Assume Mark buys a corporate bearer bond in the primary market so he is the first owner of this bond. Mark buys the bearer bond at a price of 100% of par value. The bearer bond has annual payments (not semiannual payments), 25 years to maturity, a $40,000 par value, and a 7% coupon rate. Additionally, the bond is callable at year 15 with a $1.10 call premium per $100 of par value. Lori buysthe bearer bond from Mark when it has 19 years to maturity at a price of 103% of par value. Anne buys the bearer bond from Lori when it has 15 years to maturity at a price of 102% of par value

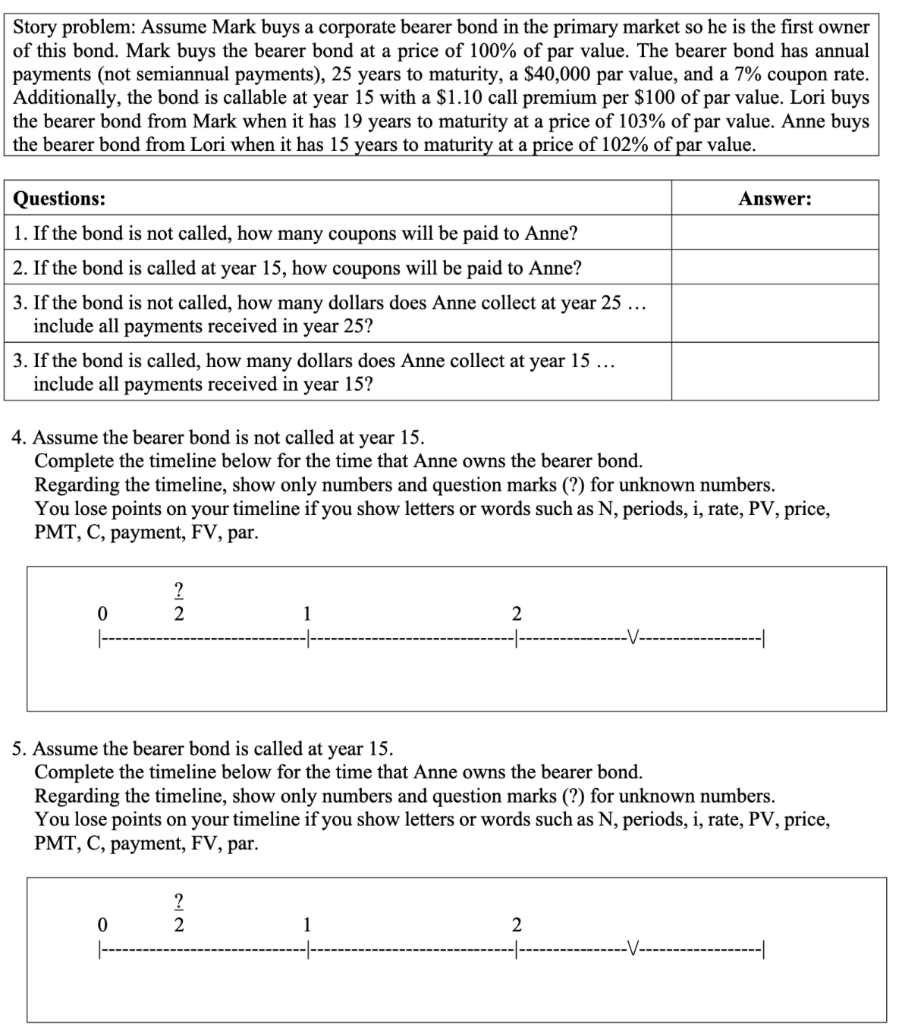

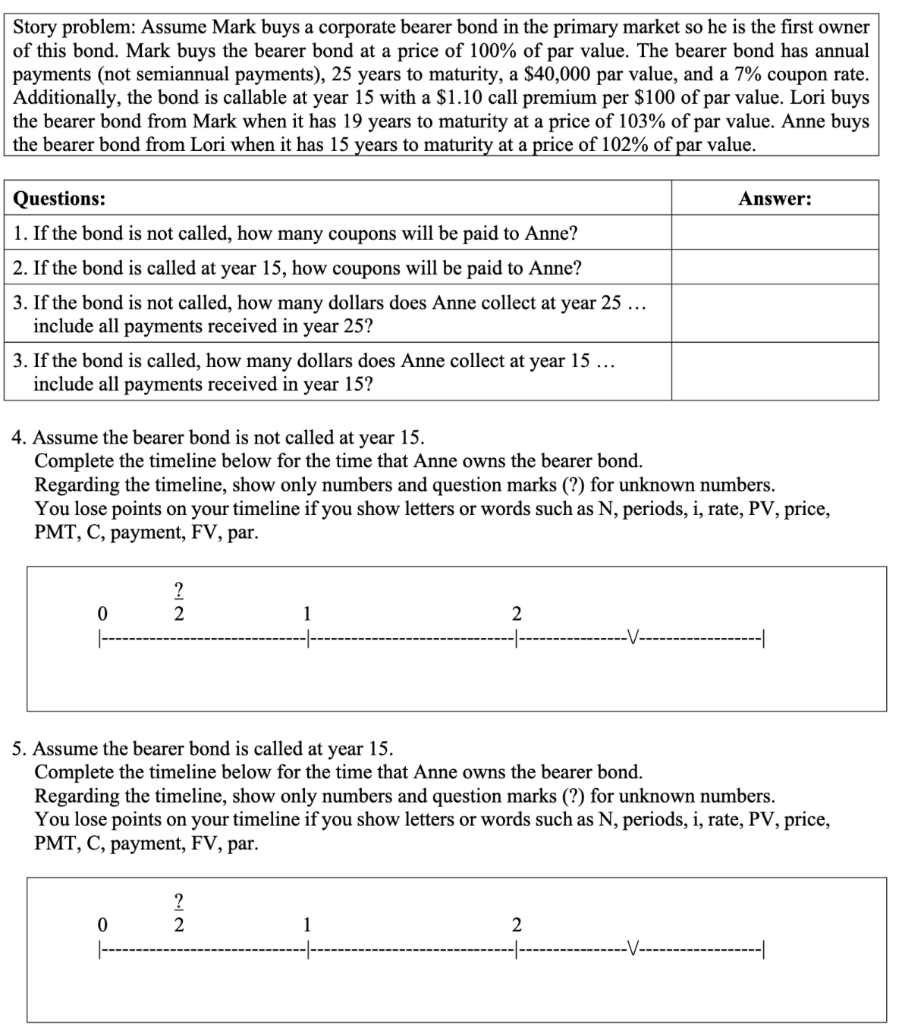

Story problem: Assume Mark buys a corporate bearer bond in the primary market so he is the first owner of this bond. Mark buys the bearer bond at a price of 100% of par value. The bearer bond has annual payments (not semiannual payments), 25 years to maturity, a $40,000 par value, and a 7% coupon rate. Additionally, the bond is callable at year 15 with a $1.10 call premium per $100 of par value. Lori buys the bearer bond from Mark when it has 19 years to maturity at a price of 103% of par value. Anne buys the bearer bond from Lori when it has 15 years to maturity at a price of 102% of par value. 4. Assume the bearer bond is not called at year 15 . Complete the timeline below for the time that Anne owns the bearer bond. Regarding the timeline, show only numbers and question marks (?) for unknown numbers. You lose points on your timeline if you show letters or words such as N, periods, i, rate, PV, price, PMT, C, payment, FV, par. 5. Assume the bearer bond is called at year 15 . Complete the timeline below for the time that Anne owns the bearer bond. Regarding the timeline, show only numbers and question marks (?) for unknown numbers. You lose points on your timeline if you show letters or words such as N, periods, i, rate, PV, price, PMT, C, payment, FV, par. Story problem: Assume Mark buys a corporate bearer bond in the primary market so he is the first owner of this bond. Mark buys the bearer bond at a price of 100% of par value. The bearer bond has annual payments (not semiannual payments), 25 years to maturity, a $40,000 par value, and a 7% coupon rate. Additionally, the bond is callable at year 15 with a $1.10 call premium per $100 of par value. Lori buys the bearer bond from Mark when it has 19 years to maturity at a price of 103% of par value. Anne buys the bearer bond from Lori when it has 15 years to maturity at a price of 102% of par value. 4. Assume the bearer bond is not called at year 15 . Complete the timeline below for the time that Anne owns the bearer bond. Regarding the timeline, show only numbers and question marks (?) for unknown numbers. You lose points on your timeline if you show letters or words such as N, periods, i, rate, PV, price, PMT, C, payment, FV, par. 5. Assume the bearer bond is called at year 15 . Complete the timeline below for the time that Anne owns the bearer bond. Regarding the timeline, show only numbers and question marks (?) for unknown numbers. You lose points on your timeline if you show letters or words such as N, periods, i, rate, PV, price, PMT, C, payment, FV, par