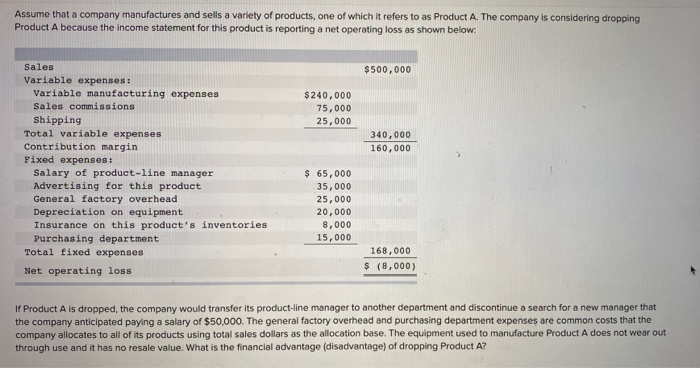

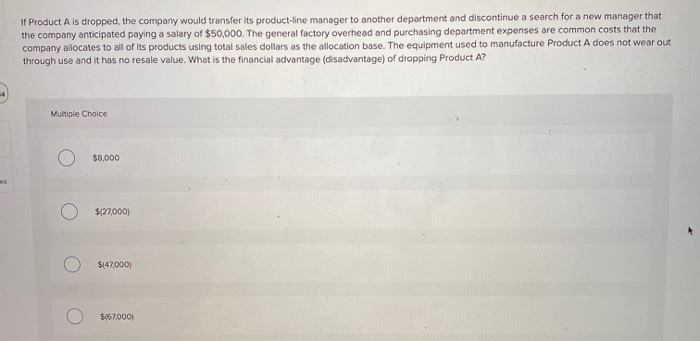

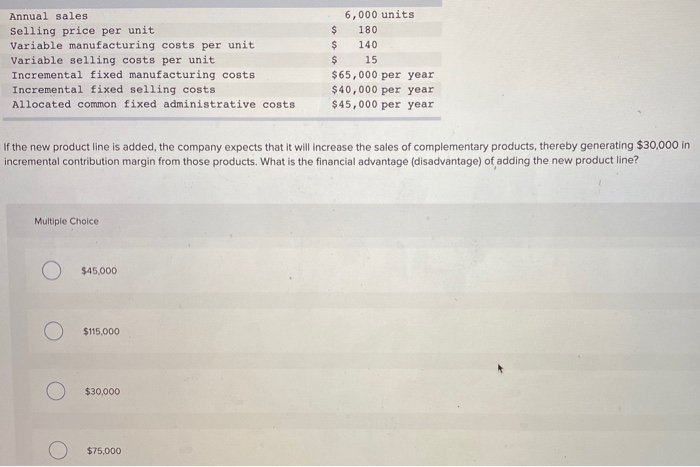

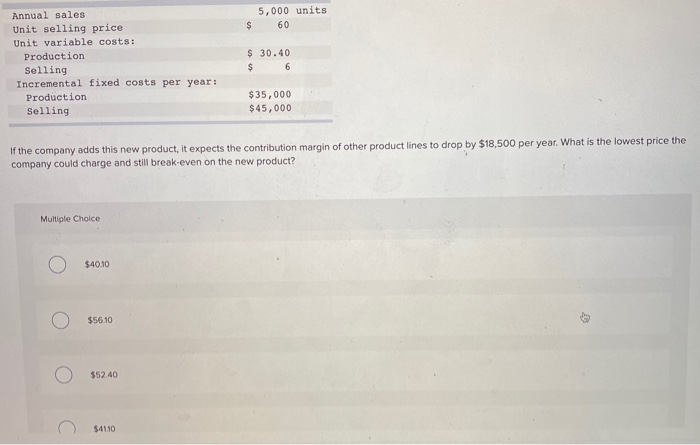

Assume that a company manufactures and sells a variety of products, one of which it refers to as Product A. The company is considering dropping Product A because the income statement for this product is reporting a net operating loss as shown below. $500,000 $ 240,000 75,000 25,000 340,000 160,000 Sales Variable expenses : Variable manufacturing expenses Sales commissions Shipping Total variable expenses Contribution margin Fixed expenses : Salary of product-line manager Advertising for this product General factory overhead Depreciation on equipment Insurance on this product's inventories Purchasing department Total fixed expenses Net operating loss $ 65,000 35,000 25,000 20,000 8,000 15,000 168,000 $ (8,000) If Product A is dropped, the company would transfer its product-line manager to another department and discontinue a search for a new manager that the company anticipated paying a salary of $50,000. The general factory overhead and purchasing department expenses are common costs that the company allocates to all of its products using total sales dollars as the allocation base. The equipment used to manufacture Product A does not wear out through use and it has no resale value. What is the financial advantage (disadvantage) of dropping Product A? If Product Ais dropped, the company would transfer its product-line manager to another department and discontinue a search for a new manager that the company anticipated paying a salary of $50,000. The general factory overhead and purchasing department expenses are common costs that the company allocates to all of its products using total sales dollars as the allocation base. The equipment used to manufacture Product A does not wear out through use and it has no resale value. What is the financial advantage (disadvantage) of dropping Product A? Multiple Choice $8,000 $127,000) $(47,000) $167.000) 0 Annual sales Selling price per unit Variable manufacturing costs per unit Variable selling costs per unit Incremental fixed manufacturing costs Incremental fixed selling costs Allocated common fixed administrative costs 6,000 units $ 180 140 $ 15 $65,000 per year $ 40,000 per year $45,000 per year If the new product line is added, the company expects that it will increase the sales of complementary products, thereby generating $30,000 in incremental contribution margin from those products. What is the financial advantage (disadvantage) of adding the new product line? Multiple Choice $45,000 $115,000 $30,000 $75,000 5,000 units 60 $ Annual sales Unit selling price Unit variable costs: Production Selling Incremental fixed costs per year: Production Selling $ 30.40 $ 6 $35,000 $ 45,000 If the company adds this new product, it expects the contribution margin of other product lines to drop by $18,500 per year. What is the lowest price the company could charge and still break-even on the new product? Multiple Choice $40:10 $56.10 $52.40 $4110