Question

Assume it is August 31, 2023. Jane would like to invest in her friend Rohins new restaurant. She is a freelance seamstress, and the amount

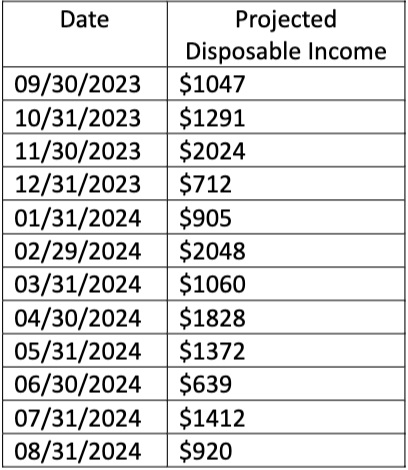

Assume it is August 31, 2023. Jane would like to invest in her friend Rohins new restaurant. She is a freelance seamstress, and the amount of money she will be able to commit every month will fluctuate with her income. Based on previous years' income patterns, her projected disposable monthly income for the next year is

(a) Jane commits to investing 25% of her disposable income into Rohins business every month. If she has a competing investment opportunity that yields 3% every six months, what is the present value of her total financial commitment to Rohin?

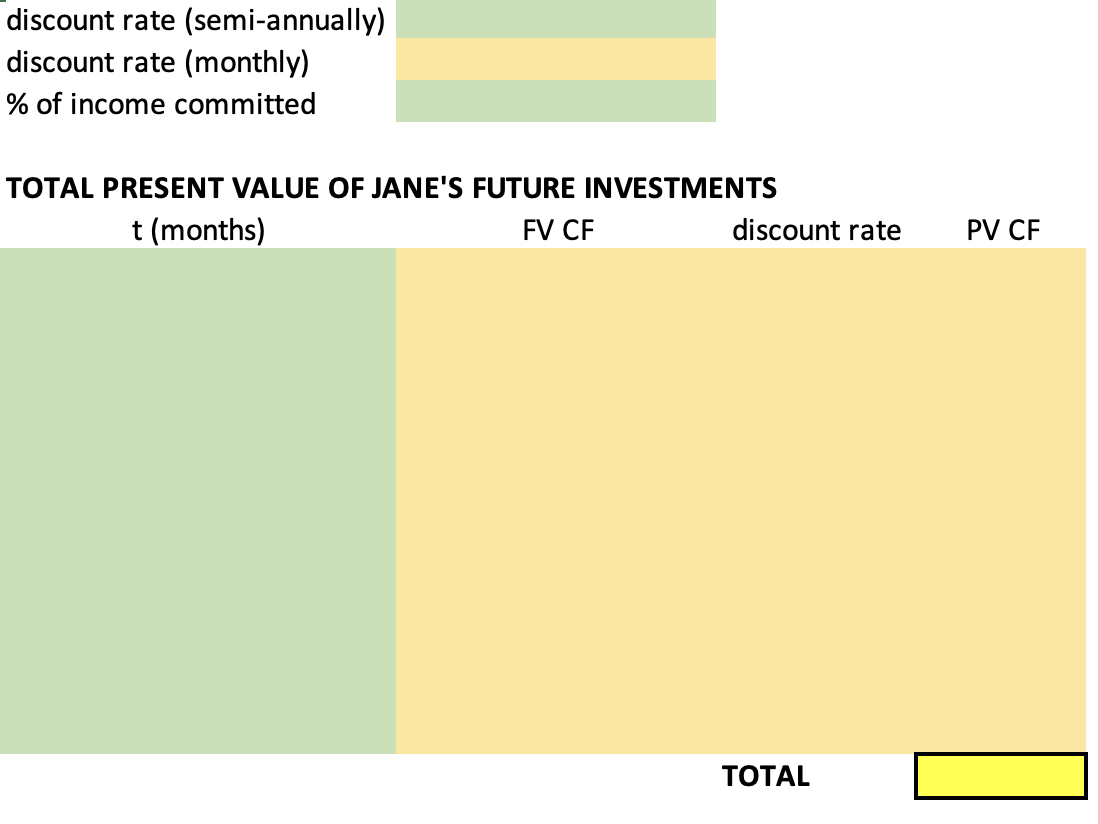

Please list the discount rate (semi-annually), discount rate (monthly), and % of income committed.

Also please show your work by using this table:

\begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{ Date } & \multicolumn{1}{c|}{ProjectedDisposableIncome} \\ \hline 09/30/2023 & $1047 \\ \hline 10/31/2023 & $1291 \\ \hline 11/30/2023 & $2024 \\ \hline 12/31/2023 & $712 \\ \hline 01/31/2024 & $905 \\ \hline 02/29/2024 & $2048 \\ \hline 03/31/2024 & $1060 \\ \hline 04/30/2024 & $1828 \\ \hline 05/31/2024 & $1372 \\ \hline 06/30/2024 & $639 \\ \hline 07/31/2024 & $1412 \\ \hline 08/31/2024 & $920 \\ \hline \end{tabular} TOTAL PRESENT VALUE OF JANE'S FUTURE INVESTMENTS t (months) FVCF discount rate PVCF \begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{ Date } & \multicolumn{1}{c|}{ProjectedDisposableIncome} \\ \hline 09/30/2023 & $1047 \\ \hline 10/31/2023 & $1291 \\ \hline 11/30/2023 & $2024 \\ \hline 12/31/2023 & $712 \\ \hline 01/31/2024 & $905 \\ \hline 02/29/2024 & $2048 \\ \hline 03/31/2024 & $1060 \\ \hline 04/30/2024 & $1828 \\ \hline 05/31/2024 & $1372 \\ \hline 06/30/2024 & $639 \\ \hline 07/31/2024 & $1412 \\ \hline 08/31/2024 & $920 \\ \hline \end{tabular} TOTAL PRESENT VALUE OF JANE'S FUTURE INVESTMENTS t (months) FVCF discount rate PVCF

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started