Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Atab Sdn Bhd which prepares its account to 30 September annually, carries on a shoe manufacturing business. In June 2015, it completed the construction

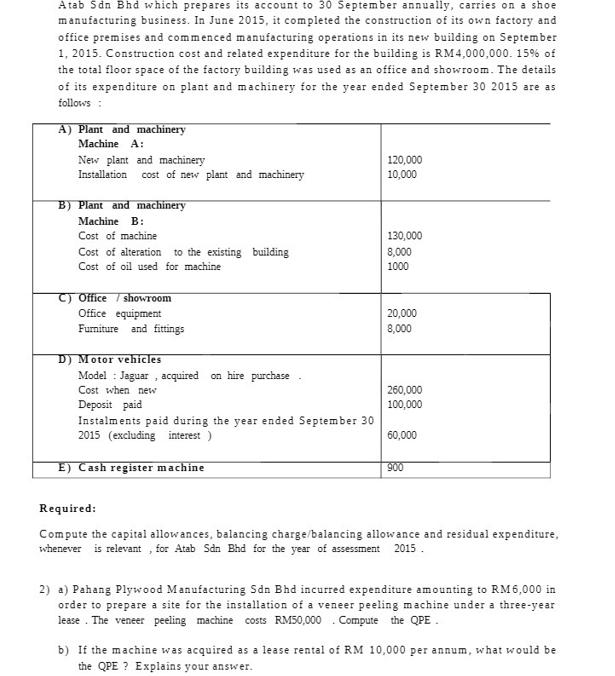

Atab Sdn Bhd which prepares its account to 30 September annually, carries on a shoe manufacturing business. In June 2015, it completed the construction of its own factory and office premises and commenced manufacturing operations in its new building on September 1, 2015. Construction cost and related expenditure for the building is RM4,000,000. 15% of the total floor space of the factory building was used as an office and showroom. The details of its expenditure on plant and machinery for the year ended September 30 2015 are as follows: A) Plant and machinery Machine A: New plant and machinery Installation cost of new plant and machinery B) Plant and machinery Machine B: Cost of machine Cost of alteration to the existing building Cost of oil used for machine Office/showroom Office equipment Furniture and fittings D) Motor vehicles Model: Jaguar, acquired on hire purchase. Cost when new Deposit paid Instalments paid during the year ended September 30 2015 (excluding interest) E) Cash register machine 120,000 10,000 130,000 8,000 1000 20,000 8,000 260,000 100,000 60,000 900 Required: Compute the capital allowances, balancing charge/balancing allowance and residual expenditure, whenever is relevant, for Atab Sdn Bhd for the year of assessment 2015. 2) a) Pahang Plywood Manufacturing Sdn Bhd incurred expenditure amounting to RM6,000 in order to prepare a site for the installation of a veneer peeling machine under a three-year lease. The veneer peeling machine costs RM50,000. Compute the QPE. b) If the machine was acquired as a lease rental of RM 10,000 per annum, what would be the QPE? Explains your answer.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Atab Sdn Bhd Capital Allowances Balancing ChargeAllowance and Residual Expenditure a Plant and Machinery Machine A Cost of Plant and Machinery RM12000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started