Assume company XZY has 45 million common share outstanding and has the peers presented in Exh 1.11. Using the multiple approach and Exh 1.11, compute ABC implied value median price per share assuming ABC's 2014 revenue was $10 billions. Round and enter the answer to nearest cents.

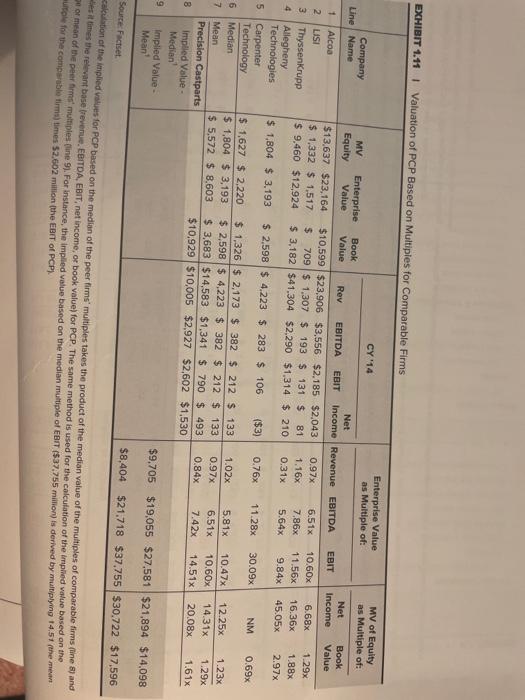

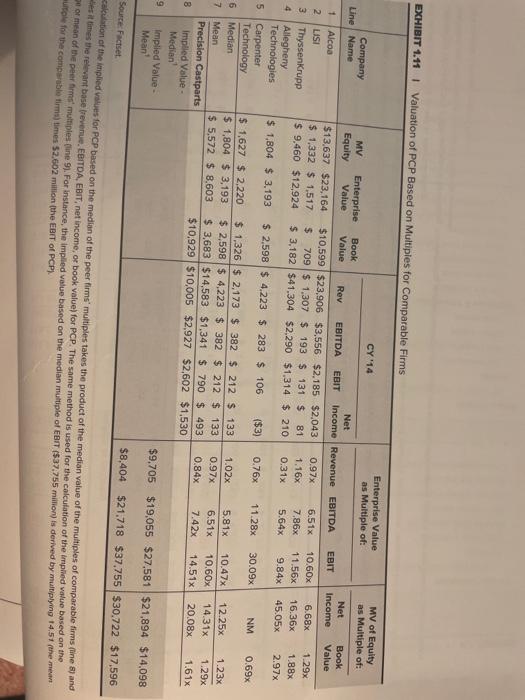

EXHIBIT 1.11 Valuation of PCP Based on Multiples for comparable Firms Enterprise Value MV of Equity CY'14 as Multiple of: as Multiple of: Company MV Enterprise Book Net Net Book Line Name Equity Value Value Rey EBITDA EBIT Income Revenue EBITDA EBIT Income Value 1 Alcoa $13,637 $23,164 $10.599 $23.906 $3,556 $2,185 $2,043 0.97x 6.51x 10.60x 6.68% 129x 2 LISI $ 1,332 $ 1,517 $ 709 $ 1,307 $ 193 $ 131 $ 81 1.16x 7.86x 11.56% 16.36x 1 88% 3 ThyssenKrupp $ 9.460 $12.924 $ 3,182 $41.304 $2,290 $1,314 $ 210 0.31x 5.64x 9.84x 45.05x 2.97% 4 Allegheny Technologies $ 1,804 $ 3.193 $ 2,598 $ 4.223 $ 283 $ 106 (53) 0.76x 11.28x 30.09x NM 0.69x 5 Carpenter Technology $ 1,627 $ 2.220 $ 1,326 $ 2.173 $ 382 $ 212 $ 133 1.02x 5.81x 10.47x 12.25x 1.23% 6 Median $ 1,804 $ 3,193 $ 2,598 $ 4,223 $ 382 $ 212 $ 133 0.97x 6.51x 10.60% 14.31x 1.29x 7 Mean $ 5,572 $ 8,603 $ 3,683 $14,583 $1,341 $ 790 $ 493 0.84x 7.42% 14.51x 20.08x 1.61x Precision Castparts $10.929 $10,005 $2,927 $2,602 $1.530 8 Impiled Value Median $9.705 $19,055 $27,581 $21,894 $14,098 9 Implied Value - Mean $8,404 $21,718 $37,755 $30.722 $17,596 Source: Factset. calculation of the impled values for PCP based on the median of the peer firms multiples takes the product of the median value of the multiples of comparable firms fine 8) and est times the relevant base revenue. EBITDA, EBIT, net income, or book value) for PCP. The same method is used for the calculation of the implied value based on the for mean of the performs multiples fine 9). For instance, the impled value based on the median multiple of EBIT($37,755 million) is derived by multiplying 14.51 me man uitle for the compartim) times 52,602 min (the EBIT of PCP). EXHIBIT 1.11 Valuation of PCP Based on Multiples for comparable Firms Enterprise Value MV of Equity CY'14 as Multiple of: as Multiple of: Company MV Enterprise Book Net Net Book Line Name Equity Value Value Rey EBITDA EBIT Income Revenue EBITDA EBIT Income Value 1 Alcoa $13,637 $23,164 $10.599 $23.906 $3,556 $2,185 $2,043 0.97x 6.51x 10.60x 6.68% 129x 2 LISI $ 1,332 $ 1,517 $ 709 $ 1,307 $ 193 $ 131 $ 81 1.16x 7.86x 11.56% 16.36x 1 88% 3 ThyssenKrupp $ 9.460 $12.924 $ 3,182 $41.304 $2,290 $1,314 $ 210 0.31x 5.64x 9.84x 45.05x 2.97% 4 Allegheny Technologies $ 1,804 $ 3.193 $ 2,598 $ 4.223 $ 283 $ 106 (53) 0.76x 11.28x 30.09x NM 0.69x 5 Carpenter Technology $ 1,627 $ 2.220 $ 1,326 $ 2.173 $ 382 $ 212 $ 133 1.02x 5.81x 10.47x 12.25x 1.23% 6 Median $ 1,804 $ 3,193 $ 2,598 $ 4,223 $ 382 $ 212 $ 133 0.97x 6.51x 10.60% 14.31x 1.29x 7 Mean $ 5,572 $ 8,603 $ 3,683 $14,583 $1,341 $ 790 $ 493 0.84x 7.42% 14.51x 20.08x 1.61x Precision Castparts $10.929 $10,005 $2,927 $2,602 $1.530 8 Impiled Value Median $9.705 $19,055 $27,581 $21,894 $14,098 9 Implied Value - Mean $8,404 $21,718 $37,755 $30.722 $17,596 Source: Factset. calculation of the impled values for PCP based on the median of the peer firms multiples takes the product of the median value of the multiples of comparable firms fine 8) and est times the relevant base revenue. EBITDA, EBIT, net income, or book value) for PCP. The same method is used for the calculation of the implied value based on the for mean of the performs multiples fine 9). For instance, the impled value based on the median multiple of EBIT($37,755 million) is derived by multiplying 14.51 me man uitle for the compartim) times 52,602 min (the EBIT of PCP)

Assume company XZY has 45 million common share outstanding and has the peers presented in Exh 1.11. Using the multiple approach and Exh 1.11, compute ABC implied value median price per share assuming ABC's 2014 revenue was $10 billions. Round and enter the answer to nearest cents.

Assume company XZY has 45 million common share outstanding and has the peers presented in Exh 1.11. Using the multiple approach and Exh 1.11, compute ABC implied value median price per share assuming ABC's 2014 revenue was $10 billions. Round and enter the answer to nearest cents.