Answered step by step

Verified Expert Solution

Question

1 Approved Answer

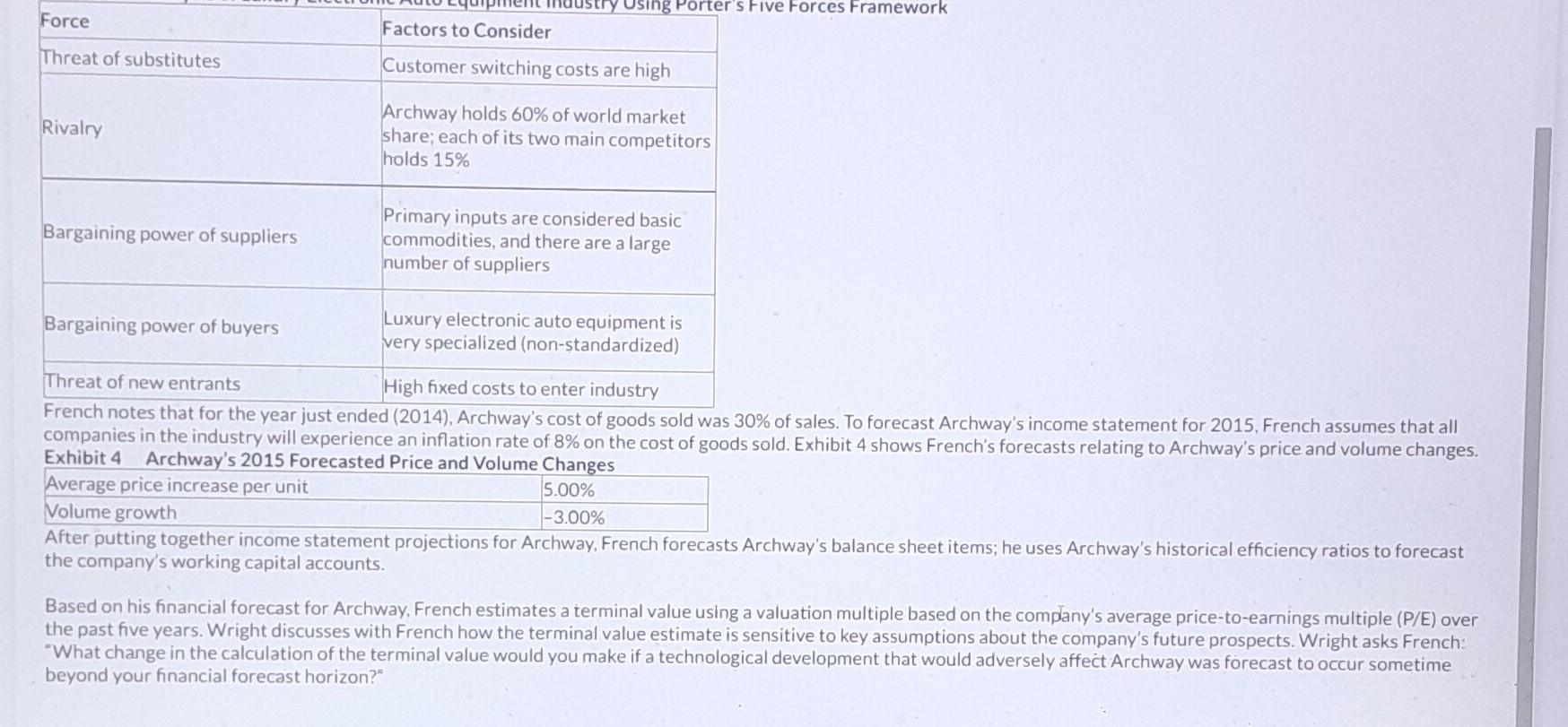

Assume sales volume for the company is expected to shrink 3.00% while their average price per unit is expected to rise 5.00% and all companies

Assume sales volume for the company is expected to shrink 3.00% while their average price per unit is expected to rise 5.00% and all companies in the industry will experience an inflation rate of 8.00% on cost of good sold. if cost of good sold for the company was originally 30% of sales, what percent of sales will it become as a result of these factors?

Arter putting together income statement projections for Archway, French forecasts Archway's balance sheet items; he uses Archway's historical efficiency ratios to forecast the company's working capital accounts. Based on his financial forecast for Archway, French estimates a terminal value using a valuation multiple based on the complany's average price-to-earnings multiple (P/E) over the past five years. Wright discusses with French how the terminal value estimate is sensitive to key assumptions about the company's future prospects. Wright asks French: "What change in the calculation of the terminal value would you make if a technological development that would adversely affect Archway was forecast to occur sometime beyond your financial forecast horizon?" Arter putting together income statement projections for Archway, French forecasts Archway's balance sheet items; he uses Archway's historical efficiency ratios to forecast the company's working capital accounts. Based on his financial forecast for Archway, French estimates a terminal value using a valuation multiple based on the complany's average price-to-earnings multiple (P/E) over the past five years. Wright discusses with French how the terminal value estimate is sensitive to key assumptions about the company's future prospects. Wright asks French: "What change in the calculation of the terminal value would you make if a technological development that would adversely affect Archway was forecast to occur sometime beyond your financial forecast horizonStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started