Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume Oakley, Inc.-the maker of sunglasses, goggles, and other products-made merchandise costing $137,200 and sold it on credit to Sunglass Hut for $405,000 with

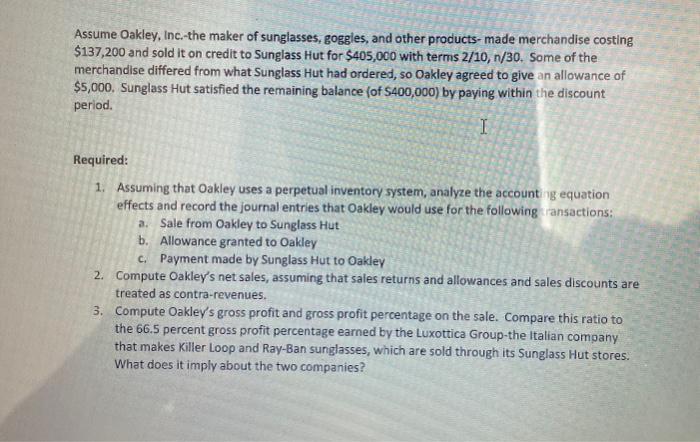

Assume Oakley, Inc.-the maker of sunglasses, goggles, and other products-made merchandise costing $137,200 and sold it on credit to Sunglass Hut for $405,000 with terms 2/10, n/30. Some of the merchandise differed from what Sunglass Hut had ordered, so Oakley agreed to give an allowance of $5,000. Sunglass Hut satisfied the remaining balance (of $400,000) by paying within the discount period. I Required: 1. Assuming that Oakley uses a perpetual inventory system, analyze the accounting equation effects and record the journal entries that Oakley would use for the following transactions: a. Sale from Oakley to Sunglass Hut b. Allowance granted to Oakley c. Payment made by Sunglass Hut to Oakley 2. Compute Oakley's net sales, assuming that sales returns and allowances and sales discounts are treated as contra-revenues. 3. Compute Oakley's gross profit and gross profit percentage on the sale. Compare this ratio to the 66.5 percent gross profit percentage earned by the Luxottica Group-the Italian company that makes Killer Loop and Ray-Ban sunglasses, which are sold through its Sunglass Hut stores. What does it imply about the two companies?

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1a Sale from Oakley to Sunglass Hut Dr Accounts Receivable Sunglass Hut 405000 Cr Sales Revenue ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started