Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume Joan plans to invest an amount today in an account with an interest rate of 4% (compounded annually) and wait 5 years before withdrawing

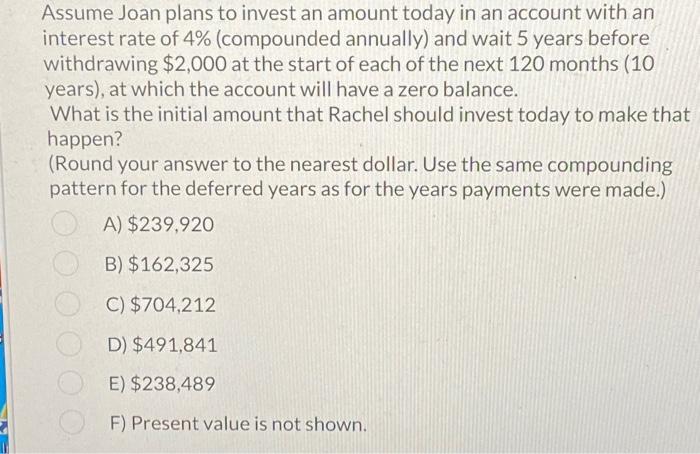

Assume Joan plans to invest an amount today in an account with an interest rate of 4% (compounded annually) and wait 5 years before withdrawing $2,000 at the start of each of the next 120 months (10) years), at which the account will have a zero balance. What is the initial amount that Rachel should invest today to make that happen? (Round your answer to the nearest dollar. Use the same compounding pattern for the deferred years as for the years payments were made.) A) $239,920 B) $162,325 C) $704,212 D) $491,841 E) $238,489 F) Present value is not shown.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started