Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pici plc is food producer, providing luxury food products to retailers. It prepares financial statements for the year ended 31 March each year. The

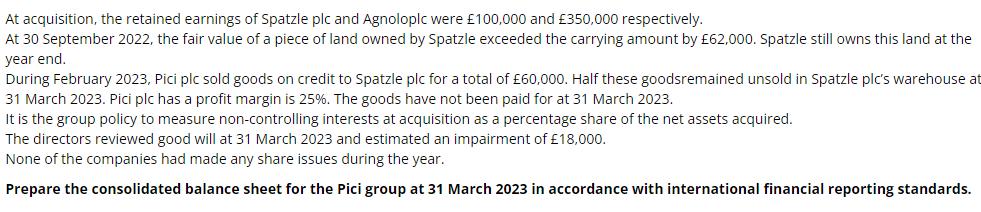

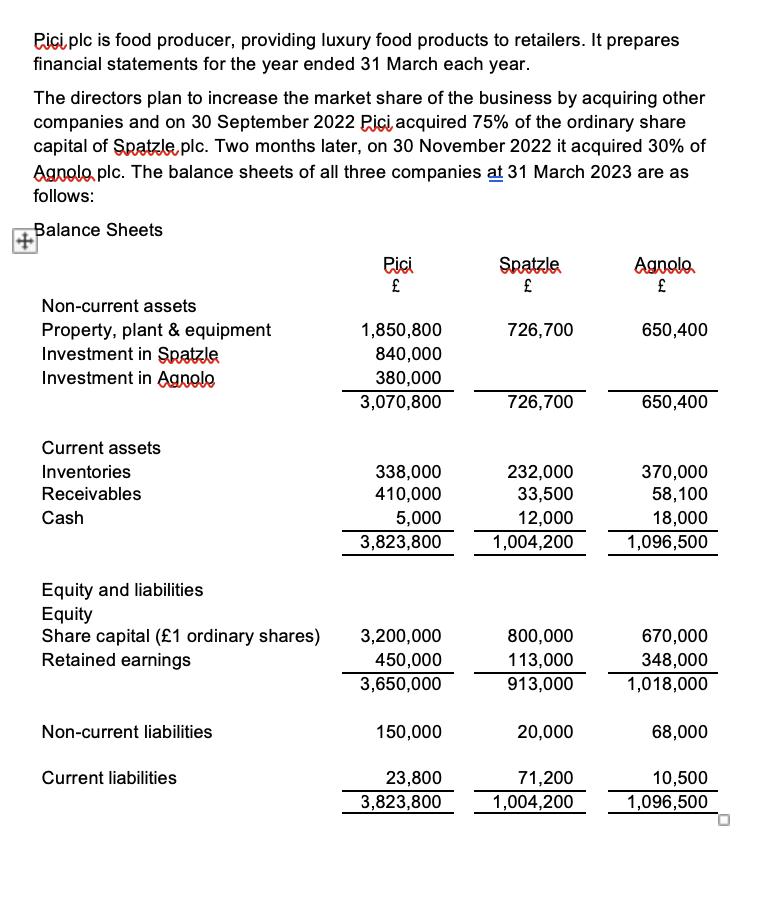

Pici plc is food producer, providing luxury food products to retailers. It prepares financial statements for the year ended 31 March each year. The directors plan to increase the market share of the business by acquiring other companies and on 30 September 2022 Pici acquired 75% of the ordinary share capital of Spatzle, plc. Two months later, on 30 November 2022 it acquired 30% of Agnolo plc. The balance sheets of all three companies at 31 March 2023 are as follows: Balance Sheets Non-current assets Property, plant & equipment Investment in Spatzle Investment in Agnolo Current assets Inventories Receivables Cash Equity and liabilities Equity Share capital (1 ordinary shares) Retained earnings Non-current liabilities Current liabilities Pici 1,850,800 840,000 380,000 3,070,800 338,000 410,000 5,000 3,823,800 3,200,000 450,000 3,650,000 150,000 23,800 3,823,800 Spatzle 726,700 726,700 232,000 33,500 12,000 1,004,200 800,000 113,000 913,000 20,000 71,200 1,004,200 Agnolo 650,400 650,400 370,000 58,100 18,000 1,096,500 670,000 348,000 1,018,000 68,000 10,500 1,096,500 At acquisition, the retained earnings of Spatzle plc and Agnoloplc were 100,000 and 350,000 respectively. At 30 September 2022, the fair value of a piece of land owned by Spatzle exceeded the carrying amount by 62,000. Spatzle still owns this land at the year end. During February 2023, Pici plc sold goods on credit to Spatzle plc for a total of 60,000. Half these goodsremained unsold in Spatzle plc's warehouse at 31 March 2023. Pici plc has a profit margin is 25%. The goods have not been paid for at 31 March 2023. It is the group policy to measure non-controlling interests at acquisition as a percentage share of the net assets acquired. The directors reviewed good will at 31 March 2023 and estimated an impairment of 18,000. None of the companies had made any share issues during the year. Prepare the consolidated balance sheet for the Pici group at 31 March 2023 in accordance with international financial reporting standards.

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started