Question

Assume that a company is choosing between two alternativeslease a piece of equipment for five years or buy a piece of equipment and sell it

Assume that a company is choosing between two alternativeslease a piece of equipment for five years or buy a piece of equipment and sell it in five years. The costs associated with the two alternatives are summarized as follows:

| Lease | Buy | |

|---|---|---|

| Purchase cost of equipment | $ 60,000 | |

| Annual operating costs | $ 6,000 | |

| Immediate deposit | $ 25,000 | |

| Annual lease payments | $ 18,000 | |

| Salvage value (5 years from now) | $ 8,000 |

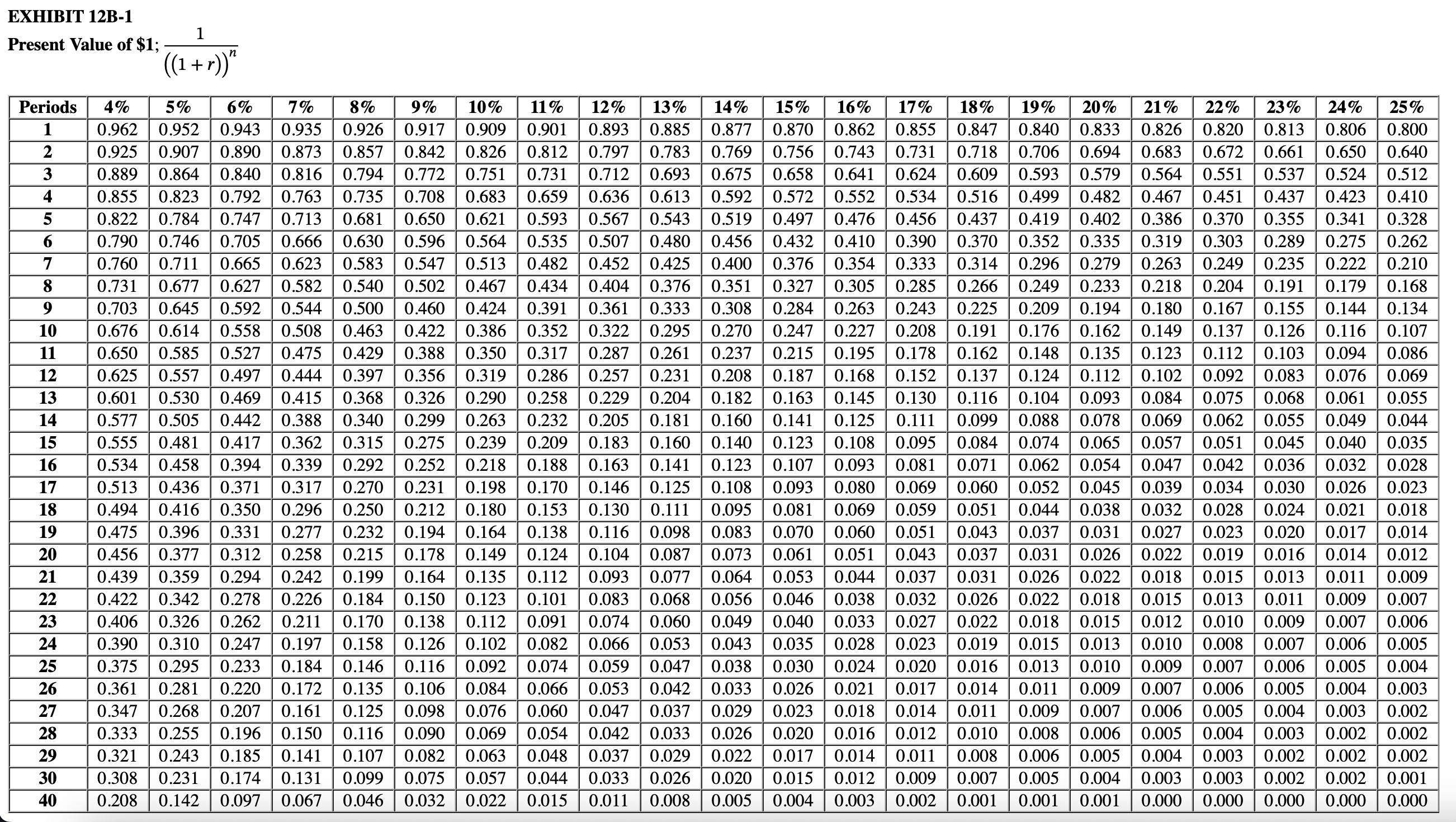

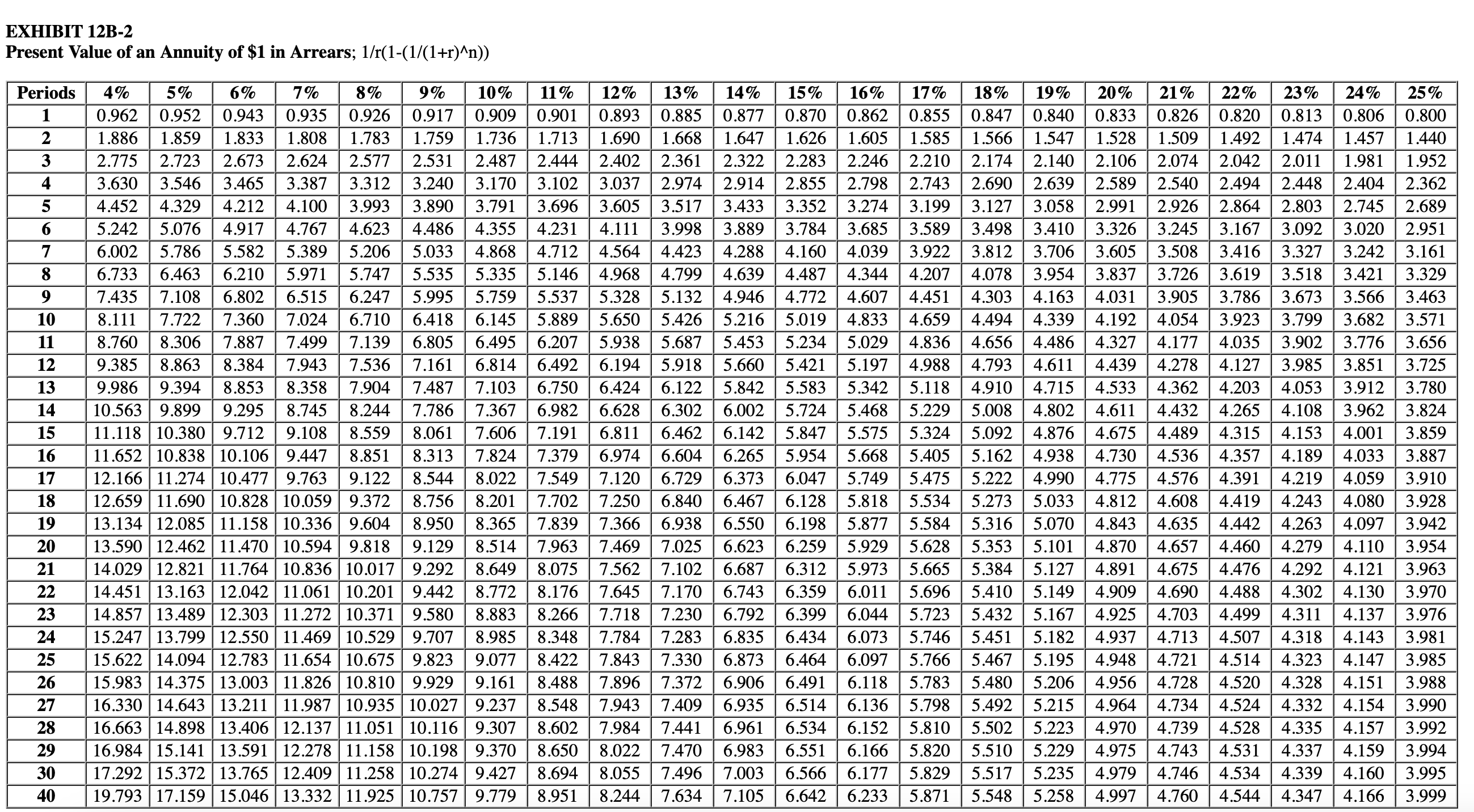

Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. If the company chooses the lease option, it will have to pay an immediate deposit of $25,000 to cover any future damages to the equipment. The deposit is refundable at the end of the lease term. The annual lease payments are made at the end of each year. Based on a net present value analysis with a discount rate of 21%, what is the financial advantage (disadvantage) of buying the equipment rather than leasing it?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started