Question

Assume that a building and the land it is situated on, along with a dump truck, are purchased at an auction. The three assets

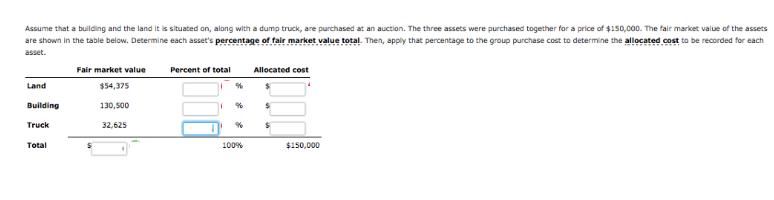

Assume that a building and the land it is situated on, along with a dump truck, are purchased at an auction. The three assets were purchased together for a price of $150,000. The fair market value of the assets are shown in the table below. Determine each asset's percentage of fair market value total. Then, apply that percentage to the group purchase cost to determine the allocated cost to be recorded for each asset. Fair market value Percent of total Allocated cost Land $54,375 Building 130,500 Truck 32,625 Total 100% $150,000

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Assets Fair Value Percent of total Weight...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Survey of Accounting

Authors: Edmonds, old, Mcnair, Tsay

2nd edition

9780077392659, 978-0-07-73417, 77392655, 0-07-734177-5, 73379557, 978-0073379555

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App