Question

Assume CAPM conditions. Your neighbor, Hilla, is so timid that she had all of the trees in her yard removed so that they would

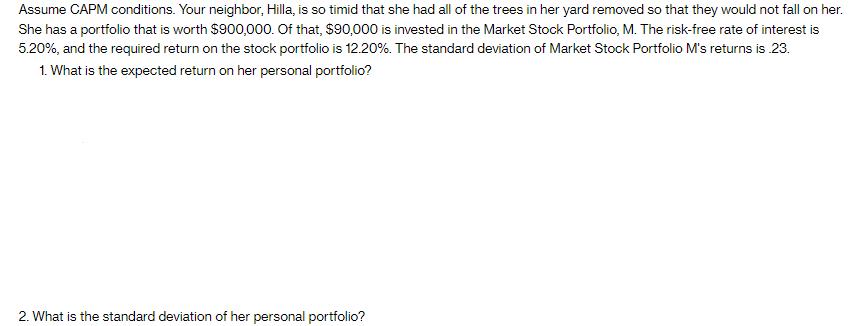

Assume CAPM conditions. Your neighbor, Hilla, is so timid that she had all of the trees in her yard removed so that they would not fall on her. She has a portfolio that is worth $900,000. Of that, $90,000 is invested in the Market Stock Portfolio, M. The risk-free rate of interest is 5.20%, and the required return on the stock portfolio is 12.20%. The standard deviation of Market Stock Portfolio M's returns is 23. 1. What is the expected return on her personal portfolio? 2. What is the standard deviation of her personal portfolio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Expected Return on Personal Portfolio Rp Rp Rf p Rm Rf Where Rf Riskfree rate 520 Rm Required return ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Thomas Beechy, Umashanker Trivedi, Kenneth MacAulay

6th edition

013703038X, 978-0137030385

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App