assume no change in tax rate at dec 1 2020. referring to AASB112 Income Taxes, discuss the accounting treatment of deferred tax liability and asset balances at 1 dec 2020 following a less tax threshold for the 2020-2021 financial year. complete the journal entries to record the effect of change in this rate. first column is book value, second column is fair value

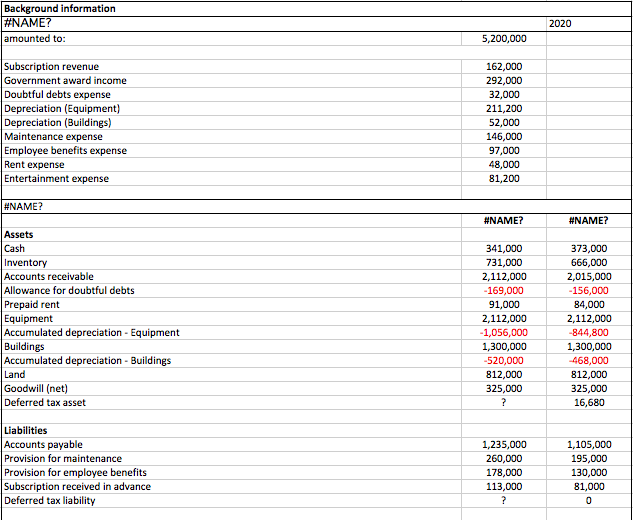

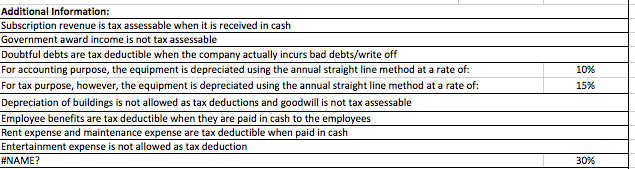

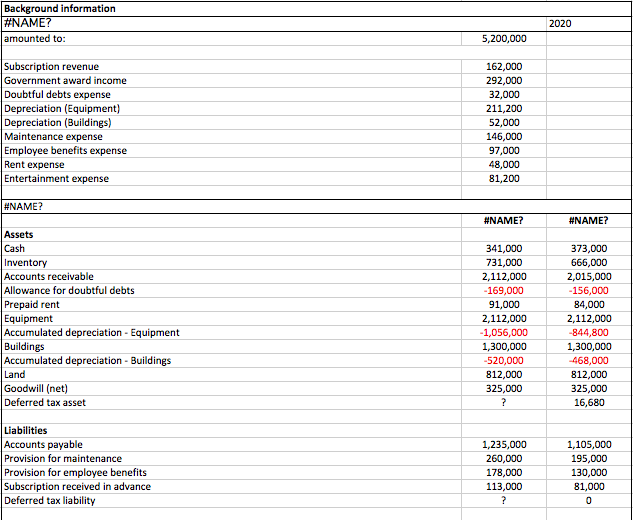

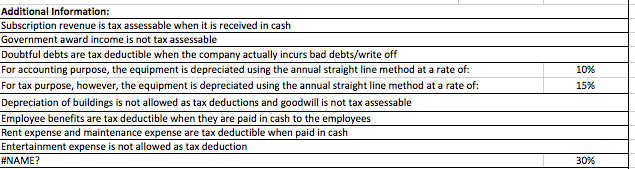

Background information #NAME? amounted to: 2020 5,200,000 Subscription revenue Government award income Doubtful debts expense Depreciation (Equipment) Depreciation (Buildings) Maintenance expense Employee benefits expense Rent expense Entertainment expense 162,000 292,000 32,000 211,200 52,000 146,000 97,000 48,000 81,200 #NAME? #NAME? #NAME? Assets Cash Inventory Accounts receivable Allowance for doubtful debts Prepaid rent Equipment Accumulated depreciation - Equipment Buildings Accumulated depreciation - Buildings Land Goodwill (net) Deferred tax asset 341,000 731,000 2,112,000 -169,000 91,000 2,112,000 -1,056,000 1,300,000 -520,000 812,000 325,000 ? 373,000 666,000 2,015,000 -156,000 84,000 2,112,000 -844,800 1,300,000 -468,000 812,000 325,000 16,680 Liabilities Accounts payable Provision for maintenance Provision for employee benefits Subscription received in advance Deferred tax liability 1,235,000 260,000 178,000 113,000 ? 1,105,000 195,000 130,000 81,000 0 Additional Information: Subscription revenue is tax assessable when it is received in cash Government award income is not tax assessable Doubtful debts are tax deductible when the company actually incurs bad debts/write off For accounting purpose, the equipment is depreciated using the annual straight line method at a rate of: For tax purpose, however, the equipment is depreciated using the annual straight line method at a rate of: Depreciation of buildings is not allowed as tax deductions and goodwill is not tax assessable Employee benefits are tax deductible when they are paid in cash to the employees Rent expense and maintenance expense are tax deductible when paid in cash Entertainment expense is not allowed as tax deduction #NAME? 10% 15% 30% Background information #NAME? amounted to: 2020 5,200,000 Subscription revenue Government award income Doubtful debts expense Depreciation (Equipment) Depreciation (Buildings) Maintenance expense Employee benefits expense Rent expense Entertainment expense 162,000 292,000 32,000 211,200 52,000 146,000 97,000 48,000 81,200 #NAME? #NAME? #NAME? Assets Cash Inventory Accounts receivable Allowance for doubtful debts Prepaid rent Equipment Accumulated depreciation - Equipment Buildings Accumulated depreciation - Buildings Land Goodwill (net) Deferred tax asset 341,000 731,000 2,112,000 -169,000 91,000 2,112,000 -1,056,000 1,300,000 -520,000 812,000 325,000 ? 373,000 666,000 2,015,000 -156,000 84,000 2,112,000 -844,800 1,300,000 -468,000 812,000 325,000 16,680 Liabilities Accounts payable Provision for maintenance Provision for employee benefits Subscription received in advance Deferred tax liability 1,235,000 260,000 178,000 113,000 ? 1,105,000 195,000 130,000 81,000 0 Additional Information: Subscription revenue is tax assessable when it is received in cash Government award income is not tax assessable Doubtful debts are tax deductible when the company actually incurs bad debts/write off For accounting purpose, the equipment is depreciated using the annual straight line method at a rate of: For tax purpose, however, the equipment is depreciated using the annual straight line method at a rate of: Depreciation of buildings is not allowed as tax deductions and goodwill is not tax assessable Employee benefits are tax deductible when they are paid in cash to the employees Rent expense and maintenance expense are tax deductible when paid in cash Entertainment expense is not allowed as tax deduction #NAME? 10% 15% 30%