Question

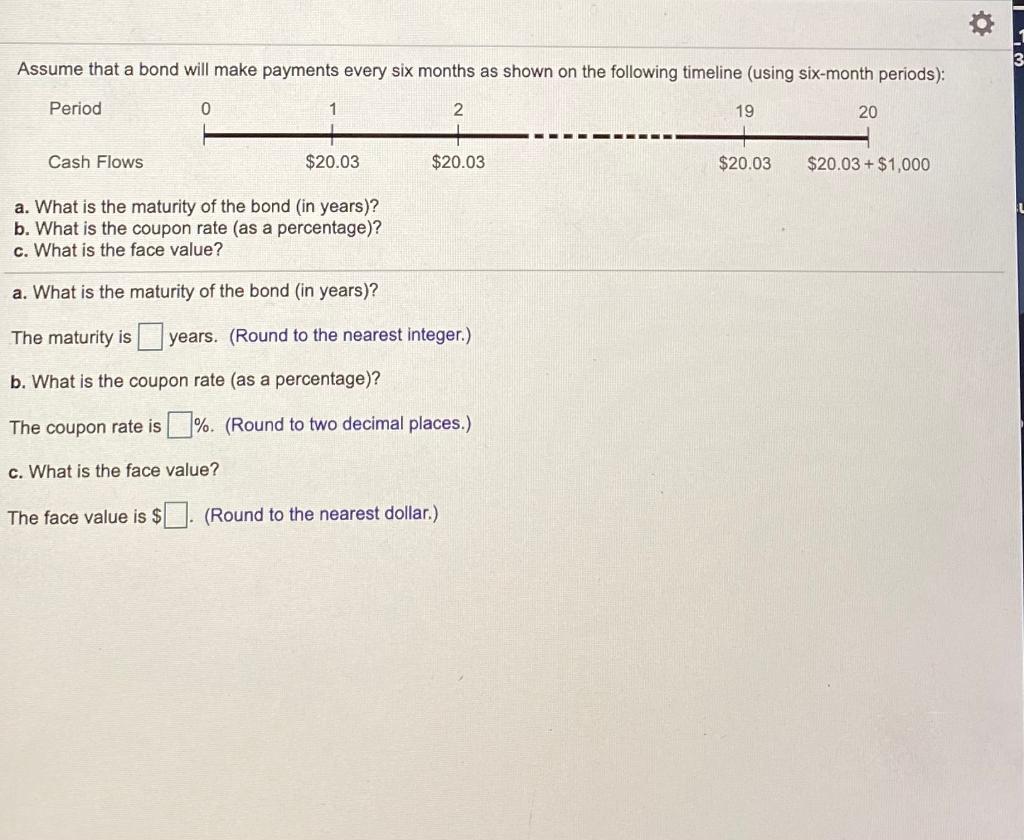

Assume that a bond will make payments every six months as shown on the following timeline (using six-month periods): The timeline starts at Period 0

Assume that a bond will make payments every six months as shown on the following timeline (using six-month periods):

The timeline starts at Period 0 and ends at Period 20. The timeline shows a cash flow of $ 20.03 each from Period 1 to Period 19. In Period 20, the cash flow is $ 20.03 plus $ 1,000.

Period

0

1

2

19

20

Cash Flows

$20.03

$20.03

$20.03

$20.03+$1,000

a. What is the maturity of the bond (in years)?

b. What is the coupon rate (as a percentage)?

c. What is the face value?

a. What is the maturity of the bond (in years)?

The maturity is

nothing

years.(Round to the nearest integer.)

b. What is the coupon rate (as a percentage)?

The coupon rate is

nothing%.

(Round to two decimal places.)

c. What is the face value?

The face value is

$nothing.

(Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started