Answered step by step

Verified Expert Solution

Question

1 Approved Answer

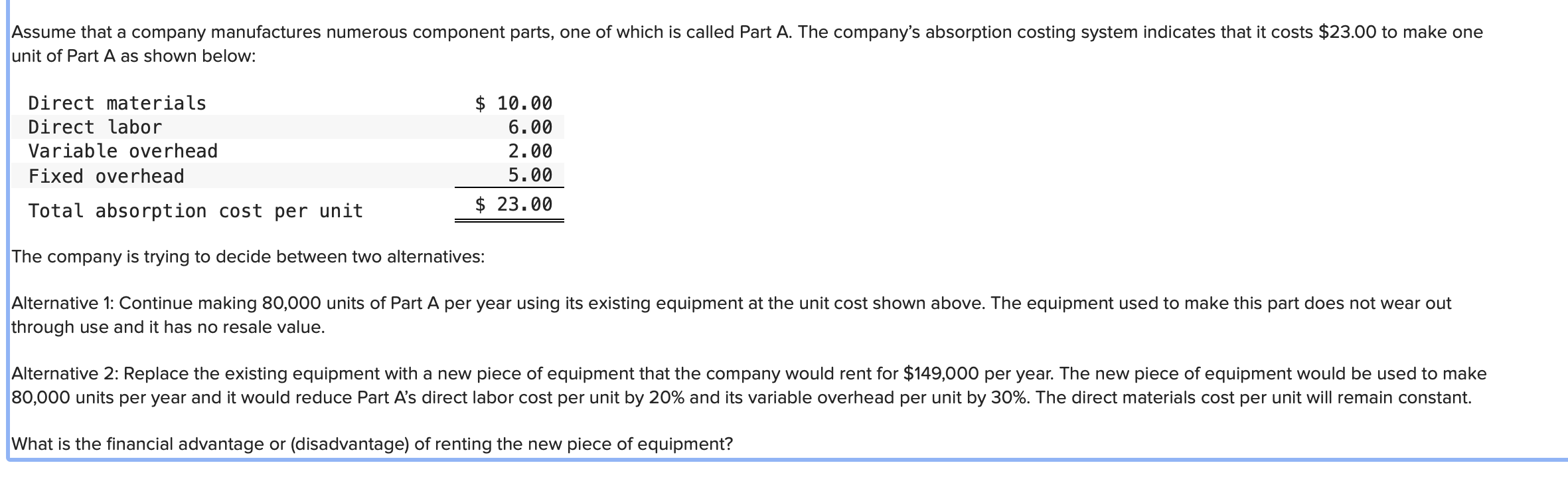

Assume that a company manufactures numerous component parts, one of which is called Part A . The company's absorption costing system indicates that it costs

Assume that a company manufactures numerous component parts, one of which is called Part A The company's absorption costing system indicates that it costs $ to make one

unit of Part A as shown below:

The company is trying to decide between two alternatives:

Alternative : Continue making units of Part A per year using its existing equipment at the unit cost shown above. The equipment used to make this part does not wear out

through use and it has no resale value.

Alternative : Replace the existing equipment with a new piece of equipment that the company would rent for $ per year. The new piece of equipment would be used to make

units per year and it would reduce Part As direct labor cost per unit by and its variable overhead per unit by The direct materials cost per unit will remain constant.

What is the financial advantage or disadvantage of renting the new piece of equipment? Multiple Choice

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started