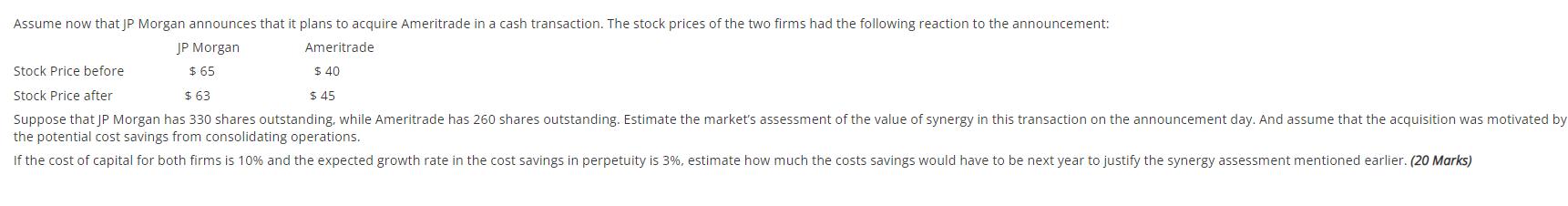

Assume now that JP Morgan announces that it plans to acquire Ameritrade in a cash transaction. The stock prices of the two firms had

Assume now that JP Morgan announces that it plans to acquire Ameritrade in a cash transaction. The stock prices of the two firms had the following reaction to the announcement: JP Morgan Ameritrade $65 $ 40 Stock Price before Stock Price after $63 Suppose that JP Morgan has 330 shares outstanding, while Ameritrade has 260 shares outstanding. Estimate the market's assessment of the value of synergy in this transaction on the announcement day. And assume that the acquisition was motivated by the potential cost savings from consolidating operations. If the cost of capital for both firms is 10% and the expected growth rate in the cost savings in perpetuity is 3%, estimate how much the costs savings would have to be next year to justify the synergy assessment mentioned earlier. (20 Marks) $45

Step by Step Solution

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

We may compute the entire market value of JP Morgan and Ameritrade before and after the announcement ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started