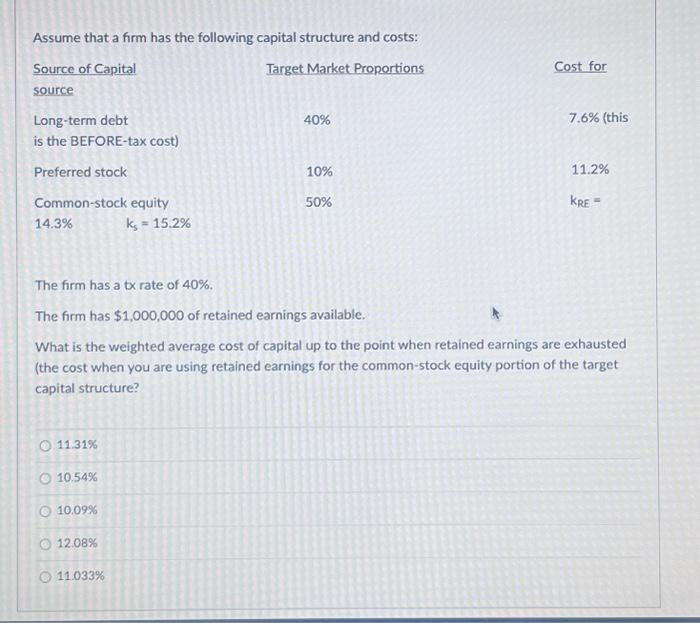

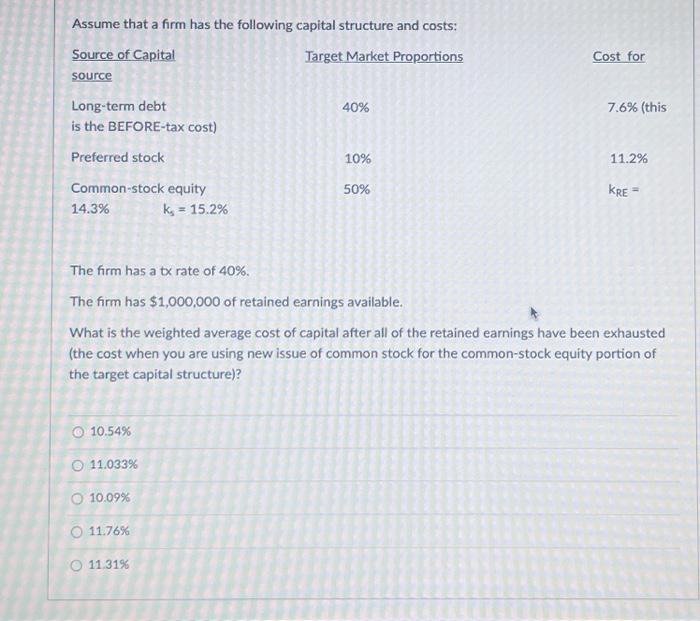

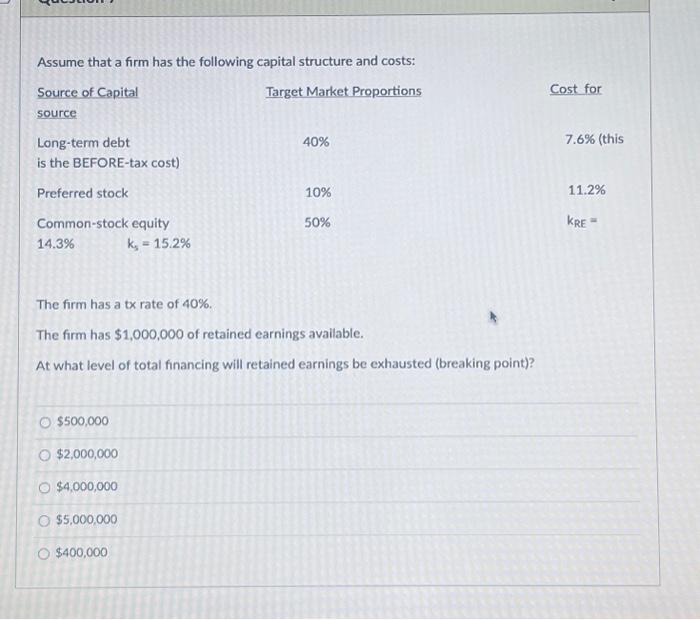

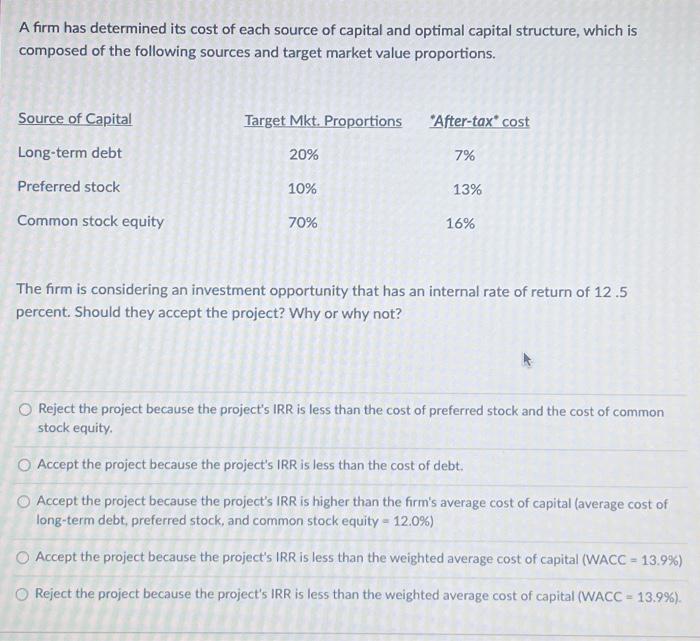

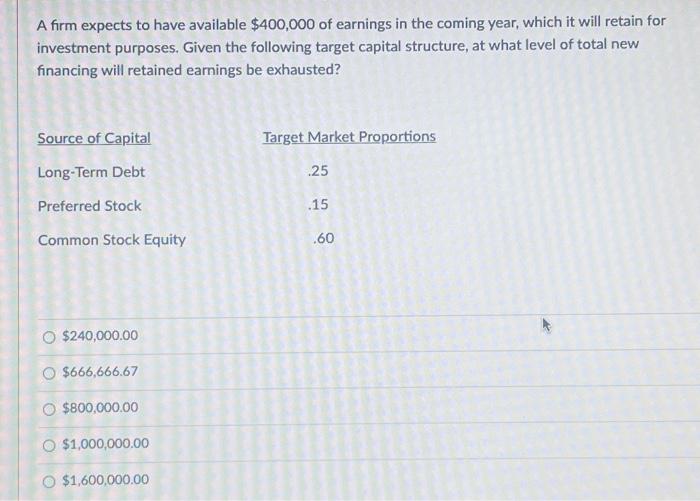

Assume that a firm has the following capital structure and costs: The firm has a tx rate of 40%. The firm has $1,000,000 of retained earnings available. What is the weighted average cost of capital up to the point when retained earnings are exhausted (the cost when you are using retained earnings for the common-stock equity portion of the target capital structure? 11.31% 10.54% 10.09% 12.08% 11.033% Assume that a firm has the following capital structure and costs: The firm has a tx rate of 40%. The firm has $1,000,000 of retained earnings available. What is the weighted average cost of capital after all of the retained earnings have been exhausted (the cost when you are using new issue of common stock for the common-stock equity portion of the target capital structure)? 10.54% 11.033% 10.09% 11.76% 11.31% Assume that a firm has the following capital structure and costs: The firm has a tx rate of 40%. The firm has $1,000,000 of retained earnings available. At what level of total financing will retained earnings be exhausted (breaking point)? $500,000$2,000,000$4,000,000$5,000,000$400,000 A firm has determined its cost of each source of capital and optimal capital structure, which is composed of the following sources and target market value proportions. The firm is considering an investment opportunity that has an internal rate of return of 12.5 percent. Should they accept the project? Why or why not? Reject the project because the project's IRR is less than the cost of preferred stock and the cost of common stock equity. Accept the project because the project's IRR is less than the cost of debt. Accept the project because the project's IRR is higher than the firm's average cost of capital (average cost of long-term debt, preferred stock, and common stock equity =12.0% ) Accept the project because the project's IRR is less than the weighted average cost of capital (WACC =13.9% ) Reject the project because the project's IRR is less than the weighted average cost of capital (WACC =13.9% ). A firm expects to have available $400,000 of earnings in the coming year, which it will retain for investment purposes. Given the following target capital structure, at what level of total new financing will retained earnings be exhausted? $240,000.00 $666,666.67 $800,000.00 $1,000,000.00 $1,600,000.00