Answered step by step

Verified Expert Solution

Question

1 Approved Answer

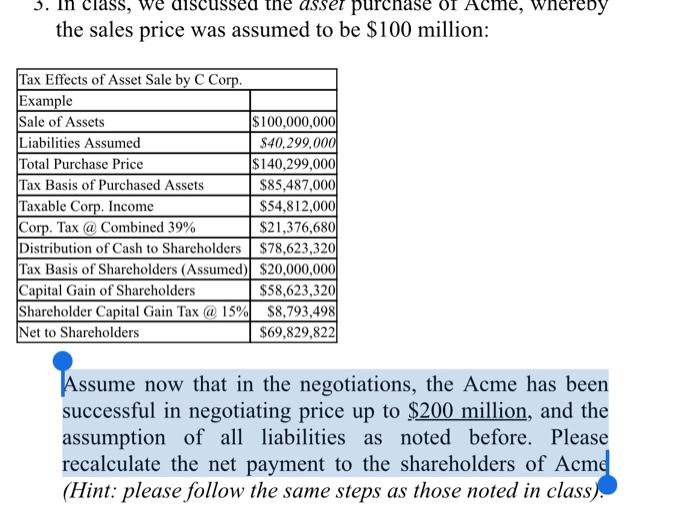

Assume now that in the negotiations, the Acme has been successful in negotiating price up to $200 million , and the assumption of all liabilities

Assume now that in the negotiations, the Acme has been successful in negotiating price up to $200 million, and the assumption of all liabilities as noted before. Please recalculate the net payment to the shareholders of Acme. excel format

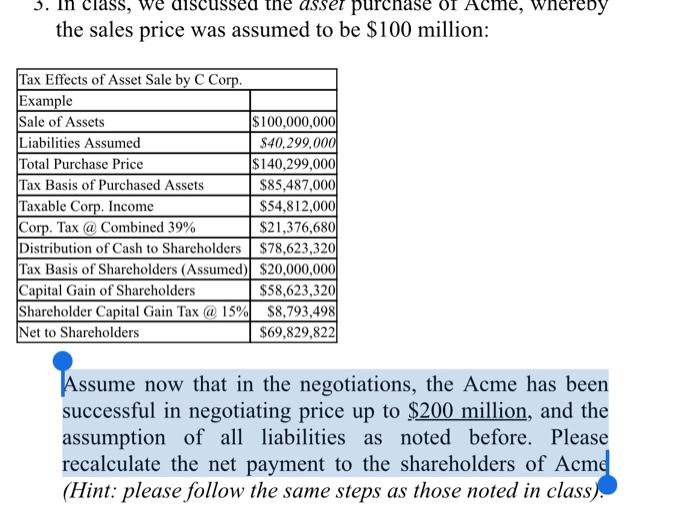

3. class, we disc asset purchase of Acme, whereby the sales price was assumed to be $100 million: Tax Effects of Asset Sale by C Corp. Example Sale of Assets Liabilities Assumed Total Purchase Price Tax Basis of Purchased Assets Taxable Corp. Income Corp. Tax @ Combined 39% Distribution of Cash to Shareholders $100,000,000 $40,299,000 $140,299,000 $85,487,000 $54,812,000 $21,376,680 $78,623,320 Tax Basis of Shareholders (Assumed) $20,000,000 Capital Gain of Shareholders $58,623,320 Shareholder Capital Gain Tax @ 15% $8,793,498 Net to Shareholders. $69,829,822 Assume now that in the negotiations, the Acme has been successful in negotiating price up to $200 million, and the assumption of all liabilities as noted before. Please recalculate the net payment to the shareholders of Acme (Hint: please follow the same steps as those noted in class)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started