Question

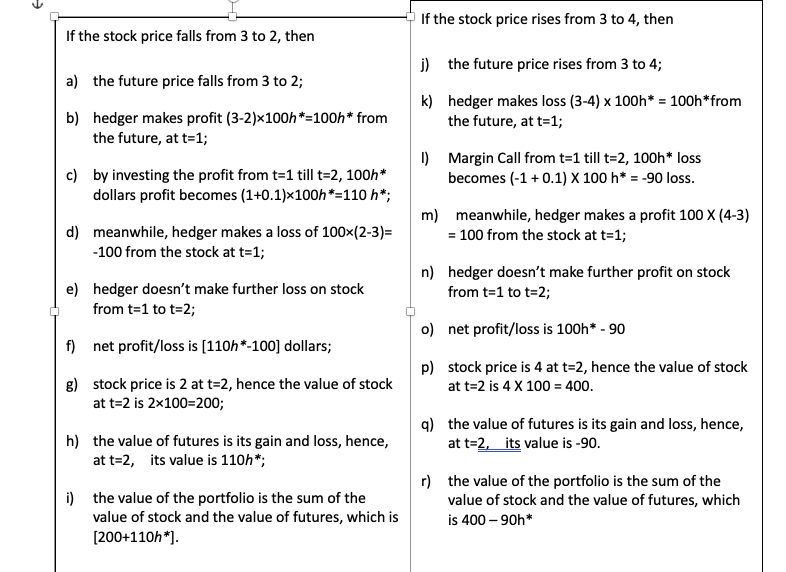

Assume hedger takes hedge ratio as h* , i.e, if the risk exposure is a long position of 100 units of spot commodity, to hedge

Assume hedger takes hedge ratio as h*, i.e, if the risk exposure is a long position of 100 units of spot commodity, to hedge the risk, hedger will short 100h* futures underlying on that commodity.

]Please solve using the last two lines in the table: To make the hedge portfolio risk-free, the value of the portfolio should not vary no matter stock price rises or falls (or, equivalently, the hedge portfolio should not make profit in one state and make loss in the other, where the state means stock price rises or falls). Please based on the above fact, solve the optimal hedge ratio h*.

To make the hedge portfolio risk-free, the hedge portfolio should not make profit in one state and make loss in the other, where the state means stock price rises or falls. Please use the optimal hedge ratio solved above to verify this fact.

If the stock price rises from 3 to 4, then If the stock price falls from 3 to 2, then j) the future price rises from 3 to 4; a) the future price falls from 3 to 2; b) hedger makes profit (3-2)x100h*=100h* from the future, at t=1; k) hedger makes loss (3-4) x 100h* = 100h*from the future, at t=1; 1) c) by investing the profit from t=1 till t=2, 100h* dollars profit becomes (1+0.1)x100h-110 h*; Margin Call from t=1 tillt=2, 100h* loss becomes (-1 + 0.1) X 100 h* = -90 loss. d) meanwhile, hedger makes a loss of 100x(2-3)= -100 from the stock at t=1; m) meanwhile, hedger makes a profit 100 X (4-3) = 100 from the stock at t=1; e) hedger doesn't make further loss on stock from t=1 to t=2; n) hedger doesn't make further profit on stock from t=1 to t=2; o) net profit/loss is 100h* - 90 f) net profit/loss is (110h*-100) dollars; g) stock price is 2 at t=2, hence the value of stock at t=2 is 2x100=200; p) stock price is 4 at t=2, hence the value of stock at t=2 is 4 x 100 = 400. h) the value of futures is its gain and loss, hence, at t=2, its value is 110h*; q) the value of futures is its gain and loss, hence, at t=2, its value is -90. the value of the portfolio is the sum of the value of stock and the value of futures, which is (200+110h*). r) the value of the portfolio is the sum of the value of stock and the value of futures, which is 400 - 90h* If the stock price rises from 3 to 4, then If the stock price falls from 3 to 2, then j) the future price rises from 3 to 4; a) the future price falls from 3 to 2; b) hedger makes profit (3-2)x100h*=100h* from the future, at t=1; k) hedger makes loss (3-4) x 100h* = 100h*from the future, at t=1; 1) c) by investing the profit from t=1 till t=2, 100h* dollars profit becomes (1+0.1)x100h-110 h*; Margin Call from t=1 tillt=2, 100h* loss becomes (-1 + 0.1) X 100 h* = -90 loss. d) meanwhile, hedger makes a loss of 100x(2-3)= -100 from the stock at t=1; m) meanwhile, hedger makes a profit 100 X (4-3) = 100 from the stock at t=1; e) hedger doesn't make further loss on stock from t=1 to t=2; n) hedger doesn't make further profit on stock from t=1 to t=2; o) net profit/loss is 100h* - 90 f) net profit/loss is (110h*-100) dollars; g) stock price is 2 at t=2, hence the value of stock at t=2 is 2x100=200; p) stock price is 4 at t=2, hence the value of stock at t=2 is 4 x 100 = 400. h) the value of futures is its gain and loss, hence, at t=2, its value is 110h*; q) the value of futures is its gain and loss, hence, at t=2, its value is -90. the value of the portfolio is the sum of the value of stock and the value of futures, which is (200+110h*). r) the value of the portfolio is the sum of the value of stock and the value of futures, which is 400 - 90h*Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started