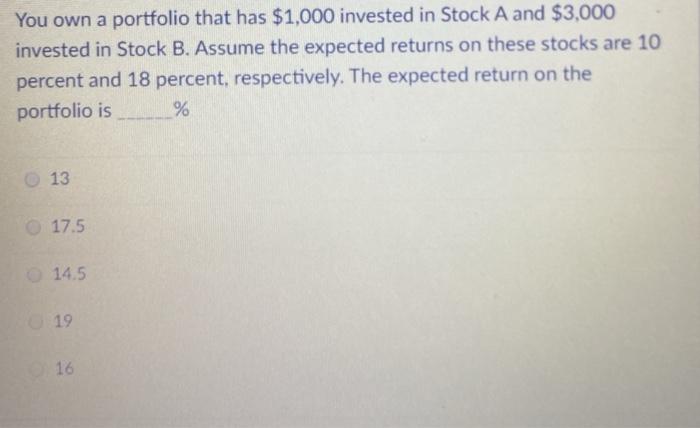

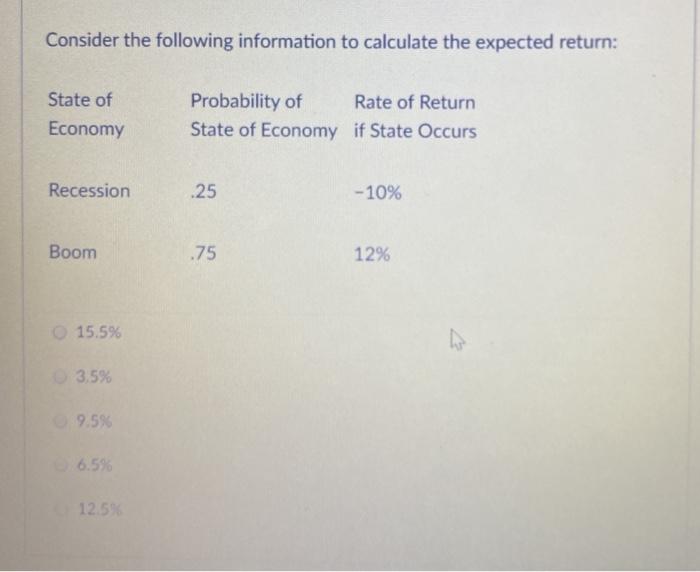

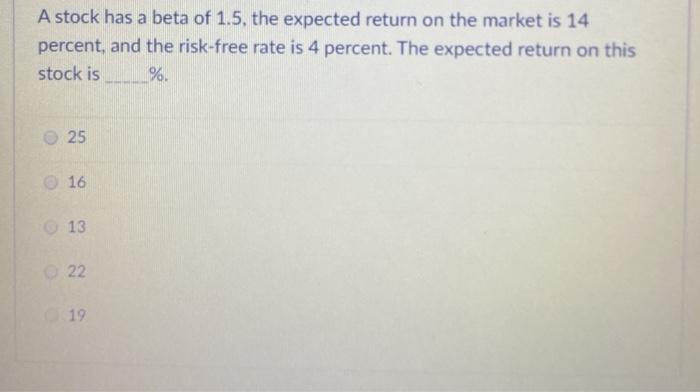

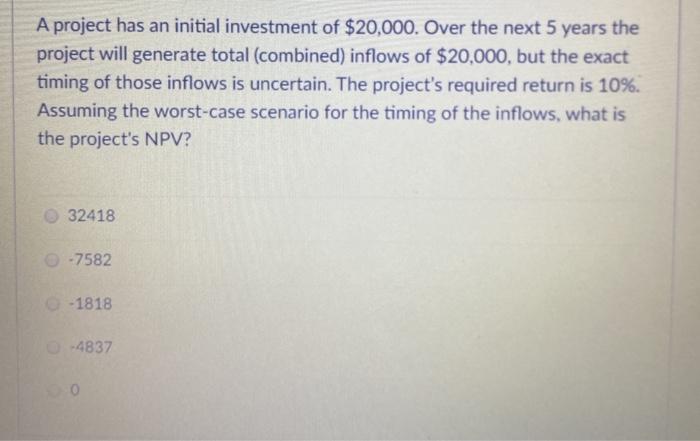

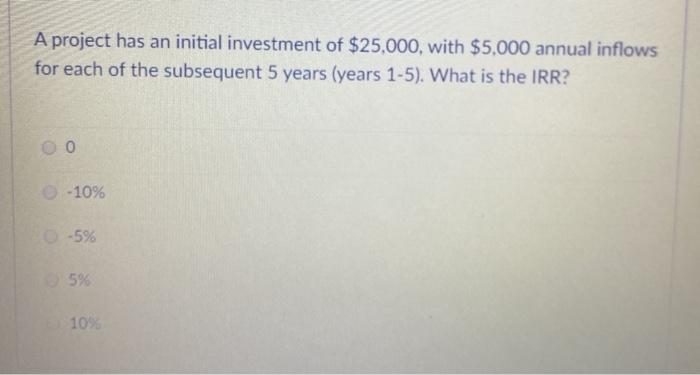

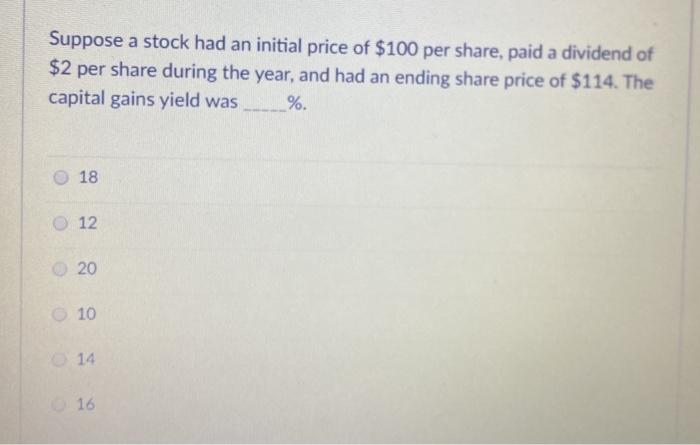

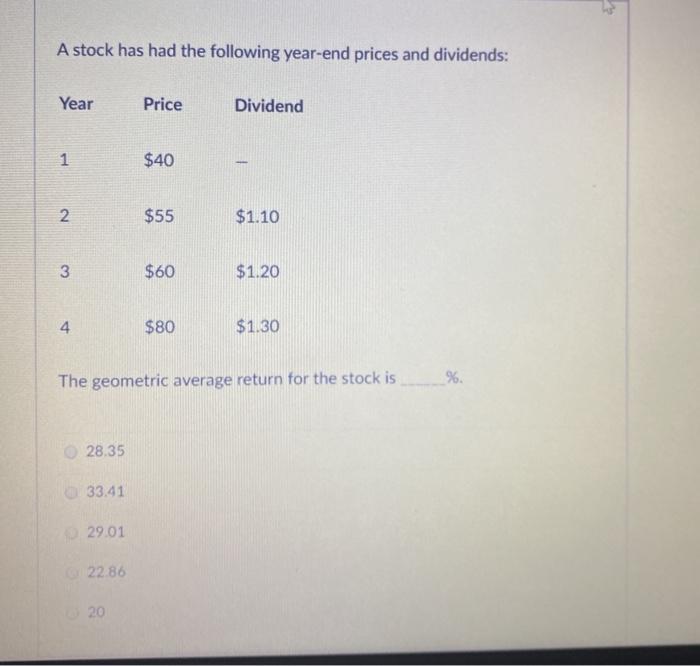

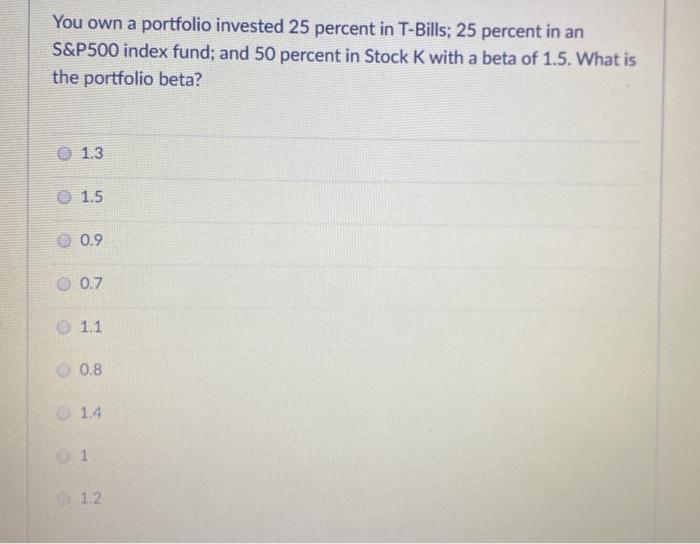

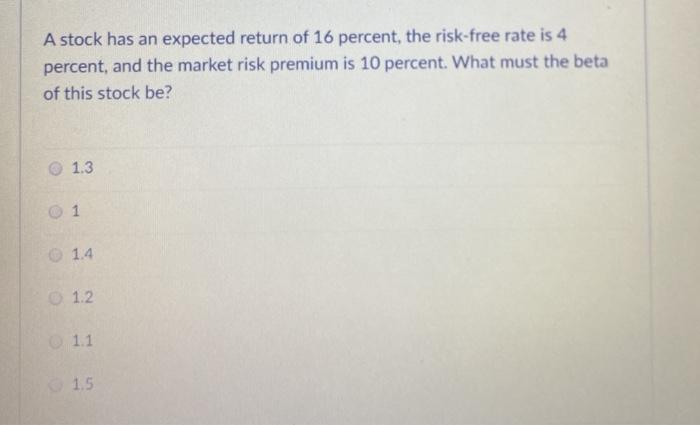

Assume arithmetic average annual returns are as follows: Large corporate stocks: 10.1% Long-term corporate bonds: 6.6% Long-term government bonds: 5.9% US T-Bills: 3.8% Inflation: 3.1%. Given the data above, the large corporate stocks therefore tend to earn a risk premium. 12.8% 0.79 6.396 2.19 796 Suppose you bought a bond with an annual coupon rate of 7 percent one year ago for $900. The bond sells for $925 today. Assuming a $1,000 face value, what was your total nominal rate of return on this investment over the past year? 12.22% 10.5696 11.11% 12.78% 11.67% Use the following returns for X to calculate standard deviation: Year X 1 1 33% N -6% 13 15% 16.70% 15.39% 18.08% se 14189 19 529 A stock has had returns of -10%, 7% and 21% over the last three years. What is the geometric return for the stock? 6.20% 5.88% 04.90% 5.23% 5.56% You own a portfolio that has $1,000 invested in Stock A and $3,000 invested in Stock B. Assume the expected returns on these stocks are 10 percent and 18 percent, respectively. The expected return on the portfolio is % 13 17.5 14.5 19 16 Consider the following information to calculate the expected return: State of Economy Probability of Rate of Return State of Economy if State Occurs Recession .25 -10% Boom 1.75 12% 15.5% 3.5% 9.586 6.5% 12.5 A stock has a beta of 1.5, the expected return on the market is 14 percent, and the risk-free rate is 4 percent. The expected return on this stock is %. 25 16 13 22 19 A project has an initial investment of $20,000. Over the next 5 years the project will generate total (combined) inflows of $20,000, but the exact timing of those inflows is uncertain. The project's required return is 10%. Assuming the worst-case scenario for the timing of the inflows, what is the project's NPV? 32418 -7582 -1818 4837 O A project has an initial investment of $25,000, with $5,000 annual inflows for each of the subsequent 5 years (years 1-5). What is the IRR? OO -10% -5% 5% 10% Suppose a stock had an initial price of $100 per share, paid a dividend of $2 per share during the year, and had an ending share price of $114. The capital gains yield was %. 18 12 20 10 0 14 16 A stock has had the following year-end prices and dividends: Year Price Dividend 1 1 $40 2. . $55 $1.10 3 $60 $1.20 4 $80 $1.30 The geometric average return for the stock is %. 28.35 33.41 29.01 22.86 20 You own a portfolio invested 25 percent in T-Bills: 25 percent in an S&P500 index fund; and 50 percent in Stock K with a beta of 1.5. What is the portfolio beta? 1.3 1.5 0.9 O 0.7 1.1 O 0.8 0 1.4 D1 1.2 A stock has an expected return of 16 percent, the risk-free rate is 4 percent, and the market risk premium is 10 percent. What must the beta of this stock be? 1.3 1 1.4 1.2 1.1 1.5