Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume daily compounding instead of the simple interest a. How does the 1-day value effect change? b. How does NPV change? Flying High Hang Gliders,

Assume daily compounding instead of the simple interest

a. How does the 1-day value effect change?

b. How does NPV change?

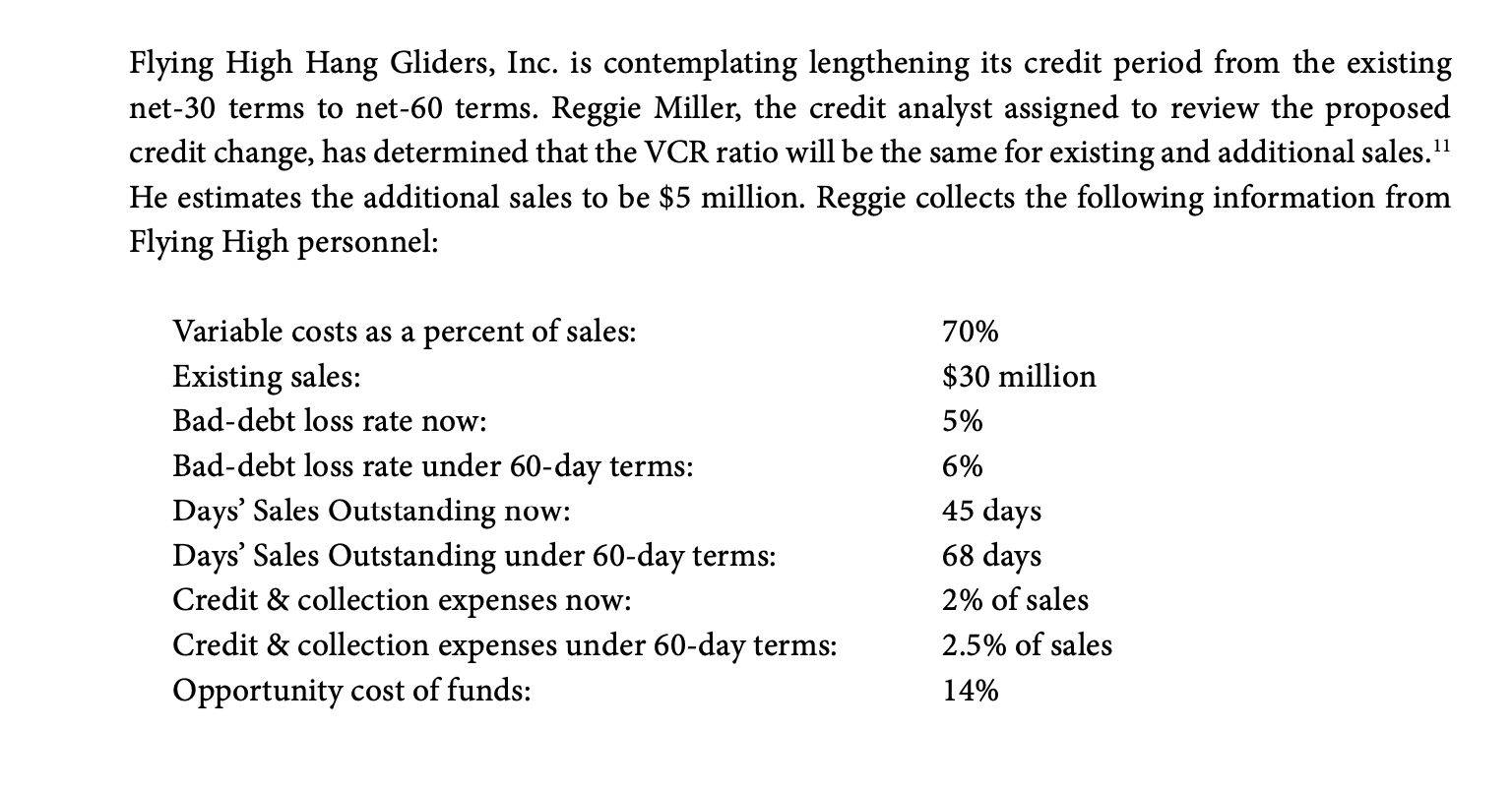

Flying High Hang Gliders, Inc. is contemplating lengthening its credit period from the existing net-30 terms to net-60 terms. Reggie Miller, the credit analyst assigned to review the proposed credit change, has determined that the VCR ratio will be the same for existing and additional sales.l1 He estimates the additional sales to be $5 million. Reggie collects the following information from Flying High personnel: Variable costs as a percent of sales: Existing sales: Bad-debt loss rate now: Bad-debt loss rate under 60-day terms: Days Sales Outstanding now: Days' Sales Outstanding under 60-day terms: Credit & collection expenses now: Credit & collection expenses under 60-day terms: Opportunity cost of funds: 70% $30 million 5% 6% 45 days 68 days 2% of sales 2.5% of sales 14% Flying High Hang Gliders, Inc. is contemplating lengthening its credit period from the existing net-30 terms to net-60 terms. Reggie Miller, the credit analyst assigned to review the proposed credit change, has determined that the VCR ratio will be the same for existing and additional sales.l1 He estimates the additional sales to be $5 million. Reggie collects the following information from Flying High personnel: Variable costs as a percent of sales: Existing sales: Bad-debt loss rate now: Bad-debt loss rate under 60-day terms: Days Sales Outstanding now: Days' Sales Outstanding under 60-day terms: Credit & collection expenses now: Credit & collection expenses under 60-day terms: Opportunity cost of funds: 70% $30 million 5% 6% 45 days 68 days 2% of sales 2.5% of sales 14%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started