Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that you have a list of stock prices ranging from 30 to 150. Plot a bull spread using calls: Buy a 3-month European

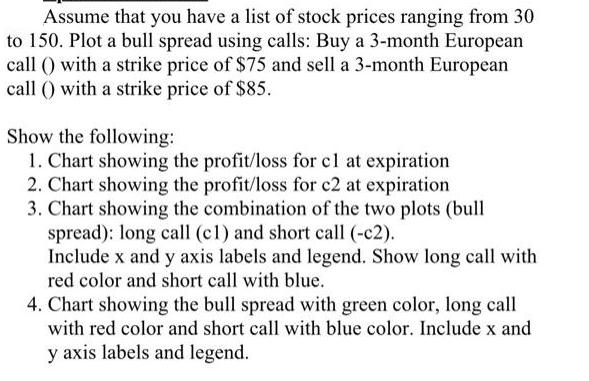

Assume that you have a list of stock prices ranging from 30 to 150. Plot a bull spread using calls: Buy a 3-month European call () with a strike price of $75 and sell a 3-month European call () with a strike price of $85. Show the following: 1. Chart showing the profit/loss for cl at expiration 2. Chart showing the profit/loss for c2 at expiration 3. Chart showing the combination of the two plots (bull spread): long call (c1) and short call (-c2). Include x and y axis labels and legend. Show long call with red color and short call with blue. 4. Chart showing the bull spread with green color, long call with red color and short call with blue color. Include x and y axis labels and legend.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Step 12 SOLUTION Assume terminal share Price S Investor 1 invests EUR 2000 by buying 40 AAStore shar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started