Question

Assume DEF Co plans to pay $23,958 for a new machine that will generate cash flows of $6,000 for five years. Also assume DEF

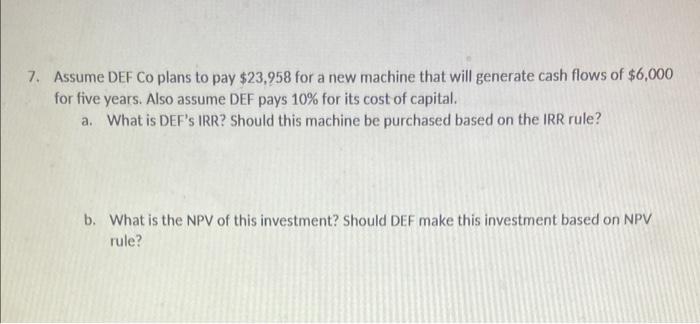

Assume DEF Co plans to pay $23,958 for a new machine that will generate cash flows of $6,000 for five years. Also assume DEF pays 10% for its cost of capital. a. What is DEF's IRR? Should this machine be purchased based on the IRR rule? b. What is the NPV of this investment? Should DEF make this investment based on NPV rule?

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below A so by financi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles

Authors: John J. Wild, Ken W. Shaw, Barbara Chiappetta

20th Edition

1259157148, 78110874, 9780077616212, 978-1259157141, 77616219, 978-0078110870

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App