Question

Assume Parent Ltd acquired 24% of the equity of Sub Ltd on 1 April 2004 and paid a cash sum of $240 000 for the

Assume Parent Ltd acquired 24% of the equity of Sub Ltd on 1 April 2004 and paid a cash sum of $240 000 for the acquisition. Because of this acquisition, Parent Ltd has significant influence over Sub Ltd.

Required:

(a) Prepare a quick estimate of the proposed increase to the investment.

| Quick estimate:

|

|

|

(b) Prepare the notional journal entry at 31 March 2021 to account for Parent Ltds investment in Sub Ltd (an associate); use the equity method as required by NZ IAS 28 Investments in Associates. The tax rate is 28%. You must include your workings on each line of your notional journal entry.

| Notional journal entry: | $Dr | $Cr |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Question 1 continued:

(c) Reconcile your quick estimate to your notional journal entry dollar amount.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(d) Determine the amount at which the investment asset will be measured, after being equity accounted for, in the Investors financial statements at 31 March 2021. Show your workings.

| The Investment in Sub Ltd (an associate) will be measured at: | $ |

| Workings: | |

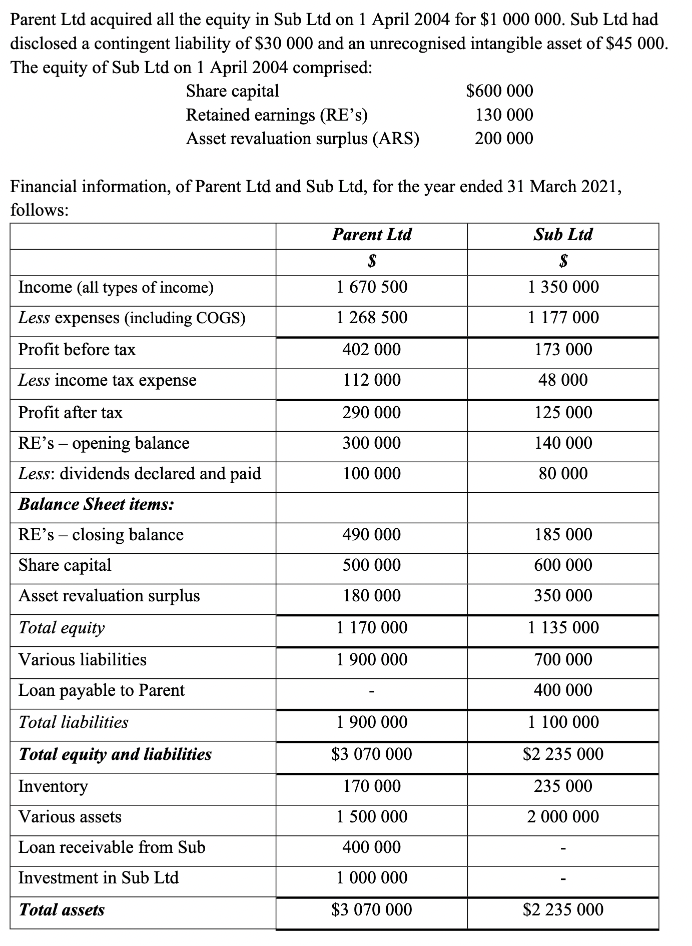

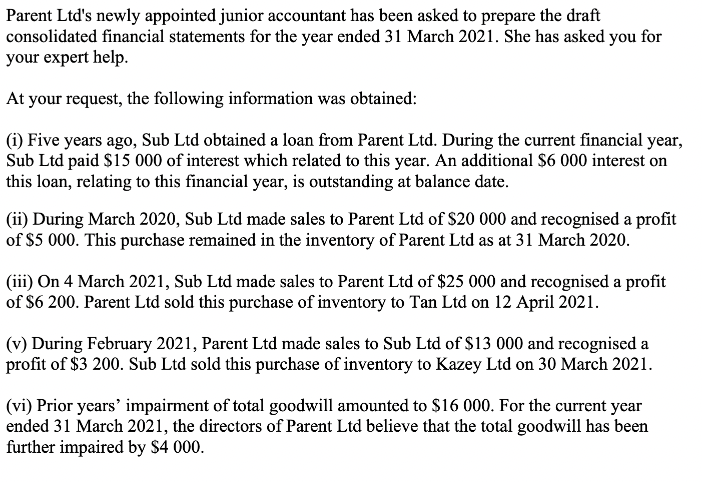

Parent Ltd acquired all the equity in Sub Ltd on 1 April 2004 for $1 000 000. Sub Ltd had disclosed a contingent liability of $30 000 and an unrecognised intangible asset of $45 000. The equity of Sub Ltd on 1 April 2004 comprised: Share capital $600 000 130 000 Retained earnings (RE's) Asset revaluation surplus (ARS) 200 000 Financial information, of Parent Ltd and Sub Ltd, for the year ended 31 March 2021, follows: Parent Ltd Sub Ltd $ $ Income (all types of income) 1 670 500 1 350 000 Less expenses (including COGS) 1 268 500 1 177 000 Profit before tax 402 000 173 000 Less income tax expense 112 000 48 000 Profit after tax 290 000 125 000 RE's-opening balance 300 000 140 000 Less: dividends declared and paid 100 000 80 000 Balance Sheet items: RE's - closing balance 490 000 185 000 Share capital 500 000 600 000 Asset revaluation surplus 180 000 350 000 Total equity 1 170 000 1 135 000 Various liabilities 1 900 000 700 000 Loan payable to Parent 400 000 Total liabilities 1 900 000 1 100 000 Total equity and liabilities $3 070 000 $2 235 000 235 000 Inventory 170 000 Various assets 1 500 000 2 000 000 Loan receivable from Sub 400 000 Investment in Sub Ltd 1 000 000 Total assets $3 070 000 $2 235 000 Parent Ltd's newly appointed junior accountant has been asked to prepare the draft consolidated financial statements for the year ended 31 March 2021. She has asked you for your expert help. At your request, the following information was obtained: (i) Five years ago, Sub Ltd obtained a loan from Parent Ltd. During the current financial year, Sub Ltd paid $15 000 of interest which related to this year. An additional $6 000 interest on this loan, relating to this financial year, is outstanding at balance date. (ii) During March 2020, Sub Ltd made sales to Parent Ltd of $20 000 and recognised a profit of $5 000. This purchase remained in the inventory of Parent Ltd as at 31 March 2020. (iii) On 4 March 2021, Sub Ltd made sales to Parent Ltd of $25 000 and recognised a profit of $6 200. Parent Ltd sold this purchase of inventory to Tan Ltd on 12 April 2021. (v) During February 2021, Parent Ltd made sales to Sub Ltd of $13 000 and recognised a profit of $3 200. Sub Ltd sold this purchase of inventory to Kazey Ltd on 30 March 2021. (vi) Prior years' impairment of total goodwill amounted to $16 000. For the current year ended 31 March 2021, the directors of Parent Ltd believe that the total goodwill has been further impaired by $4 000. Parent Ltd acquired all the equity in Sub Ltd on 1 April 2004 for $1 000 000. Sub Ltd had disclosed a contingent liability of $30 000 and an unrecognised intangible asset of $45 000. The equity of Sub Ltd on 1 April 2004 comprised: Share capital $600 000 130 000 Retained earnings (RE's) Asset revaluation surplus (ARS) 200 000 Financial information, of Parent Ltd and Sub Ltd, for the year ended 31 March 2021, follows: Parent Ltd Sub Ltd $ $ Income (all types of income) 1 670 500 1 350 000 Less expenses (including COGS) 1 268 500 1 177 000 Profit before tax 402 000 173 000 Less income tax expense 112 000 48 000 Profit after tax 290 000 125 000 RE's-opening balance 300 000 140 000 Less: dividends declared and paid 100 000 80 000 Balance Sheet items: RE's - closing balance 490 000 185 000 Share capital 500 000 600 000 Asset revaluation surplus 180 000 350 000 Total equity 1 170 000 1 135 000 Various liabilities 1 900 000 700 000 Loan payable to Parent 400 000 Total liabilities 1 900 000 1 100 000 Total equity and liabilities $3 070 000 $2 235 000 235 000 Inventory 170 000 Various assets 1 500 000 2 000 000 Loan receivable from Sub 400 000 Investment in Sub Ltd 1 000 000 Total assets $3 070 000 $2 235 000 Parent Ltd's newly appointed junior accountant has been asked to prepare the draft consolidated financial statements for the year ended 31 March 2021. She has asked you for your expert help. At your request, the following information was obtained: (i) Five years ago, Sub Ltd obtained a loan from Parent Ltd. During the current financial year, Sub Ltd paid $15 000 of interest which related to this year. An additional $6 000 interest on this loan, relating to this financial year, is outstanding at balance date. (ii) During March 2020, Sub Ltd made sales to Parent Ltd of $20 000 and recognised a profit of $5 000. This purchase remained in the inventory of Parent Ltd as at 31 March 2020. (iii) On 4 March 2021, Sub Ltd made sales to Parent Ltd of $25 000 and recognised a profit of $6 200. Parent Ltd sold this purchase of inventory to Tan Ltd on 12 April 2021. (v) During February 2021, Parent Ltd made sales to Sub Ltd of $13 000 and recognised a profit of $3 200. Sub Ltd sold this purchase of inventory to Kazey Ltd on 30 March 2021. (vi) Prior years' impairment of total goodwill amounted to $16 000. For the current year ended 31 March 2021, the directors of Parent Ltd believe that the total goodwill has been further impaired by $4 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started