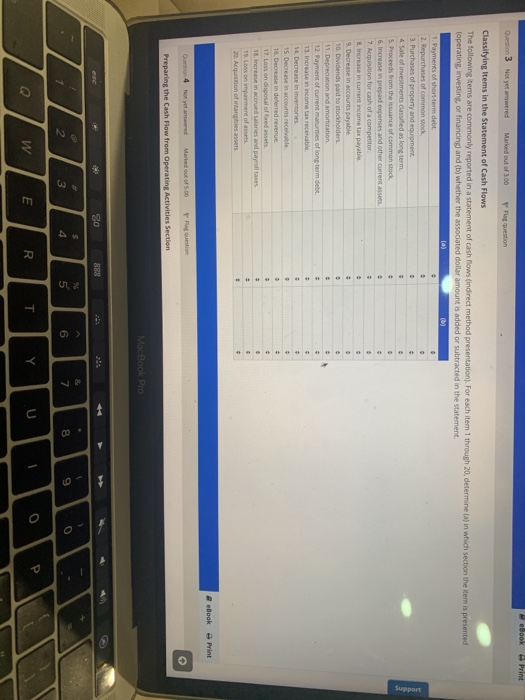

eBook Print Question 3 Not yet answered Marked out of 3.00 P Flag question Support Classifying items in the Statement of Cash Flows The following items are commonly reported in a statement of cash flows (indirect method presentation. For each item 1 through 20, determine (a) in which section the item is presented (operating investing or financing) and (b) whether the associated dollar amount is added or subtracted in the statement. (a) (D) 1. Payments of short-term debt O 2. Repurchases of common stock . 3. Purchases of property and equipment 4 sale of investments classified as long term. . 5. Proceeds from the issuance of common stock 6. Increase in prepaid expenses and other current assets 7. Acquisition for cash of a competitor . B. Increase in current income tax payable 9. Decrease in accounts payable - 10. Dividends paid to stockholders 11. Depreciation and amortization 12. Payment of current matures of long term debu. 13. Increase in income tax recevabile 14. Decrease in inventores 15. Decrease in accounts receivable + 16. Decrease in deferred revenue. 17. Loss on disposal of foed assets 18. Increase in accrued sales and payrollares . 19. Loss on impairment of assets. 20. Acquisition of incang besar + + e eBook A Print Question 4 Not yet and Marked out of 5.00 Preparing the Cash Flow from Operating Activities Section MacBook Pro 30 888 s 4 * 5 & 7 2 7 9 3 6 8 T 0 1 Y R E eBook Print Question 3 Not yet answered Marked out of 3.00 P Flag question Support Classifying items in the Statement of Cash Flows The following items are commonly reported in a statement of cash flows (indirect method presentation. For each item 1 through 20, determine (a) in which section the item is presented (operating investing or financing) and (b) whether the associated dollar amount is added or subtracted in the statement. (a) (D) 1. Payments of short-term debt O 2. Repurchases of common stock . 3. Purchases of property and equipment 4 sale of investments classified as long term. . 5. Proceeds from the issuance of common stock 6. Increase in prepaid expenses and other current assets 7. Acquisition for cash of a competitor . B. Increase in current income tax payable 9. Decrease in accounts payable - 10. Dividends paid to stockholders 11. Depreciation and amortization 12. Payment of current matures of long term debu. 13. Increase in income tax recevabile 14. Decrease in inventores 15. Decrease in accounts receivable + 16. Decrease in deferred revenue. 17. Loss on disposal of foed assets 18. Increase in accrued sales and payrollares . 19. Loss on impairment of assets. 20. Acquisition of incang besar + + e eBook A Print Question 4 Not yet and Marked out of 5.00 Preparing the Cash Flow from Operating Activities Section MacBook Pro 30 888 s 4 * 5 & 7 2 7 9 3 6 8 T 0 1 Y R E