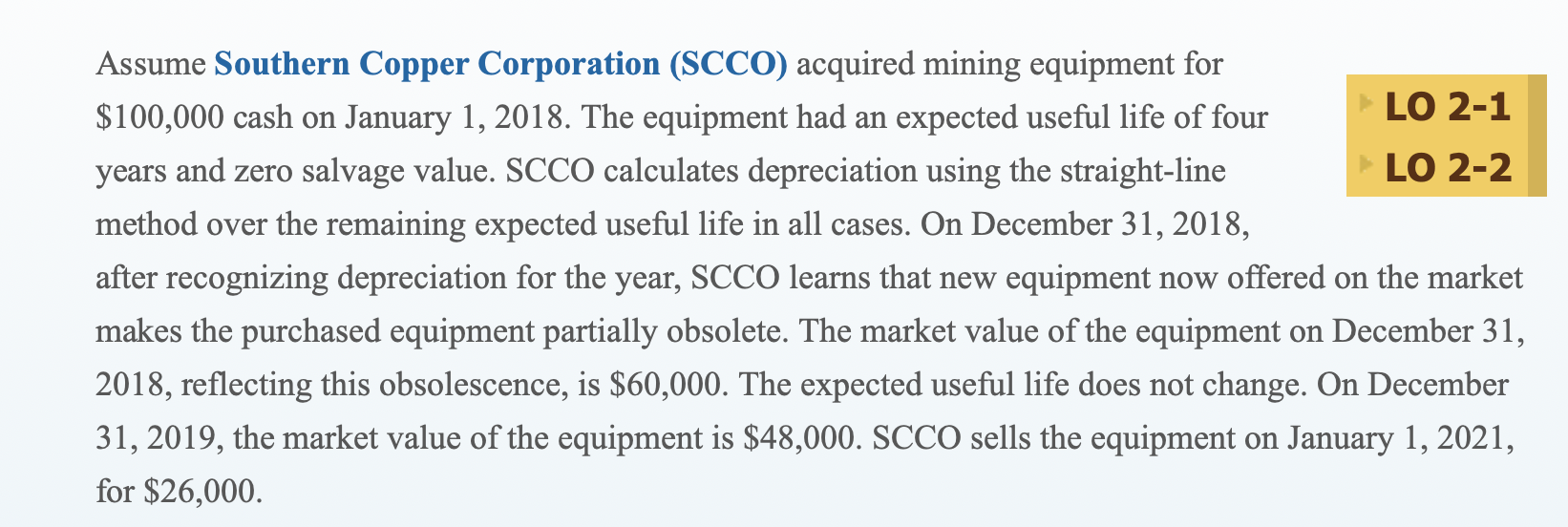

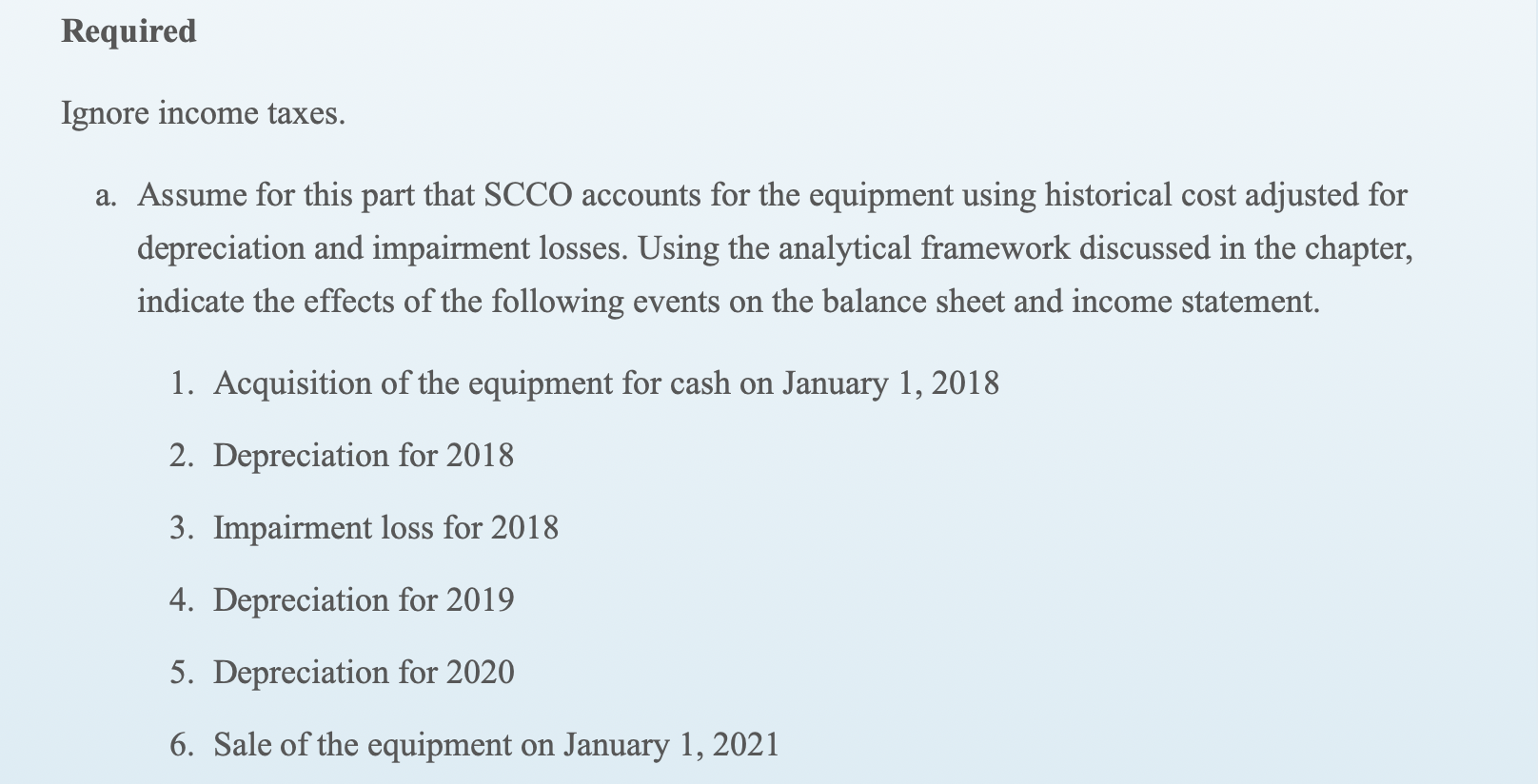

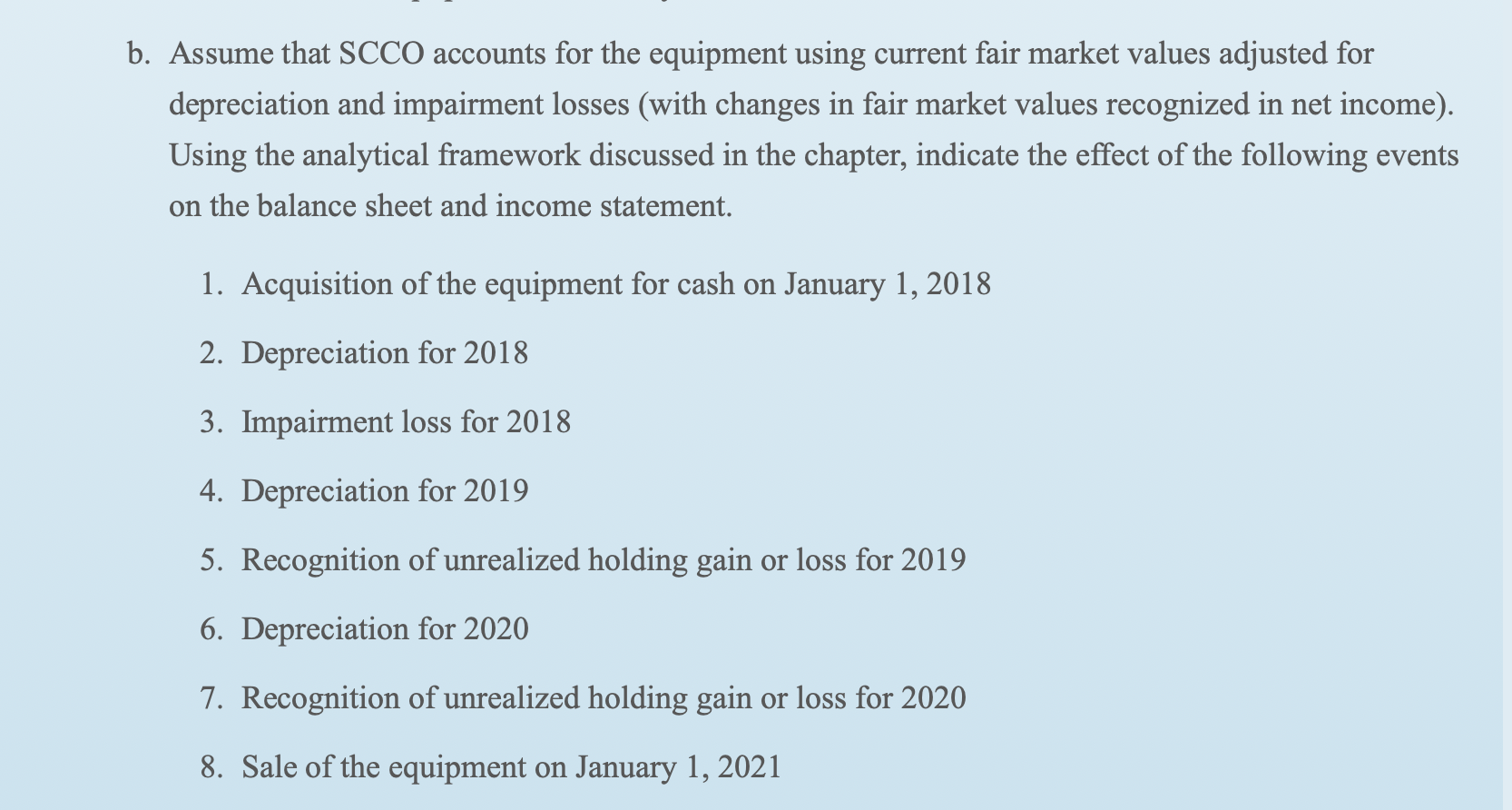

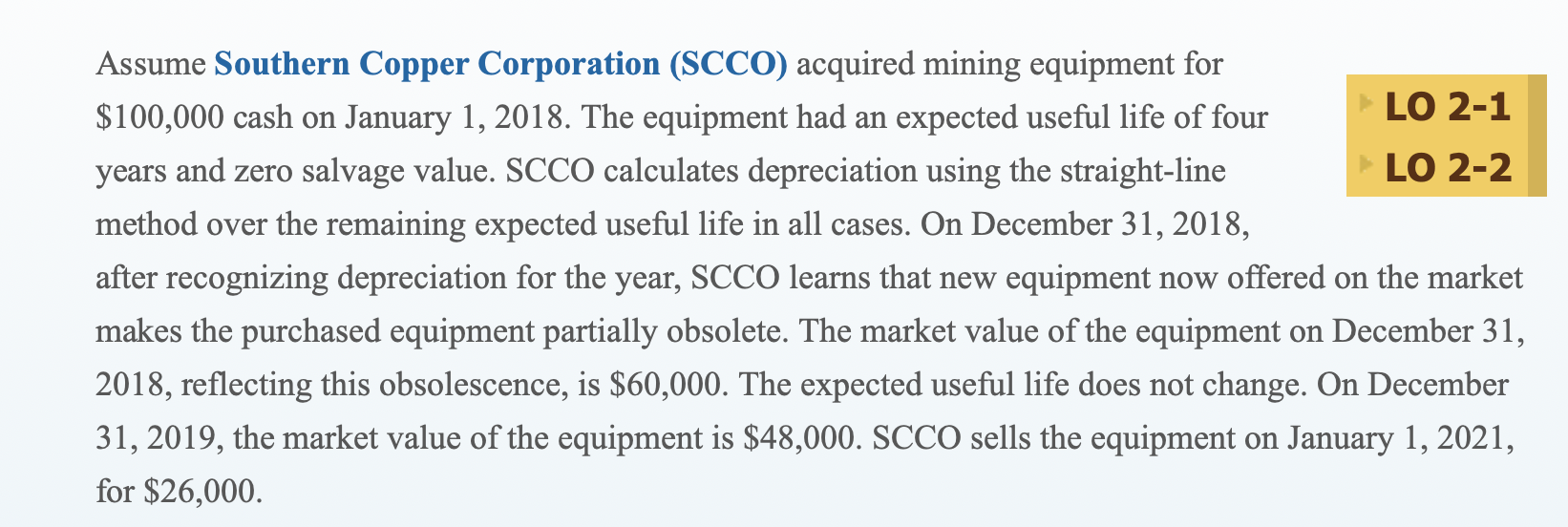

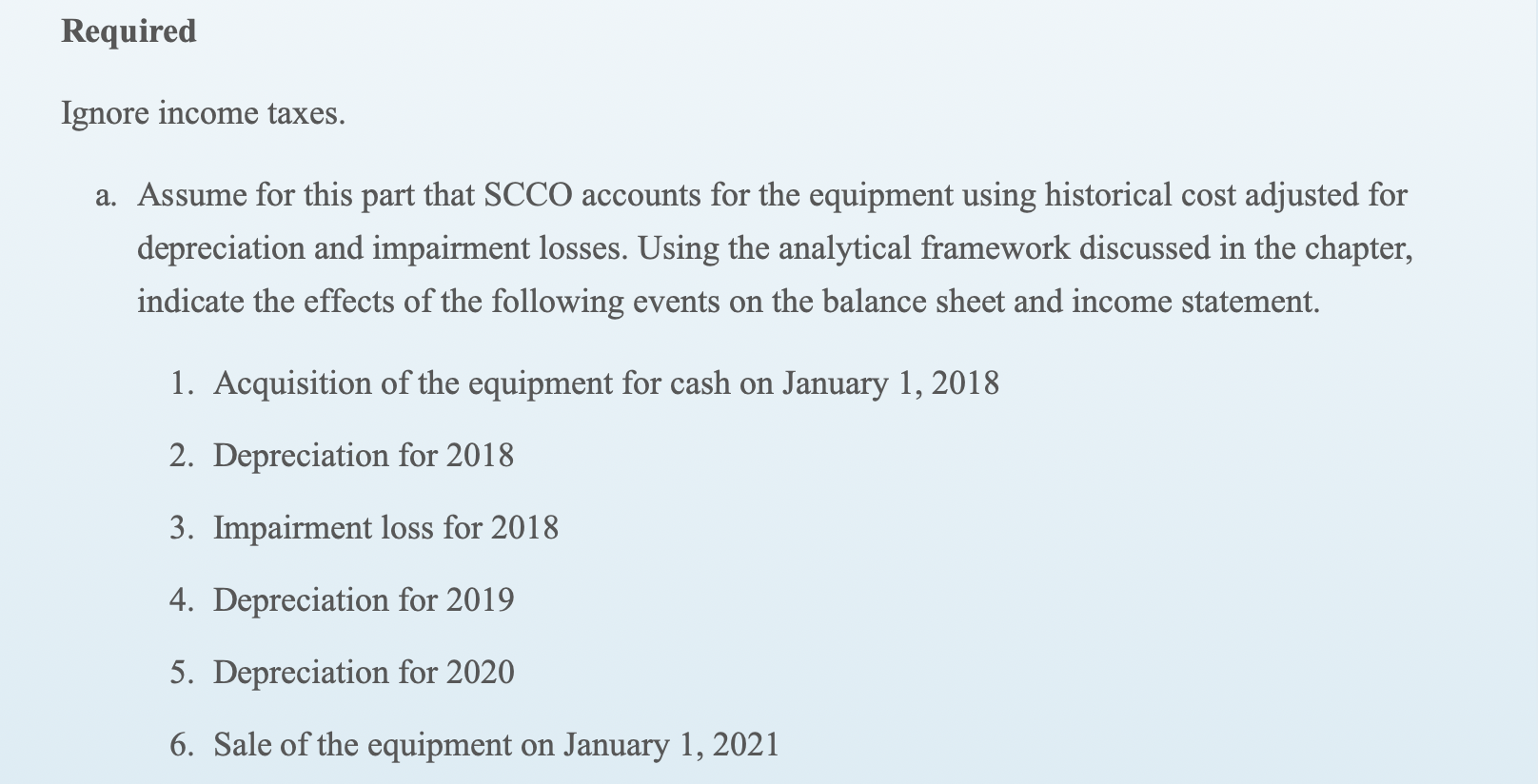

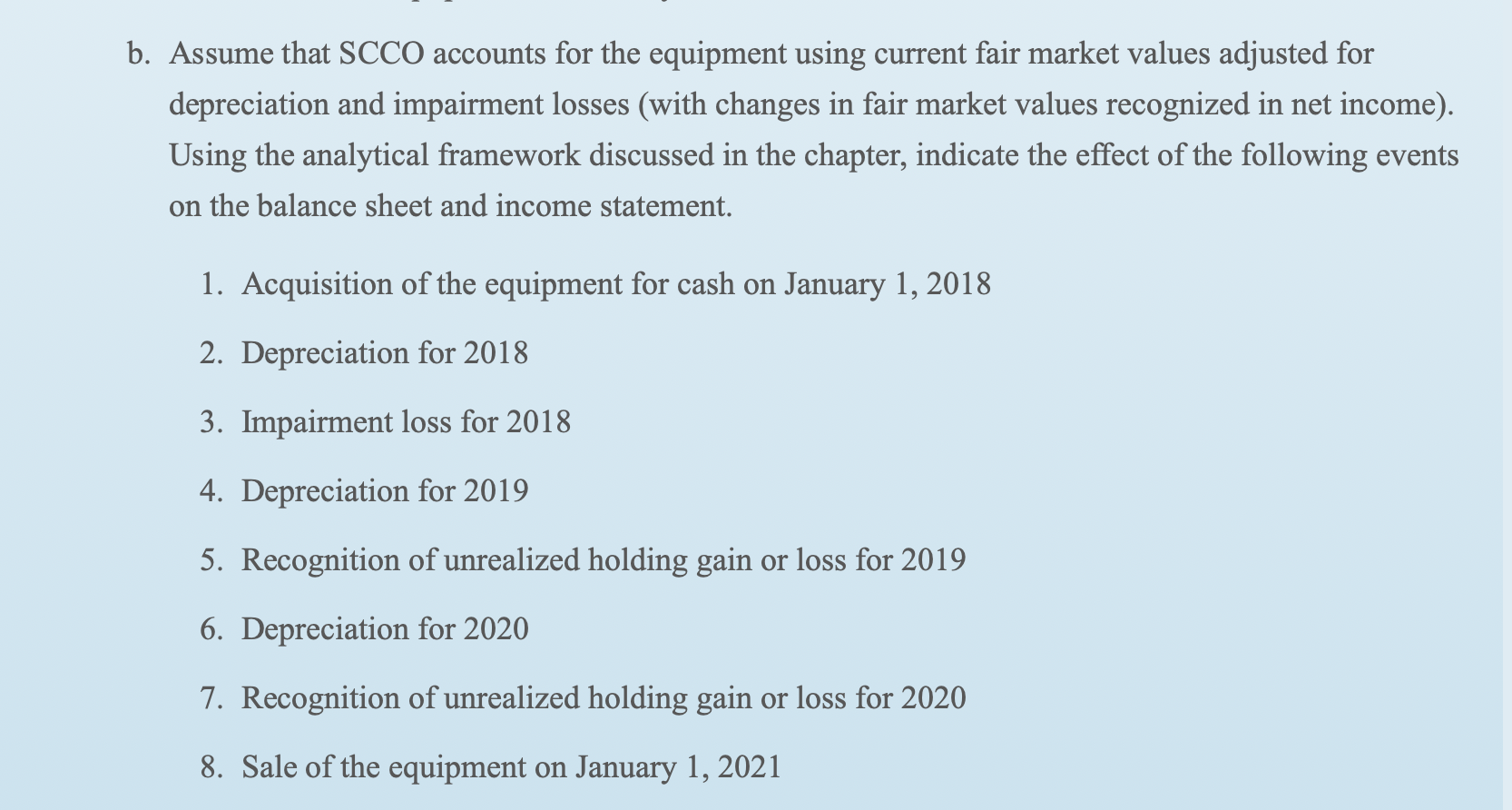

Assume Southern Copper Corporation (SCCO) acquired mining equipment for LO 2-1 $100,000 cash on January 1, 2018. The equipment had an expected useful life of four years and zero salvage value. SCCO calculates depreciation using the straight-line LO 2-2 method over the remaining expected useful life in all cases. On December 31, 2018, after recognizing depreciation for the year, SCCO learns that new equipment now offered on the market makes the purchased equipment partially obsolete. The market value of the equipment on December 31, 2018, reflecting this obsolescence, is $60,000. The expected useful life does not change. On December 31, 2019, the market value of the equipment is $48,000. SCCO sells the equipment on January 1, 2021, for $26,000. Required Ignore income taxes. a. Assume for this part that SCCO accounts for the equipment using historical cost adjusted for depreciation and impairment losses. Using the analytical framework discussed in the chapter, indicate the effects of the following events on the balance sheet and income statement. 1. Acquisition of the equipment for cash on January 1, 2018 2. Depreciation for 2018 3. Impairment loss for 2018 4. Depreciation for 2019 5. Depreciation for 2020 6. Sale of the equipment on January 1, 2021 b. Assume that SCCO accounts for the equipment using current fair market values adjusted for depreciation and impairment losses (with changes in fair market values recognized in net income). Using the analytical framework discussed in the chapter, indicate the effect of the following events on the balance sheet and income statement. 1. Acquisition of the equipment for cash on January 1, 2018 2. Depreciation for 2018 3. Impairment loss for 2018 4. Depreciation for 2019 5. Recognition of unrealized holding gain or loss for 2019 6. Depreciation for 2020 7. Recognition of unrealized holding gain or loss for 2020 8. Sale of the equipment on January 1, 2021 c. After the equipment is sold, why is retained earnings on January 1, 2021, equal to a negative $74,000 in both cases despite having shown a different pattern of expenses, gains, and losses over time? Assume Southern Copper Corporation (SCCO) acquired mining equipment for LO 2-1 $100,000 cash on January 1, 2018. The equipment had an expected useful life of four years and zero salvage value. SCCO calculates depreciation using the straight-line LO 2-2 method over the remaining expected useful life in all cases. On December 31, 2018, after recognizing depreciation for the year, SCCO learns that new equipment now offered on the market makes the purchased equipment partially obsolete. The market value of the equipment on December 31, 2018, reflecting this obsolescence, is $60,000. The expected useful life does not change. On December 31, 2019, the market value of the equipment is $48,000. SCCO sells the equipment on January 1, 2021, for $26,000. Required Ignore income taxes. a. Assume for this part that SCCO accounts for the equipment using historical cost adjusted for depreciation and impairment losses. Using the analytical framework discussed in the chapter, indicate the effects of the following events on the balance sheet and income statement. 1. Acquisition of the equipment for cash on January 1, 2018 2. Depreciation for 2018 3. Impairment loss for 2018 4. Depreciation for 2019 5. Depreciation for 2020 6. Sale of the equipment on January 1, 2021 b. Assume that SCCO accounts for the equipment using current fair market values adjusted for depreciation and impairment losses (with changes in fair market values recognized in net income). Using the analytical framework discussed in the chapter, indicate the effect of the following events on the balance sheet and income statement. 1. Acquisition of the equipment for cash on January 1, 2018 2. Depreciation for 2018 3. Impairment loss for 2018 4. Depreciation for 2019 5. Recognition of unrealized holding gain or loss for 2019 6. Depreciation for 2020 7. Recognition of unrealized holding gain or loss for 2020 8. Sale of the equipment on January 1, 2021 c. After the equipment is sold, why is retained earnings on January 1, 2021, equal to a negative $74,000 in both cases despite having shown a different pattern of expenses, gains, and losses over time