Question: Assume that a 3 -year Treasury security yields 4.50%. Also assume that the real risk-free rate (r) is 0.75%, and inflation is expected to be

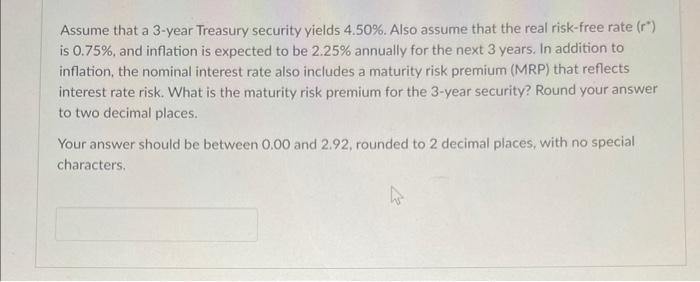

Assume that a 3 -year Treasury security yields 4.50%. Also assume that the real risk-free rate (r) is 0.75%, and inflation is expected to be 2.25% annually for the next 3 years. In addition to inflation, the nominal interest rate also includes a maturity risk premium (MRP) that reflects interest rate risk. What is the maturity risk premium for the 3 -year security? Round your answer to two decimal places. Your answer should be between 0.00 and 2.92, rounded to 2 decimal places, with no special characters

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts