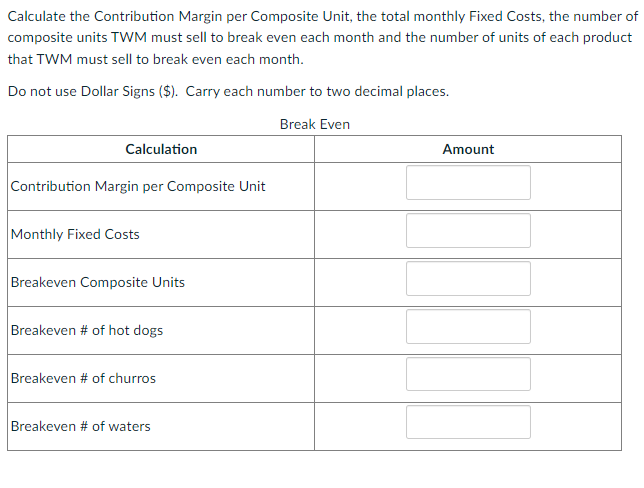

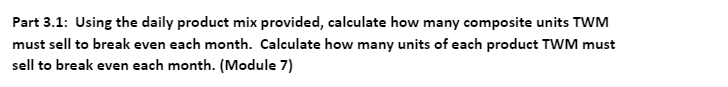

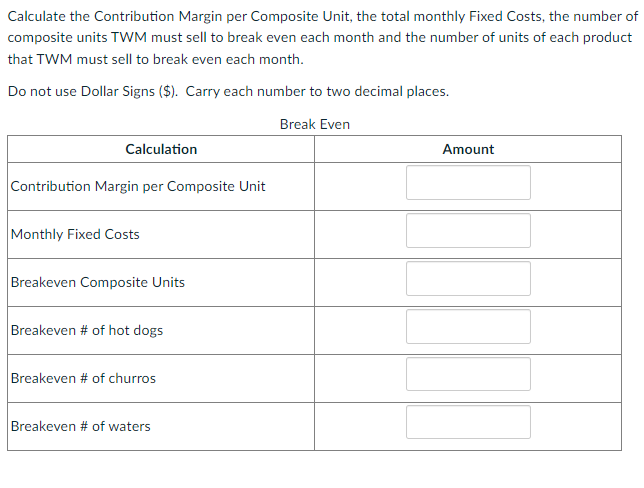

Assume one month has four weeks. Ignore payroll and income taxes. Mike Lowry owns a hot dog stand called The Weenie Man (TWM). He operates his stand on a busy street corner between the hours of 10am and 3pm, Monday - Friday. He sells hot dogs for $7 /each, churros for $5 /each and bottled water for $3 /each. He also offers free condiments to his customers. He buys hotdogs in packages of 100 for $40 and packages of 80 buns for $36. Frozen churros cost $100 for a pack of 40 and bottled water costs $18 for a pack of 24 . Each month, TWM buys king sized jars of mustard and ketchup for $100 each, onions and relish for $150 each and a vat sauerkraut $200. For health and safety reasons, he replaces all condiments on the first of every month, even though they are not usually empty. Mike bought his cart 3 years ago for $252,000 and expects that it will last for a total of seven years. The cart came with a solar panel, so he does not have utility costs. He pays for an annual street vendor permit in the amount of $6000 and renews his safe food handling certification once a year for a cost of $1200. He carries liability insurance, which costs $4,800 every six months. On average, sells 200 hot dogs, 80 churros and 120 bottles of water each day. Part 3.1: Using the daily product mix provided, calculate how many composite units TWM must sell to break even each month. Calculate how many units of each product TWM must sell to break even each month. (Module 7) Calculate the Contribution Margin per Composite Unit, the total monthly Fixed Costs, the number of composite units TWM must sell to break even each month and the number of units of each product that TWM must sell to break even each month. Do not use Dollar Signs (\$). Carry each number to two decimal places. Assume one month has four weeks. Ignore payroll and income taxes. Mike Lowry owns a hot dog stand called The Weenie Man (TWM). He operates his stand on a busy street corner between the hours of 10am and 3pm, Monday - Friday. He sells hot dogs for $7 /each, churros for $5 /each and bottled water for $3 /each. He also offers free condiments to his customers. He buys hotdogs in packages of 100 for $40 and packages of 80 buns for $36. Frozen churros cost $100 for a pack of 40 and bottled water costs $18 for a pack of 24 . Each month, TWM buys king sized jars of mustard and ketchup for $100 each, onions and relish for $150 each and a vat sauerkraut $200. For health and safety reasons, he replaces all condiments on the first of every month, even though they are not usually empty. Mike bought his cart 3 years ago for $252,000 and expects that it will last for a total of seven years. The cart came with a solar panel, so he does not have utility costs. He pays for an annual street vendor permit in the amount of $6000 and renews his safe food handling certification once a year for a cost of $1200. He carries liability insurance, which costs $4,800 every six months. On average, sells 200 hot dogs, 80 churros and 120 bottles of water each day. Part 3.1: Using the daily product mix provided, calculate how many composite units TWM must sell to break even each month. Calculate how many units of each product TWM must sell to break even each month. (Module 7) Calculate the Contribution Margin per Composite Unit, the total monthly Fixed Costs, the number of composite units TWM must sell to break even each month and the number of units of each product that TWM must sell to break even each month. Do not use Dollar Signs (\$). Carry each number to two decimal places