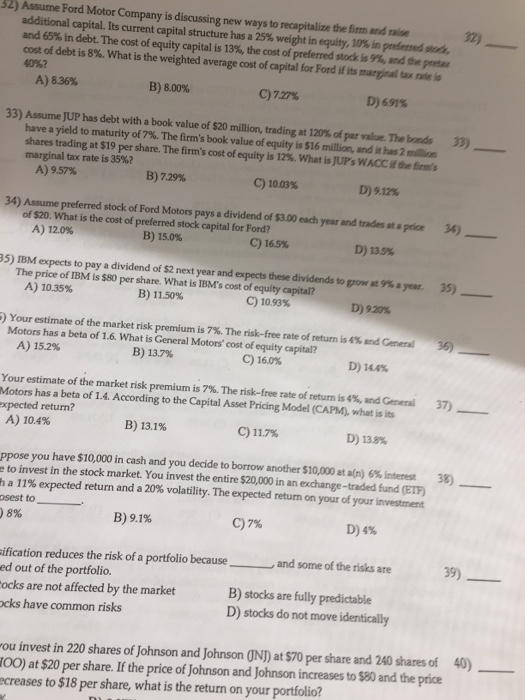

Assume Ford Motor Company is discussing new ways to recapitalize the firm and raise additional capital. Its current capital structure has a 25% weight in equity, 10% in preferred and 65% in debt. The cost of equity capital is 13%the cost of preferred stock is 9%, and pretax cost of debt is 8%. What is the weighted average cost of capital for Ford if its marpal tax rate is 40%? 32) A) 836% B)8.00% C)727% D)691% 33) AssumeJUP has debt with a book value of $20 million, trading at 120% ofpar value. The brids 33) have a yield to maturity of 7%. The firm's book value of equity is $16 million, and it has 2miln shares trading at $19 per share. The firm's cost of equity is 12%. What is jur, wAcadem marginal tax rate is 35%? A)957% B) 7.29% D) 9.12% 34) Assume preferred stock of Ford Motors pays a dividend of s$3,00each year and trades at a price 36) of $20. What is the cost of preferred stock capital for Ford? A) 12.0% B) 15.0% C)16.5% D) 135% 3 5) IBM expects to pay a dividend of S2 next year and expects these dividends to grow at 9% a year, 35) The price of 1BM is $80 per share WhatiMs cost of equity capital? A) 10.35% B) 11.50% C) 10.93% D) 920% Your estimate of the market risk premium is 7%. The risk-free rate of return is 4% and General ) Motors has a beta of 1.6. What is General Motors' cost of equity capital? A) 15.2% B) 13.7% D) 14.4% Your estimate of the market risk premium is 7%. The risk-free rate of return is 4%, and General 37) Motors has a beta of 1.4. According to the Capital Asset Pricing Model (CAPM), what is it xpected return? A) 10.4% B) 13.1% C) 11.7% D) 138% Pose you have $10,000 in cash and you decide to borrow another S10000 at a(n) 6% interest e to invest in the stock market. You invest the entire $20,000 in an exchange-traded fund (ETF h a 1 1% expected return and a 20% volatility. The expected return on your of your investment sest to : 8% 38) B) 9.1% 7% D)4% ification reduces the risk of a portfolio becauseand some of the risks are ed out of the portfolio. ocks are not affected by the market cks have common risks 39) B) stocks are fully predictable D) stocks do not move identically ou invest in 220 shares of Johnson and Johnson ?ND at $70 per share and 240 shares of OO) at $20 per share. If the price of Johnson and Johnson increases to $80 and the price creases to $18 per share, what is the return on your portfolio? 40)