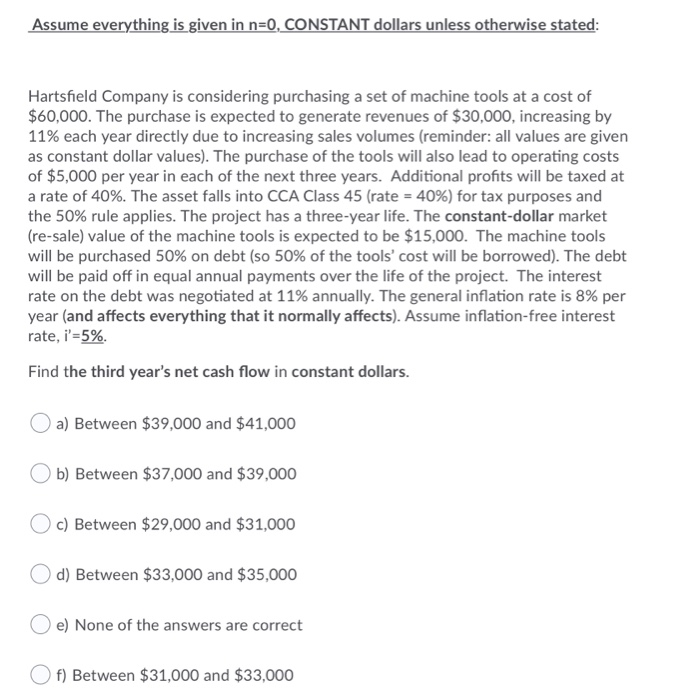

Assume everything is given in n=0, CONSTANT dollars unless otherwise stated: Hartsfield Company is considering purchasing a set of machine tools at a cost of $60,000. The purchase is expected to generate revenues of $30,000, increasing by 11% each year directly due to increasing sales volumes (reminder: all values are given as constant dollar values). The purchase of the tools will also lead to operating costs of $5,000 per year in each of the next three years. Additional profits will be taxed at a rate of 40%. The asset falls into CCA Class 45 (rate = 40%) for tax purposes and the 50% rule applies. The project has a three-year life. The constant-dollar market (re-sale) value of the machine tools is expected to be $15,000. The machine tools will be purchased 50% on debt (so 50% of the tools' cost will be borrowed). The debt will be paid off in equal annual payments over the life of the project. The interest rate on the debt was negotiated at 11% annually. The general inflation rate is 8% per year (and affects everything that it normally affects). Assume inflation-free interest rate, i'=5%. Find the third year's net cash flow in constant dollars. a) Between $39,000 and $41,000 b) Between $37,000 and $39,000 O c) Between $29,000 and $31,000 d) Between $33,000 and $35,000 e) None of the answers are correct f) Between $31,000 and $33,000 Assume everything is given in n=0, CONSTANT dollars unless otherwise stated: Hartsfield Company is considering purchasing a set of machine tools at a cost of $60,000. The purchase is expected to generate revenues of $30,000, increasing by 11% each year directly due to increasing sales volumes (reminder: all values are given as constant dollar values). The purchase of the tools will also lead to operating costs of $5,000 per year in each of the next three years. Additional profits will be taxed at a rate of 40%. The asset falls into CCA Class 45 (rate = 40%) for tax purposes and the 50% rule applies. The project has a three-year life. The constant-dollar market (re-sale) value of the machine tools is expected to be $15,000. The machine tools will be purchased 50% on debt (so 50% of the tools' cost will be borrowed). The debt will be paid off in equal annual payments over the life of the project. The interest rate on the debt was negotiated at 11% annually. The general inflation rate is 8% per year (and affects everything that it normally affects). Assume inflation-free interest rate, i'=5%. Find the third year's net cash flow in constant dollars. a) Between $39,000 and $41,000 b) Between $37,000 and $39,000 O c) Between $29,000 and $31,000 d) Between $33,000 and $35,000 e) None of the answers are correct f) Between $31,000 and $33,000