Question

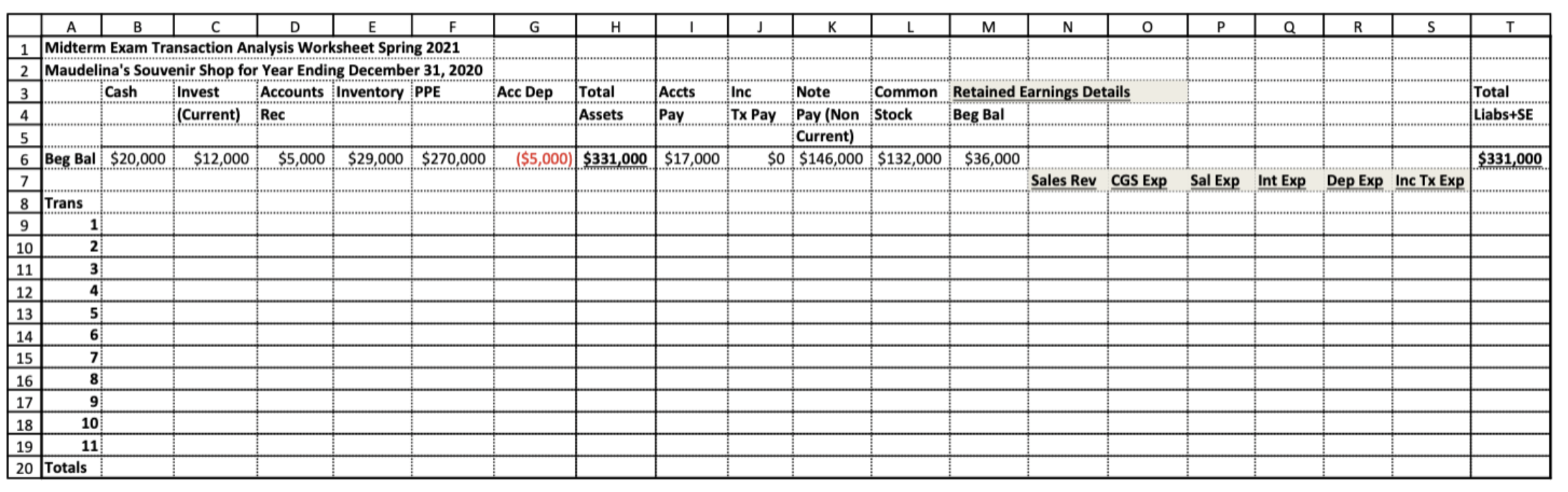

Assume Maudelinas Souvenir Shop has been in business for several years. The balances in the accounts on January 1, 2020 are in the Transaction Analysis

Assume Maudelinas Souvenir Shop has been in business for several years. The balances in the accounts on January 1, 2020 are in the Transaction Analysis Worksheet and in the T-Accounts. The following transactions took place during 2020.

- Company purchased inventory on credit (with accounts payable), cost of $355,000.

- Company made credit sales (with accounts receivable), amount of $240,000.

- Company collected accounts receivable, amount of $190,000.

- Company hired a new assistant store manager. She will start in January 2021.

- Company made cash sales, amount of $164,000.

- Company paid off accounts payable in the amount of $300,000.

- Company counted inventory at year-end, and found that the inventory sold cost $290,000.

- Company paid $37,000 in salaries in cash.

- Company paid $3,000 for interest on the note payable (Noncurrent).

- Company recognized $5,000 in depreciation on the Property, Plant and Equipment.

- Company pays income taxes at a rate of 25%. It uses an income tax payable account now, and will pay cash in the future.

- Complete the transaction analysis worksheet and indicate the account, amount and direction of the effect: increase or decrease. Put the ending balances in each column. Use the Excel worksheet.

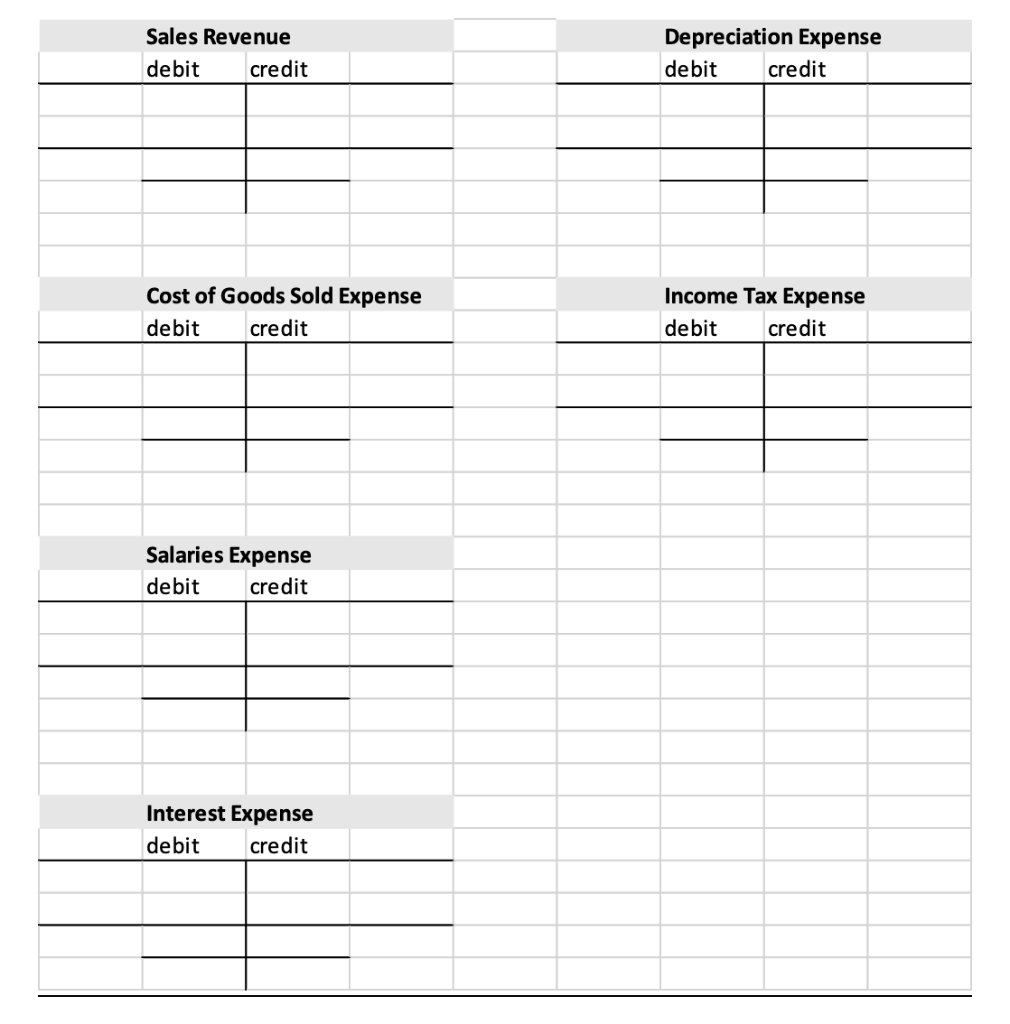

- B. Prepare journal entries for each transaction (if appropriate).

-

Transaction and Accounts Affected

Journal Entries

Debit Amount

(Record on Left)

Credit Amount

(Record on Right)

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

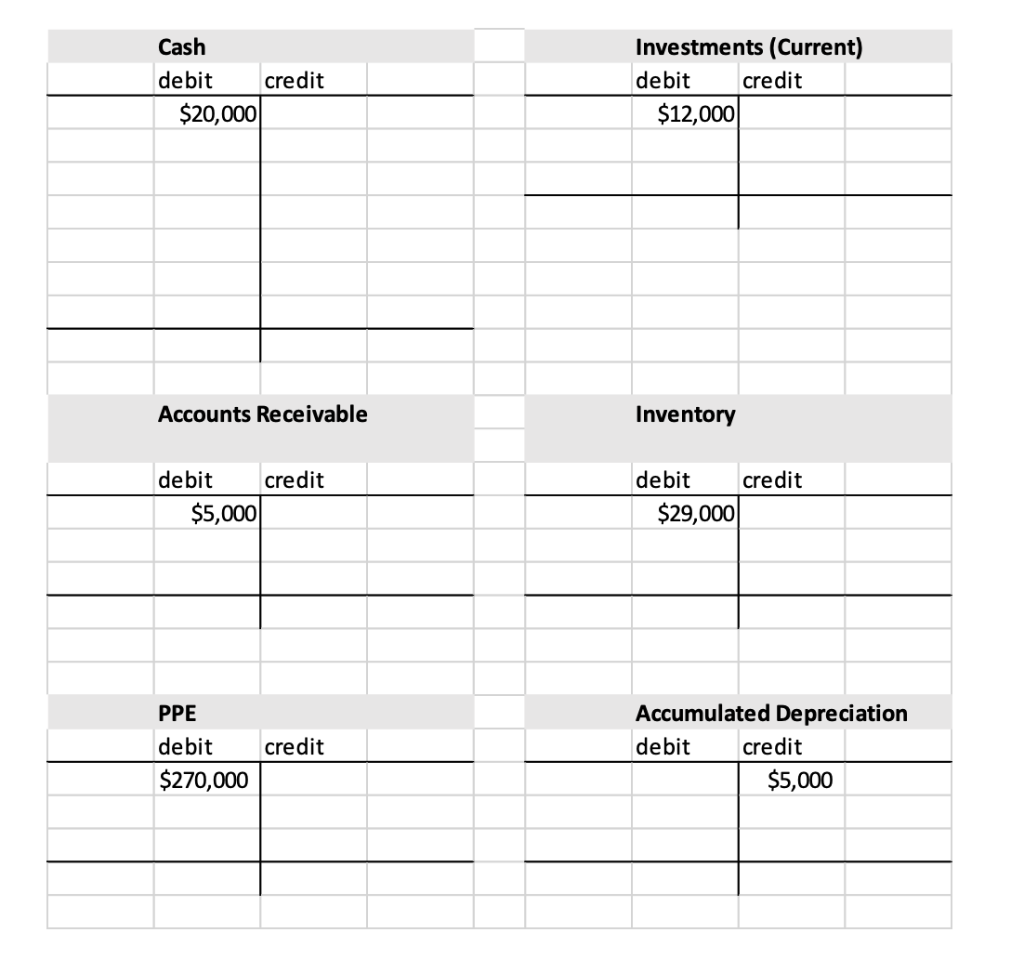

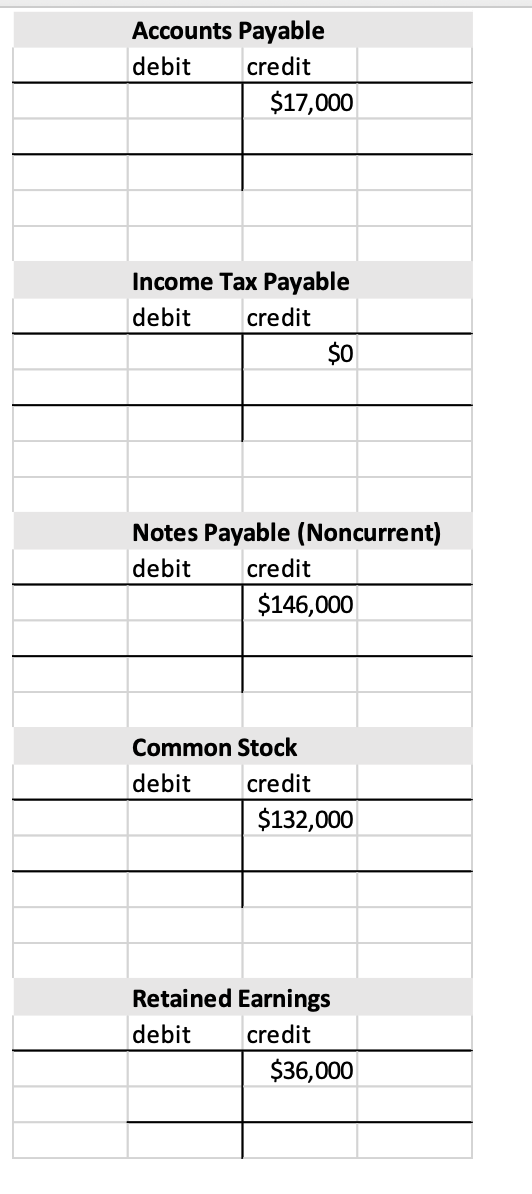

C. Post the information from the journal entries into the T-accounts.

D. Compute the ending balance in each T-account.

D. Compute the ending balance in each T-account.

-

E. Show the closing journal entry.

| Accounts Affected | Debit Amount | Credit Amount |

F. Go back to the T-accounts and post this closing journal entry. Compute the ending balances in the accounts.

Note: You do not have to prepare a trial balance.

G. You do not need to prepare a complete income statement for the year ending December 31, 2020. However, please fill in the blanks.

Maudelinas Souvenir Shop

Income Statement

For Year Ending December 31, 2020

Total Revenues ____________________

Total Expenses ____________________

Net Income ____________________

- You do not need to prepare a complete balance sheet for the year ending

December 31, 2020. However, please fill in the blanks.

Maudelinas Souvenir Shop

Balance Sheet

For Year Ending December 31, 2020

Total Assets ____________________

Total Liabilities ____________________

Total Stockholders Equity ____________________

Total Liabilities and

Stockholders Equity ____________________

Please please answer all. Thank you!

Q R S T Total Liabs+SE $331,000 from Fr. Sal Exp Int Exp Dep Exp Inc Tx Exp A B D E F G H M N 0 1 Midterm Exam Transaction Analysis Worksheet Spring 2021 2 Maudelina's Souvenir Shop for Year Ending December 31, 2020 3 Cash Invest Accounts Inventory PPE Acc Dep Total Accts Inc Note Common Retained Earnings Details 4 (Current) Rec Assets Pay Tx Pay Pay (Non Stock Beg Bal 5 Current) 6 Beg Bal $20,000 $12,000 $5,000 $29,000 $270,000 ($5,000) $331,000 $17,000 $0 $146,000 $132,000 $36,000 7 Sales Rev CGS Exp 8 Trans 9 1 10 2 11 3 12 4 13 5 14 6 15 7 16 8 17 9 18 10 19 11 20 Totals Cash debit credit $20,000 Investments (Current) debit credit $12,000 Accounts Receivable Inventory credit debit $5,000 debit credit $29,000 PPE credit debit $270,000 Accumulated Depreciation debit credit $5,000 Accounts Payable debit credit $17,000 Income Tax Payable debit credit $0 Notes Payable (Noncurrent) debit credit $146,000 Common Stock debit credit $132,000 Retained Earnings debit credit $36,000 Sales Revenue debit credit Depreciation Expense debit credit Cost of Goods Sold Expense debit credit Income Tax Expense debit credit Salaries Expense debit credit Interest Expense debit creditStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started