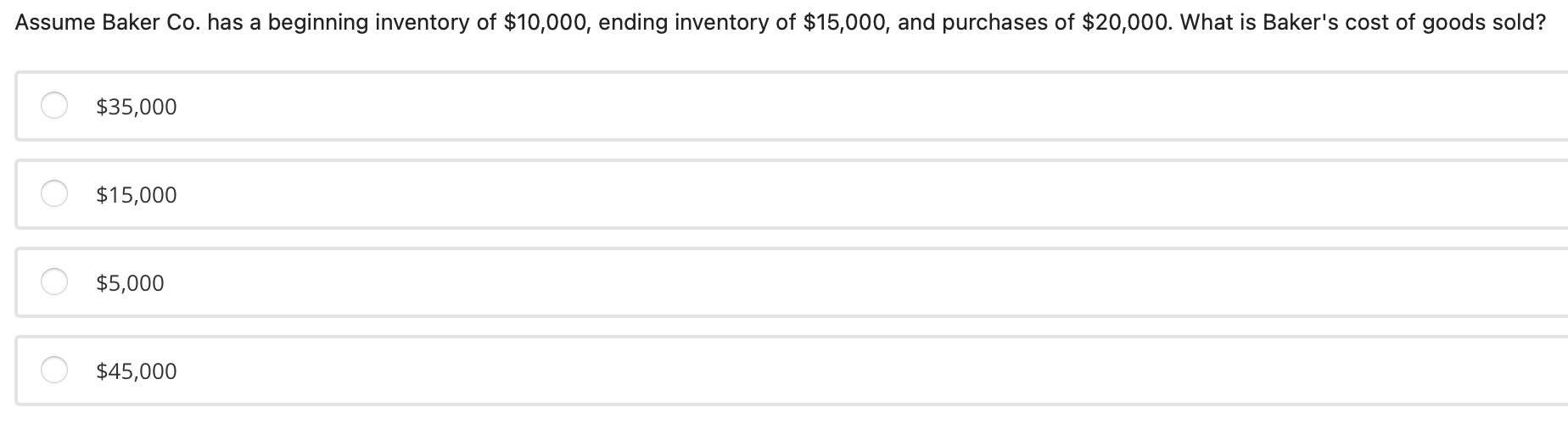

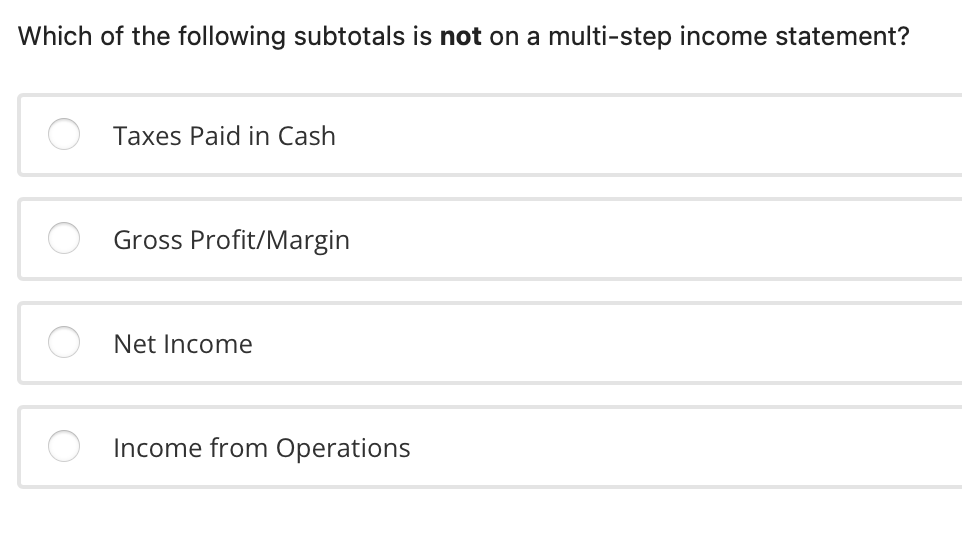

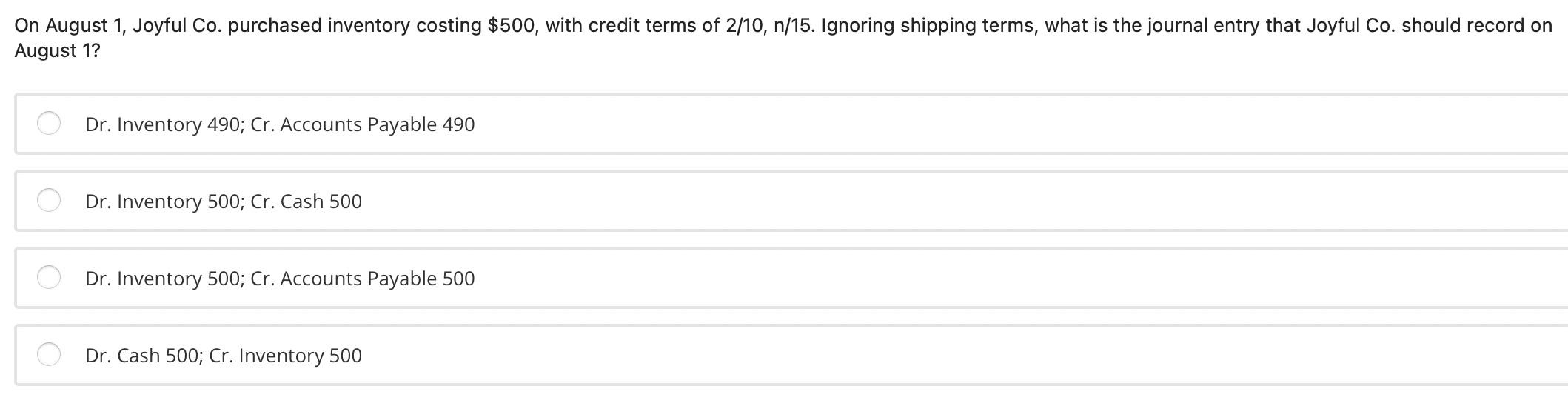

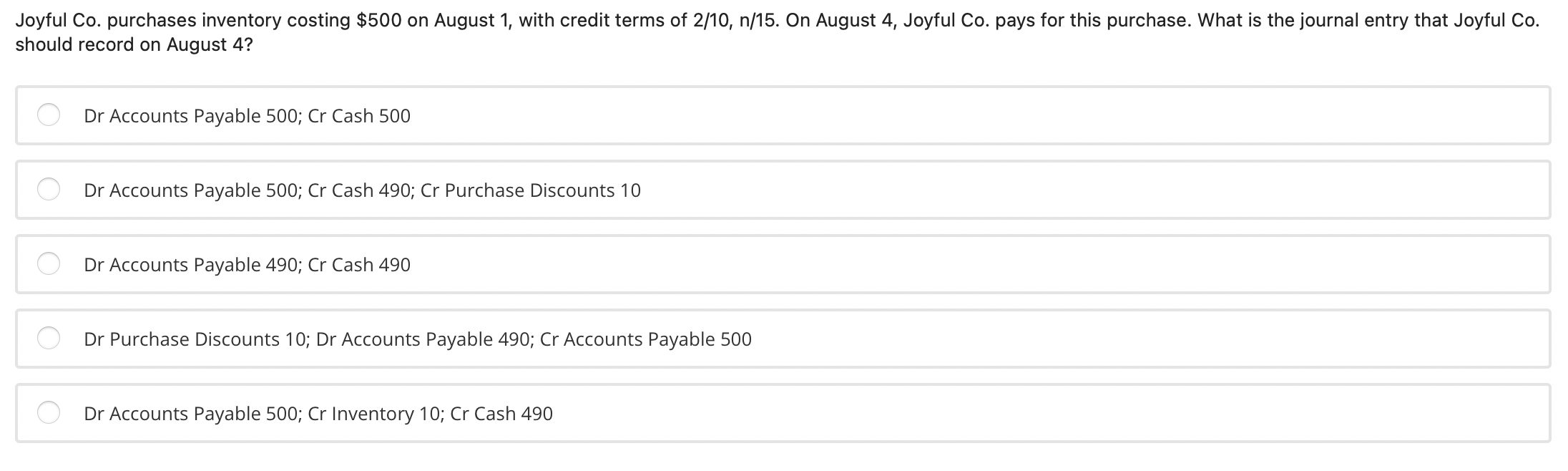

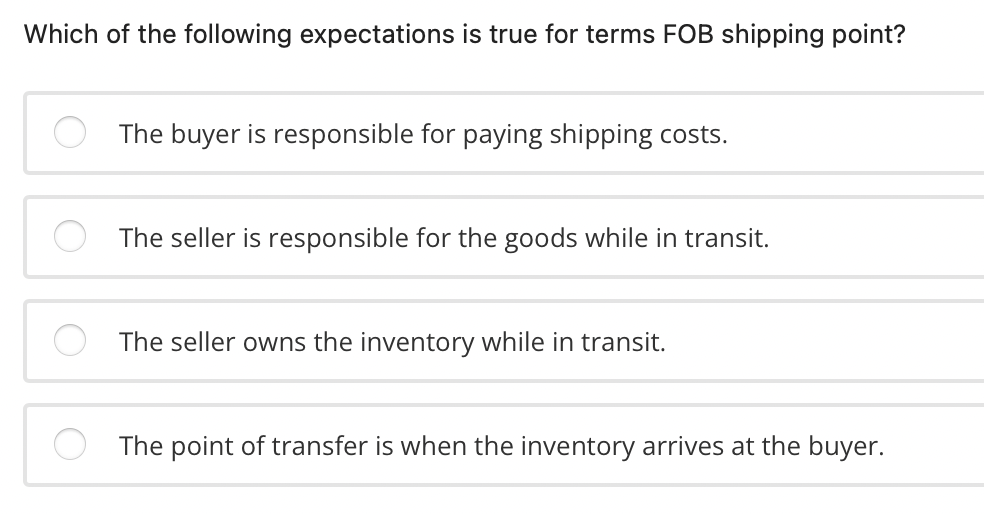

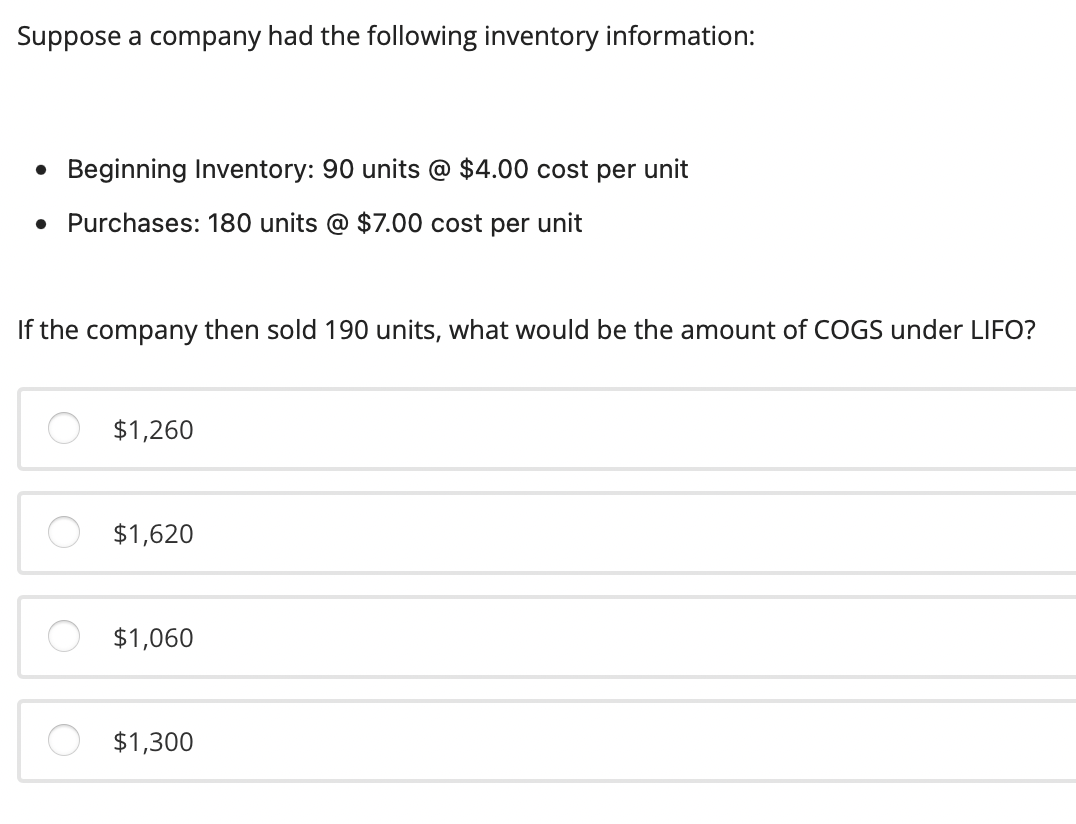

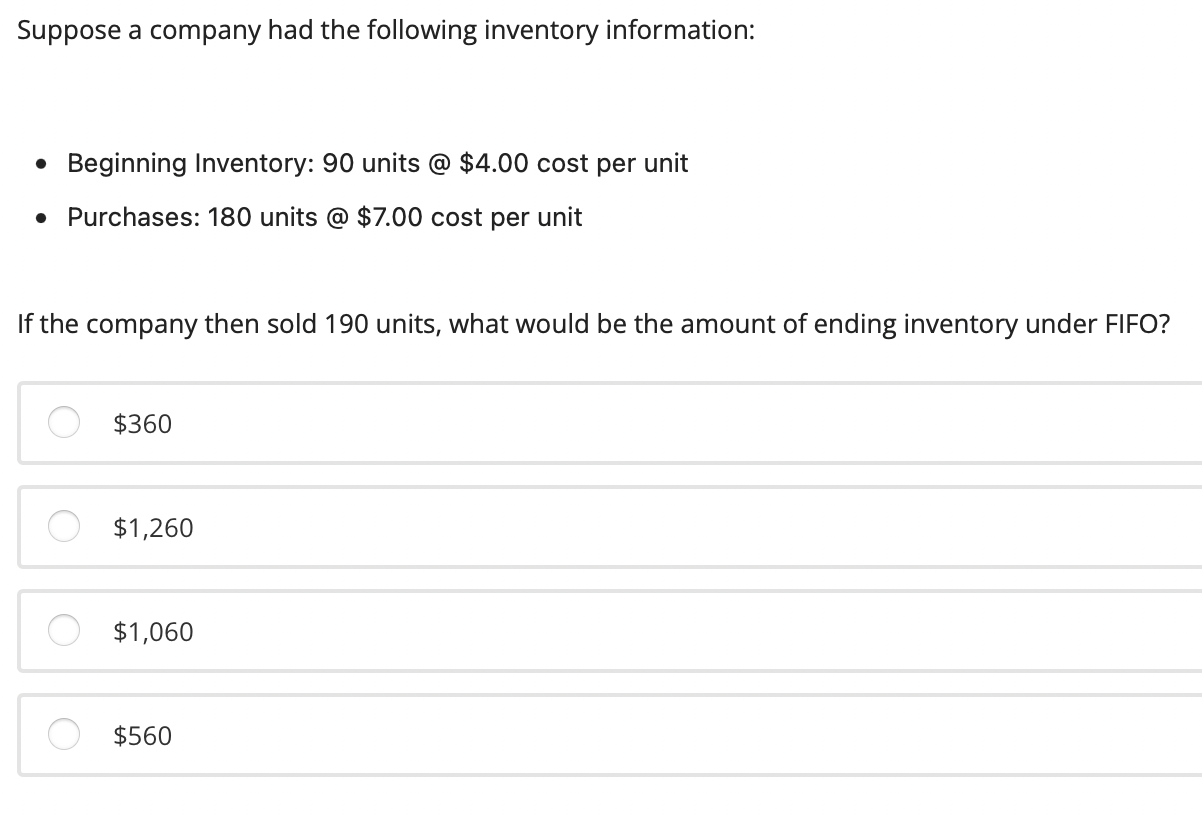

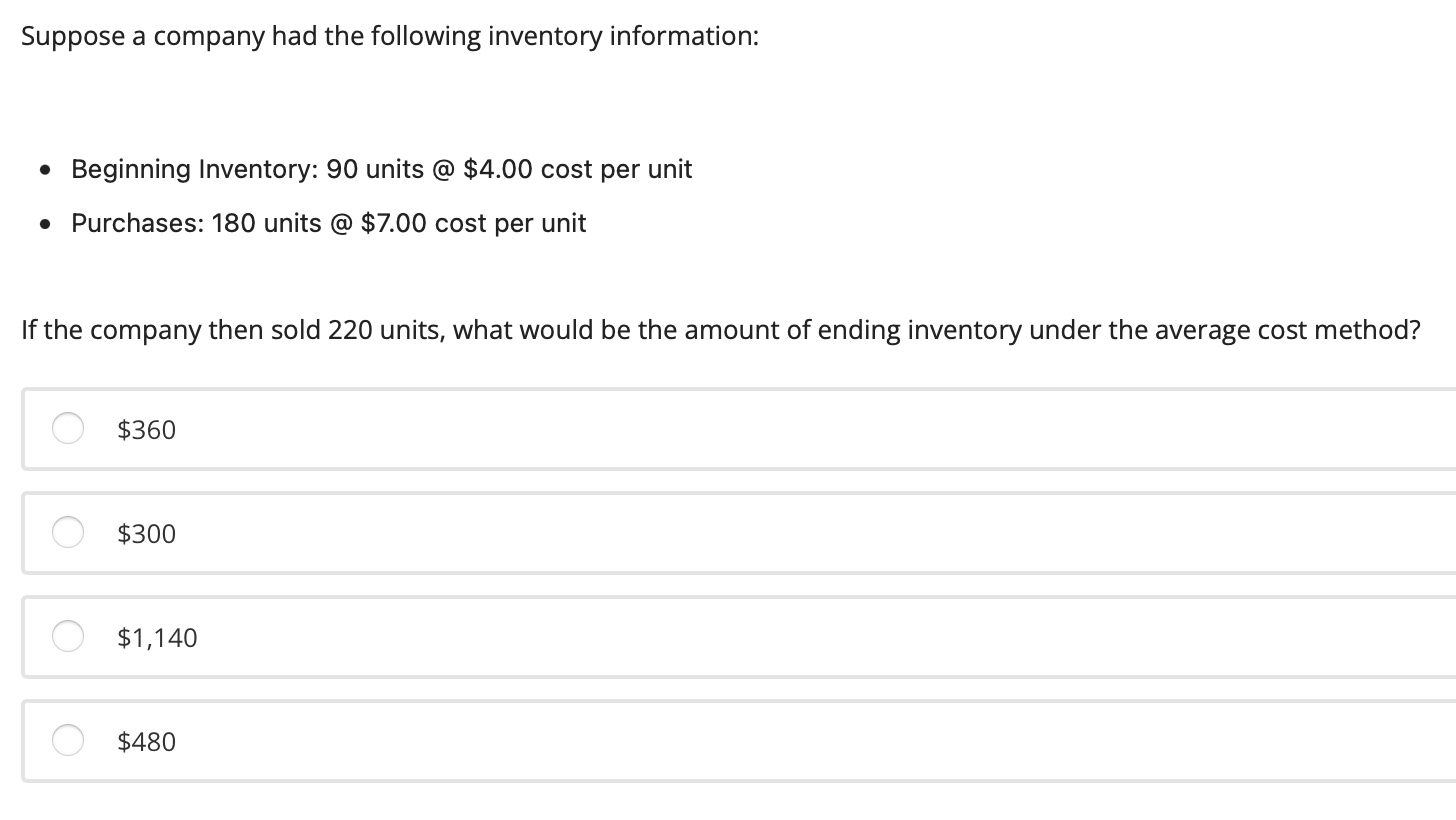

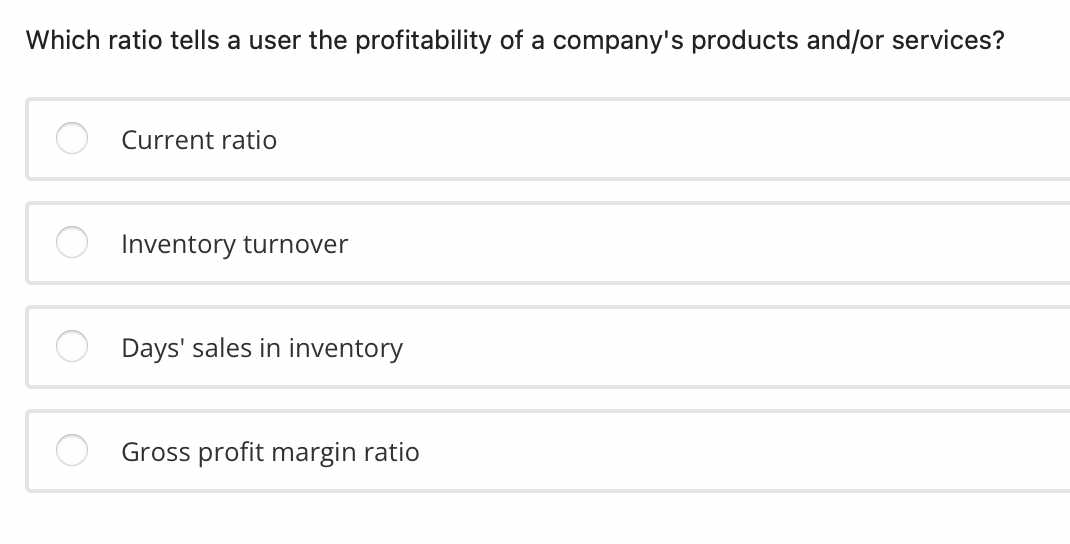

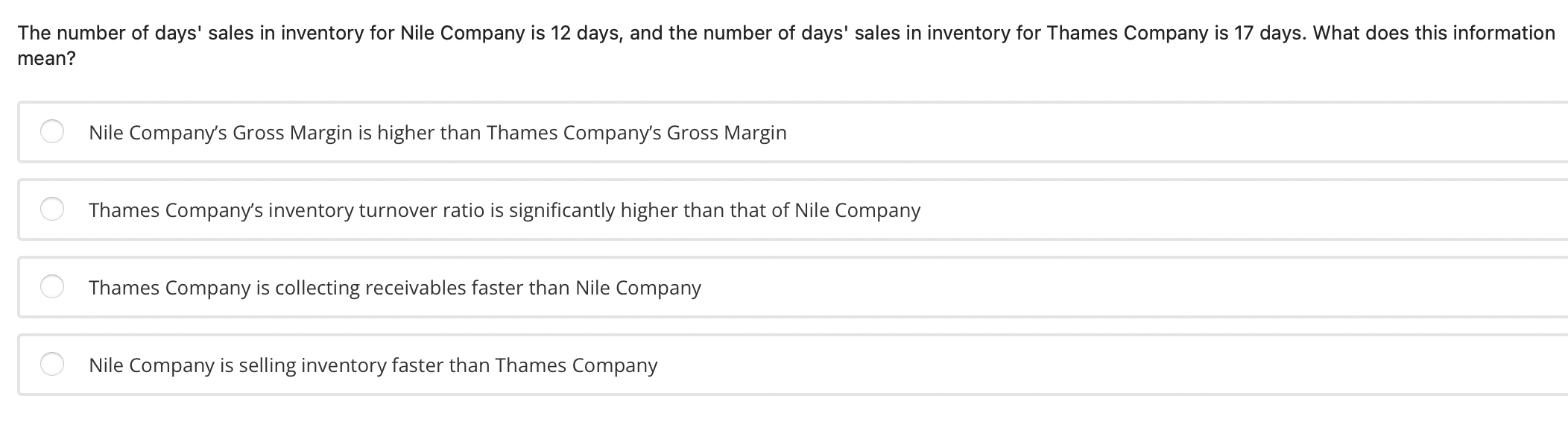

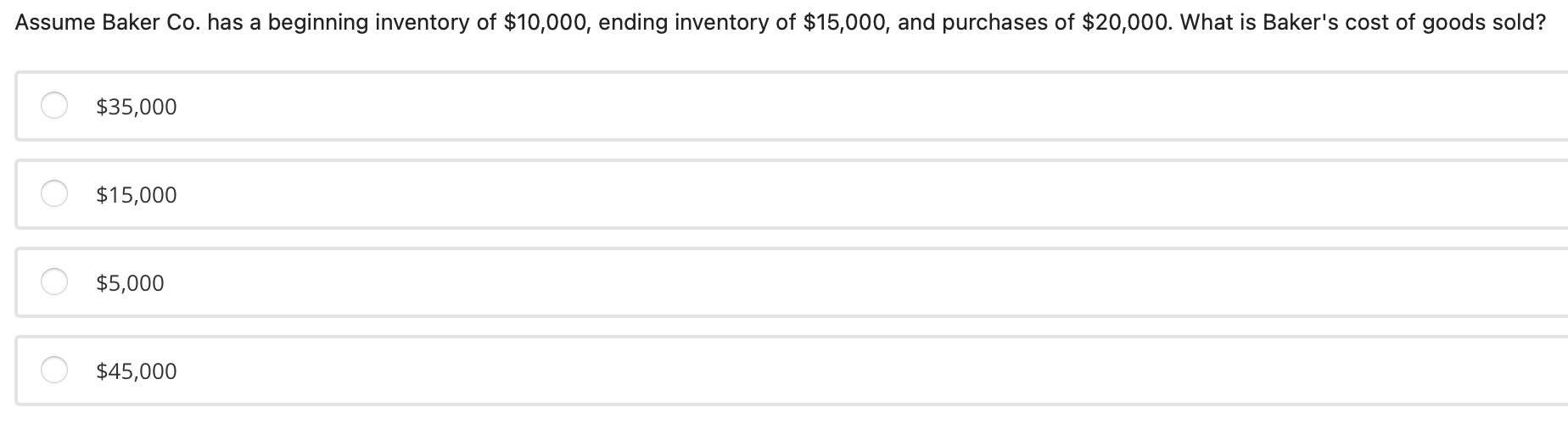

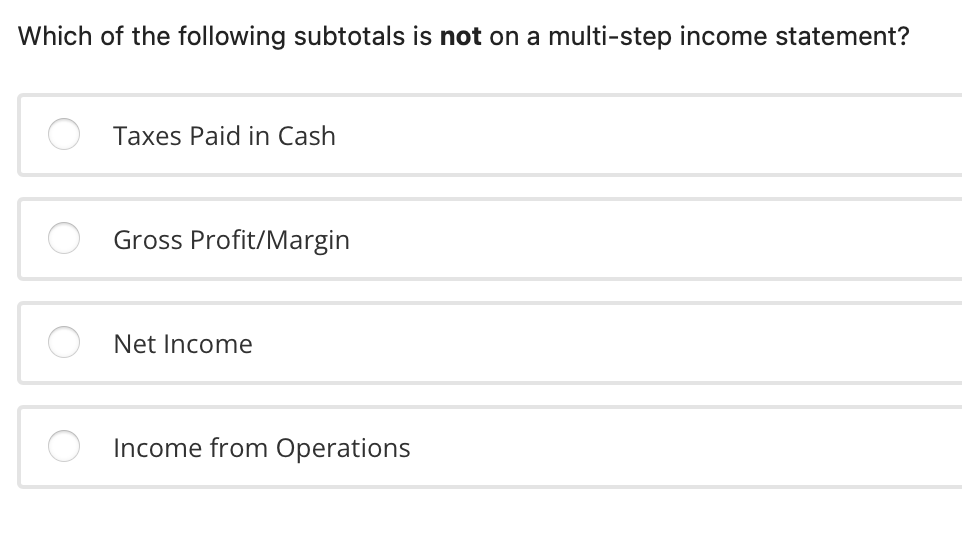

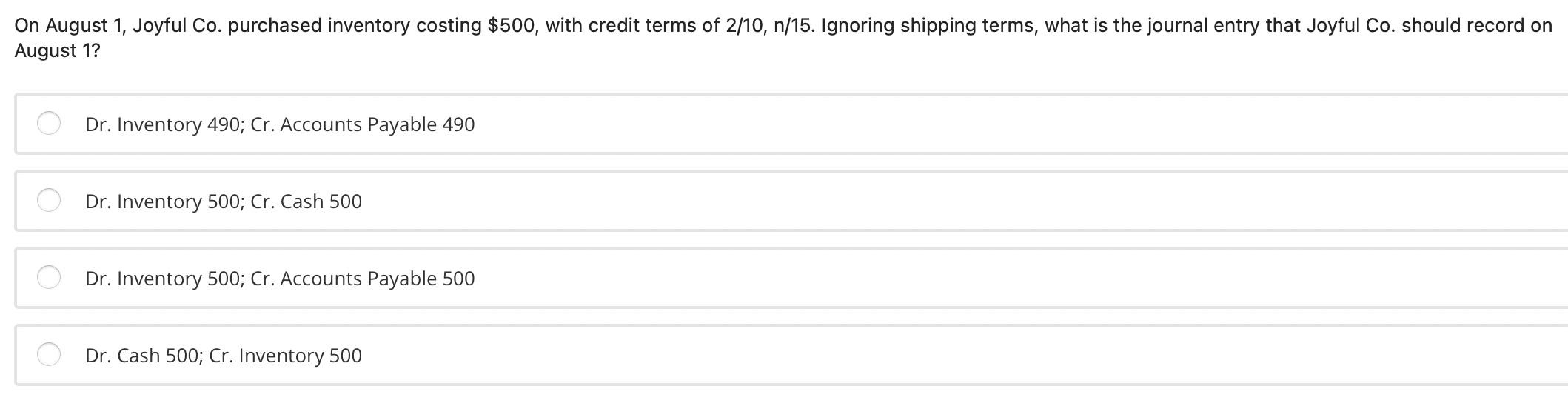

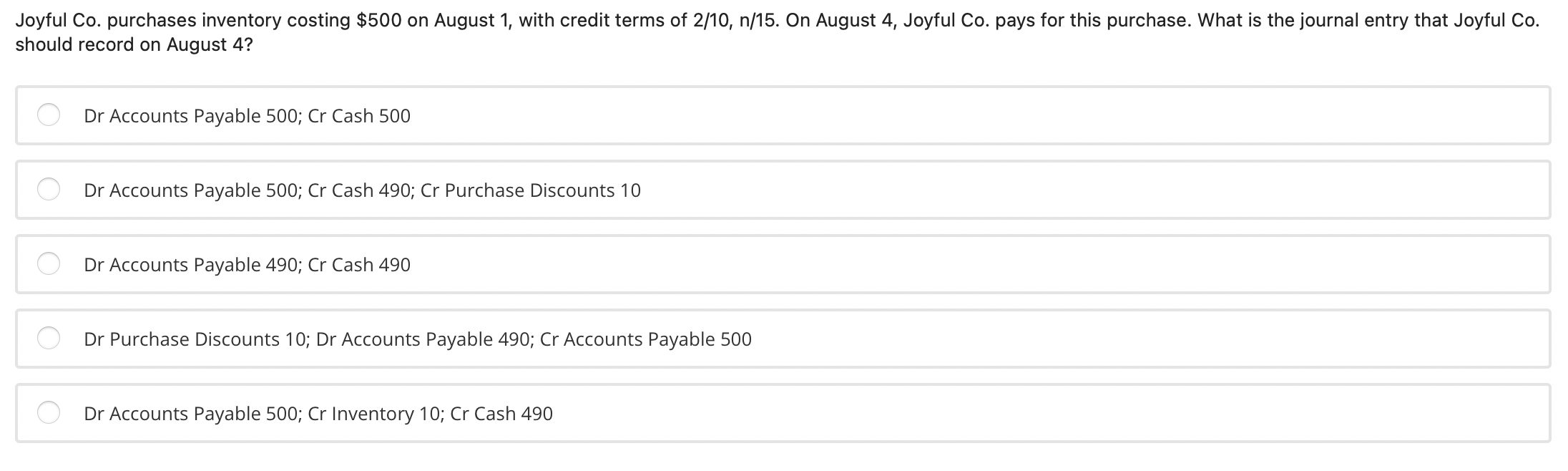

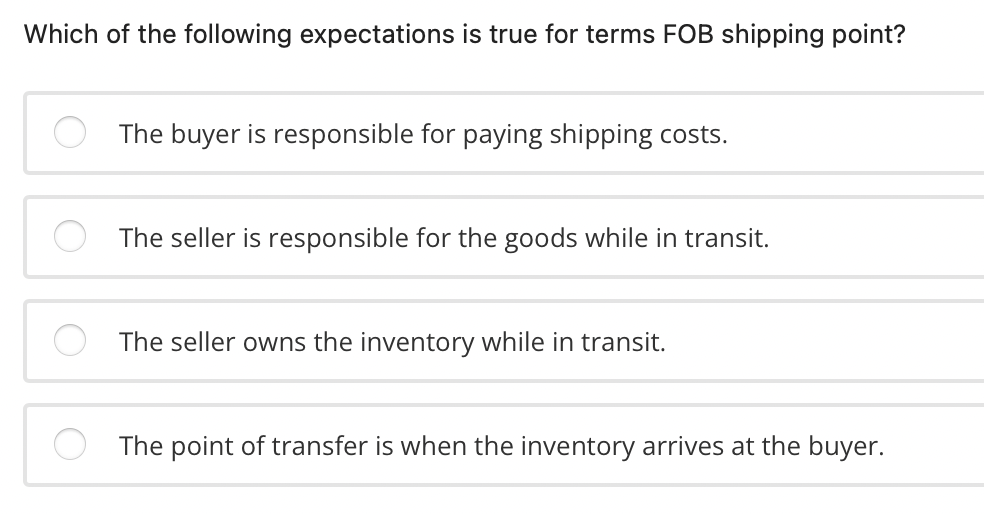

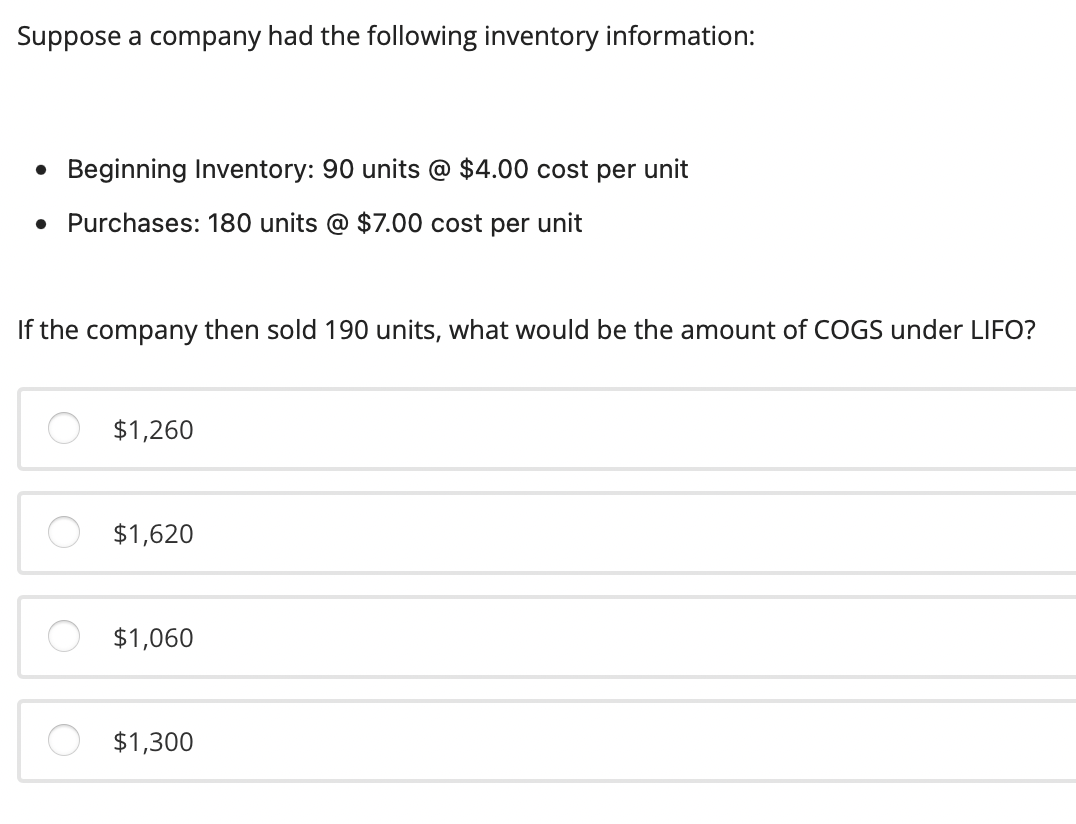

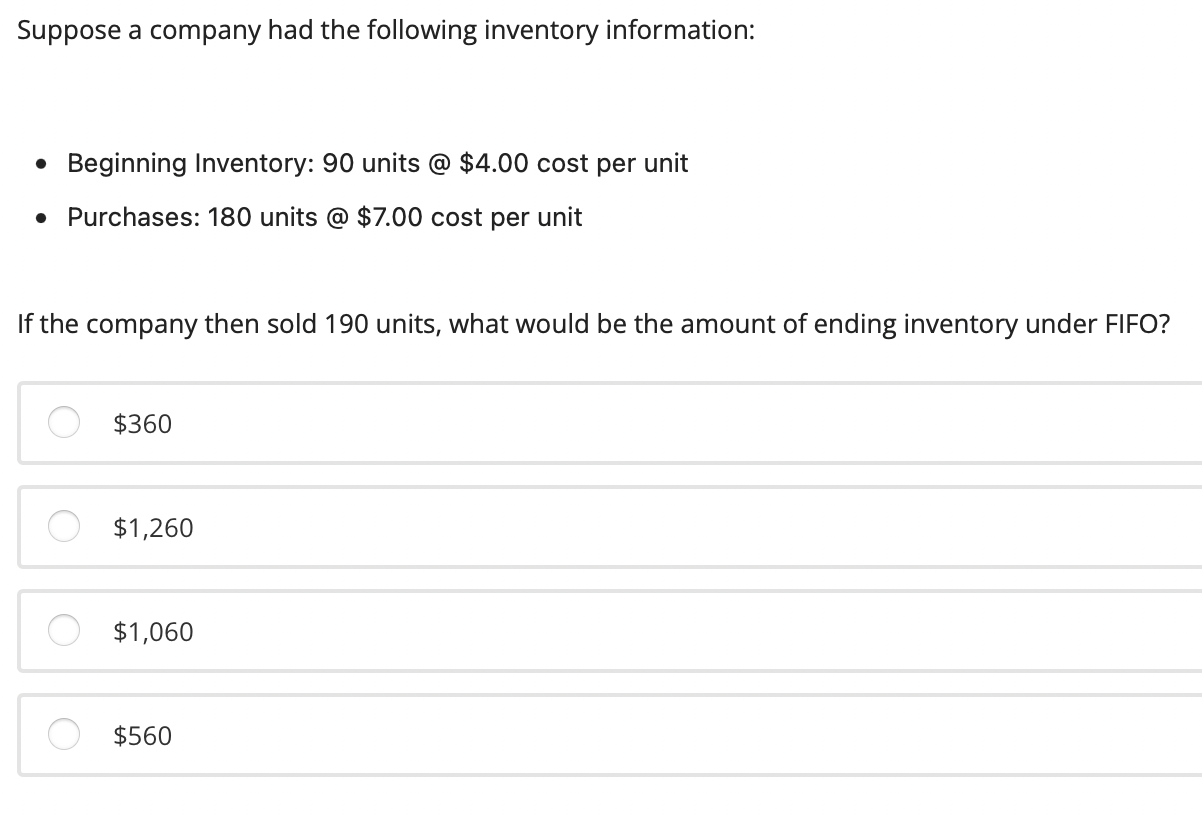

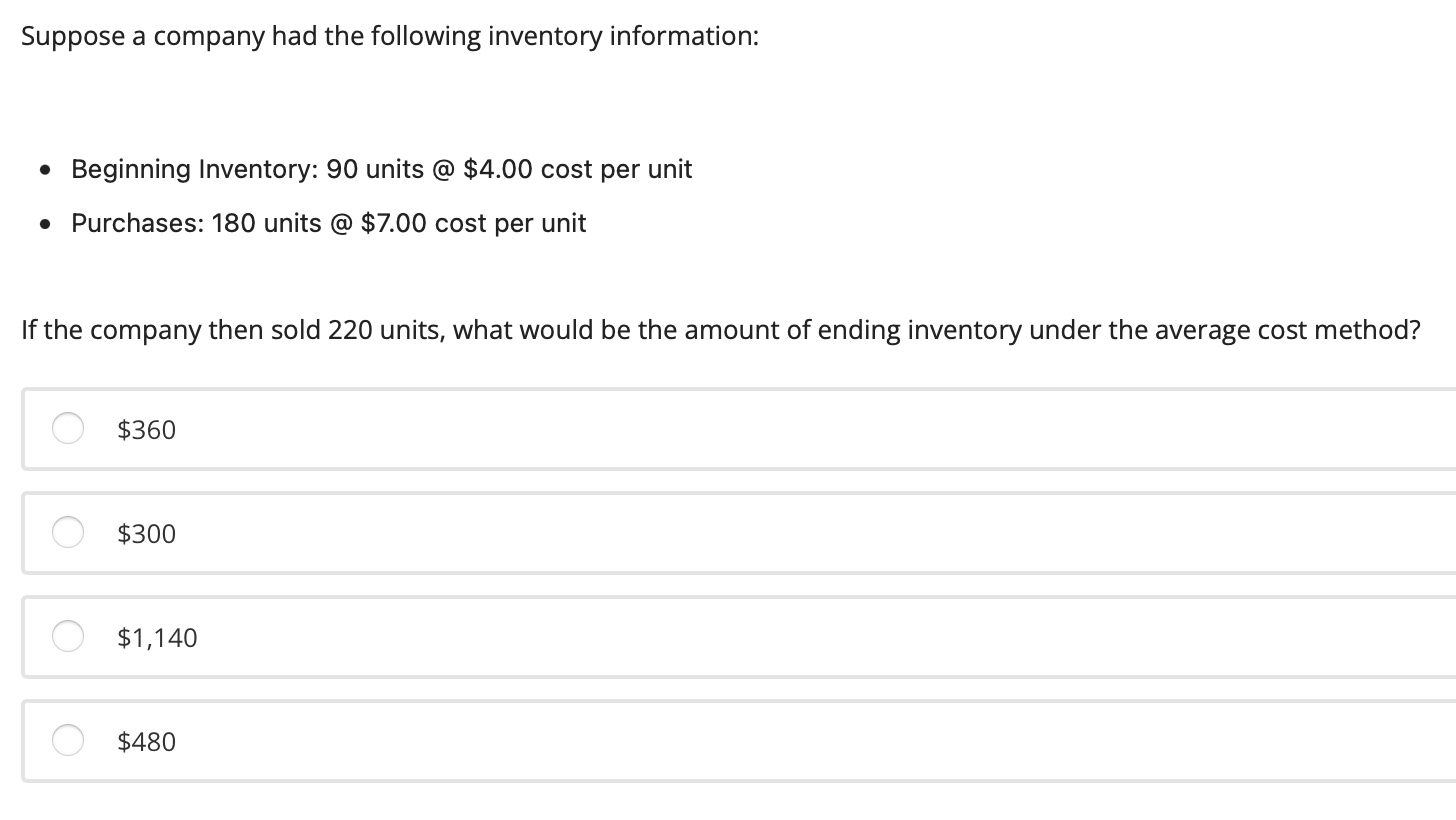

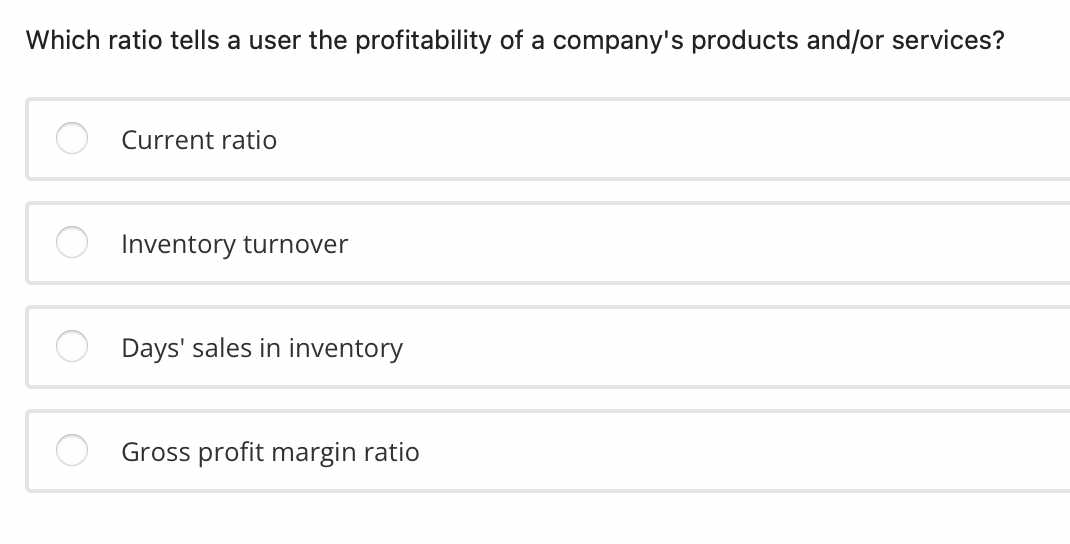

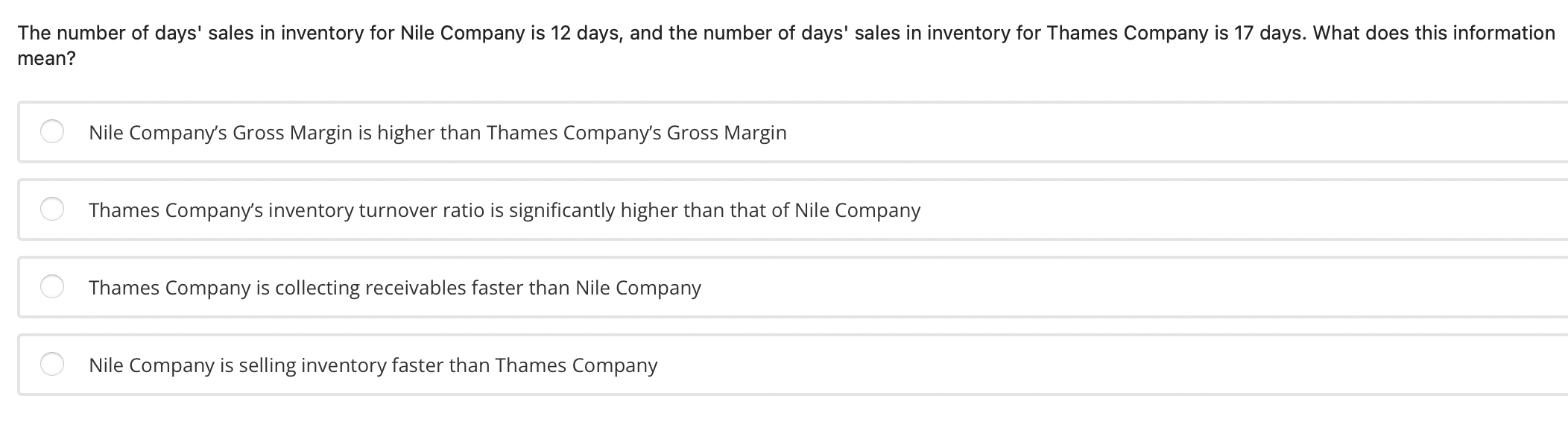

Assume Baker Co. has a beginning inventory of $10,000, ending inventory of $15,000, and purchases of $20,000. What is Baker's cost of goods sold? $35,000 $15,000 $5,000 $45,000 Which of the following subtotals is not on a multi-step income statement? Taxes Paid in Cash Gross Profit/Margin Net Income Income from Operations On August 1 , Joyful Co. purchased inventory costing $500, with credit terms of 2/10,n/15. Ignoring shipping terms, what is the journal entry that Joyful Co. should record on August 1? Dr. Inventory 490; Cr. Accounts Payable 490 Dr. Inventory 500; Cr. Cash 500 Dr. Inventory 500; Cr. Accounts Payable 500 Dr. Cash 500; Cr. Inventory 500 Joyful Co. purchases inventory costing $500 on August 1 , with credit terms of 2/10,n/15. On August 4 , Joyful Co. pays for this purchase. What is the journal entry that Joyful Co. should record on August 4? Dr Accounts Payable 500; Cr Cash 500 Dr Accounts Payable 500; Cr Cash 490; Cr Purchase Discounts 10 Dr Accounts Payable 490; Cr Cash 490 Dr Purchase Discounts 10; Dr Accounts Payable 490; Cr Accounts Payable 500 Dr Accounts Payable 500; Cr Inventory 10; Cr Cash 490 Which of the following expectations is true for terms FOB shipping point? The buyer is responsible for paying shipping costs. The seller is responsible for the goods while in transit. The seller owns the inventory while in transit. The point of transfer is when the inventory arrives at the buyer. Suppose a company had the following inventory information: - Beginning Inventory: 90 units @ \$4.00 cost per unit - Purchases: 180 units @ $7.00 cost per unit If the company then sold 190 units, what would be the amount of COGS under LIFO? $1,260 $1,620 $1,060 $1,300 Suppose a company had the following inventory information: - Beginning Inventory: 90 units @ \$4.00 cost per unit - Purchases: 180 units @ \$7.00 cost per unit If the company then sold 190 units, what would be the amount of ending inventory under FIFO? $360 $1,260 $1,060 $560 Suppose a company had the following inventory information: - Beginning Inventory: 90 units @ \$4.00 cost per unit - Purchases: 180 units @ \$7.00 cost per unit If the company then sold 220 units, what would be the amount of ending inventory under the average cost method? $360 $300 $1,140 $480 Which ratio tells a user the profitability of a company's products and/or services? Current ratio Inventory turnover Days' sales in inventory Gross profit margin ratio The number of days' sales in inventory for Nile Company is 12 days, and the number of days' sales in inventory for Thames Company is 17 days. What does this information neans? Nile Company's Gross Margin is higher than Thames Company's Gross Margin Thames Company's inventory turnover ratio is significantly higher than that of Nile Company Thames Company is collecting receivables faster than Nile Company is selling inventory faster than Thames Company