Answered step by step

Verified Expert Solution

Question

1 Approved Answer

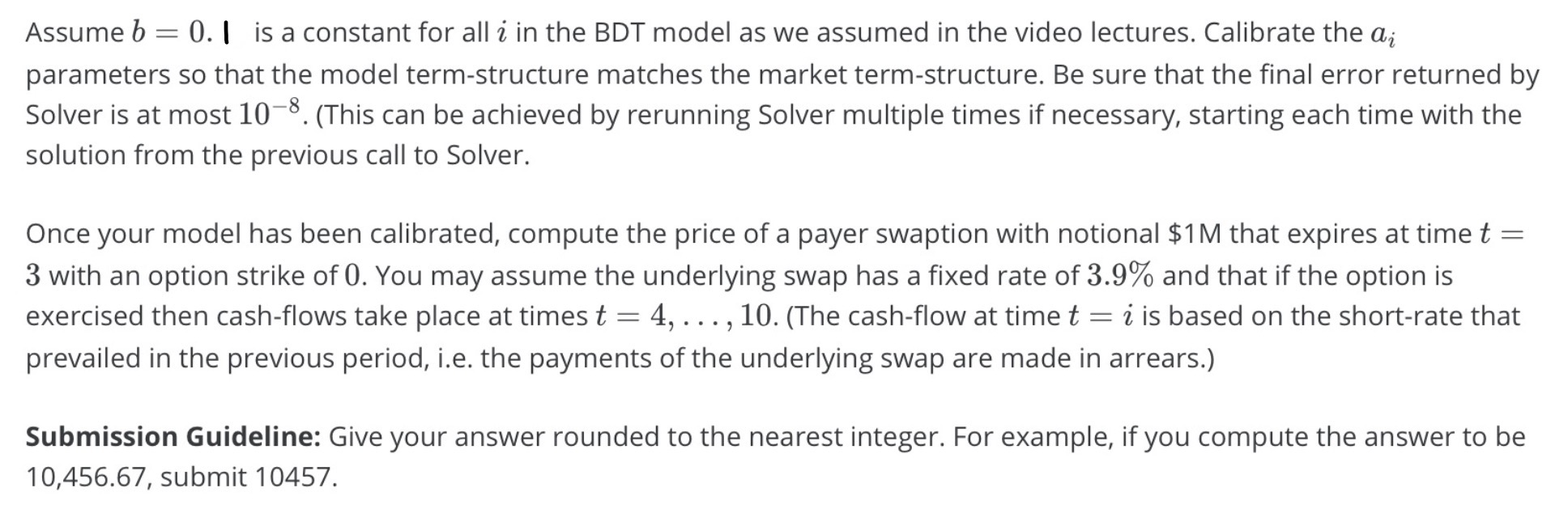

Assume b = 0.1 is a constant for all i in the BDT model as we assumed in the video lectures. Calibrate the ai

Assume b = 0.1 is a constant for all i in the BDT model as we assumed in the video lectures. Calibrate the ai parameters so that the model term-structure matches the market term-structure. Be sure that the final error returned by Solver is at most 10-8. (This can be achieved by rerunning Solver multiple times if necessary, starting each time with the solution from the previous call to Solver. = Once your model has been calibrated, compute the price of a payer swaption with notional $1M that expires at time t 3 with an option strike of 0. You may assume the underlying swap has a fixed rate of 3.9% and that if the option is exercised then cash-flows take place at times t = 4, ..., 10. (The cash-flow at time t = i is based on the short-rate that prevailed in the previous period, i.e. the payments of the underlying swap are made in arrears.) Submission Guideline: Give your answer rounded to the nearest integer. For example, if you compute the answer to be 10,456.67, submit 10457.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started