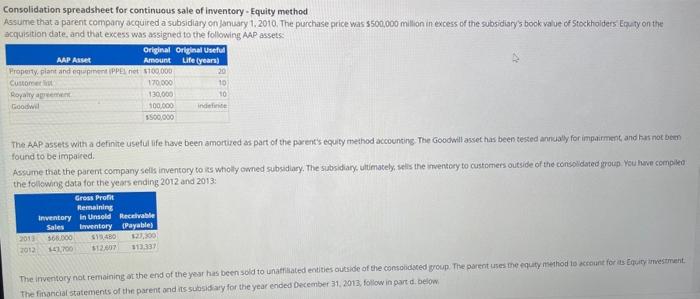

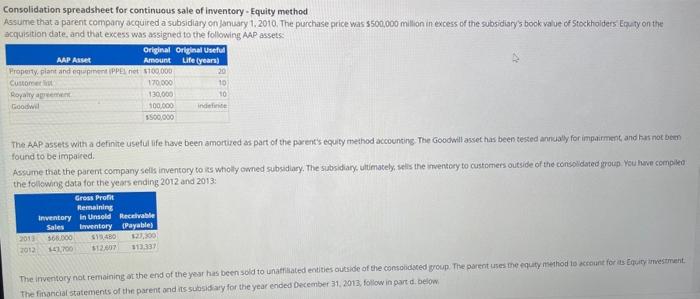

Assume that a parent company acquired a subsidiary on January 1 2010. The purchase price was $500,000 million in excess of the subsidiary's book value of stockholders' equity on the acquisition date and that excess was assigned to the following AAP assets.

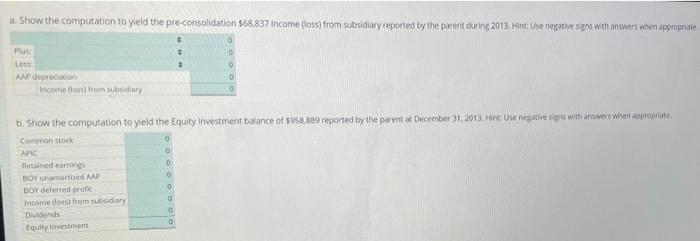

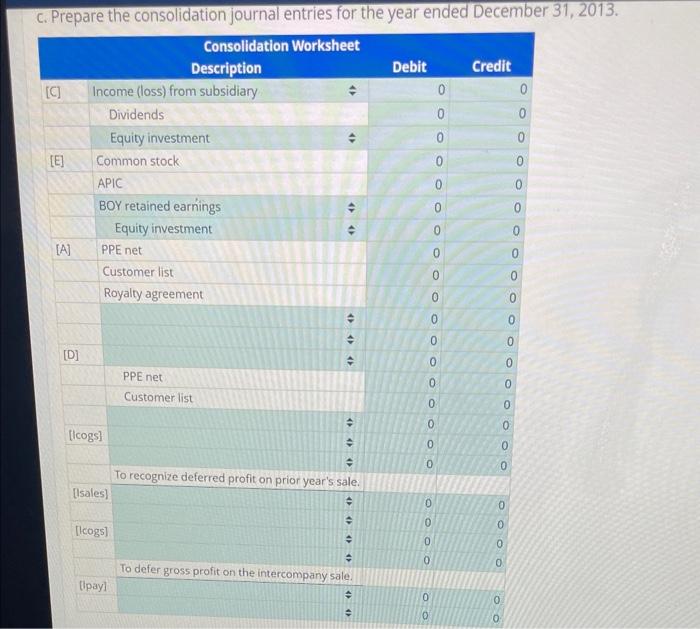

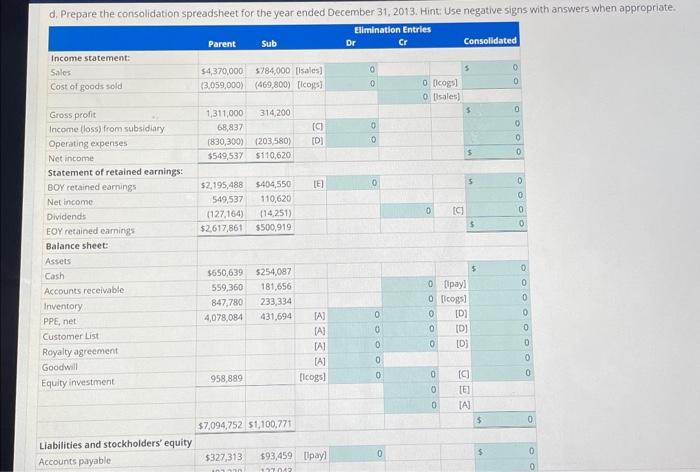

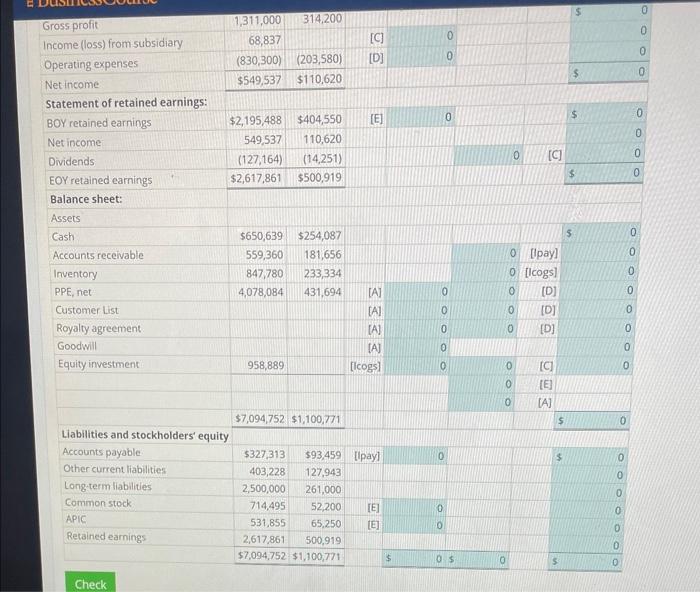

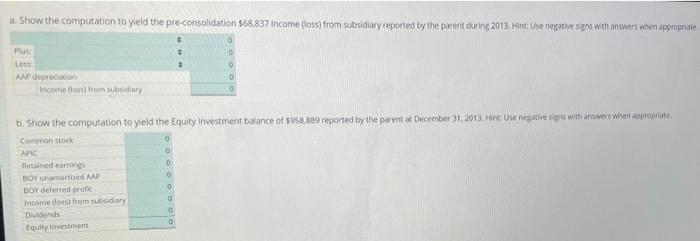

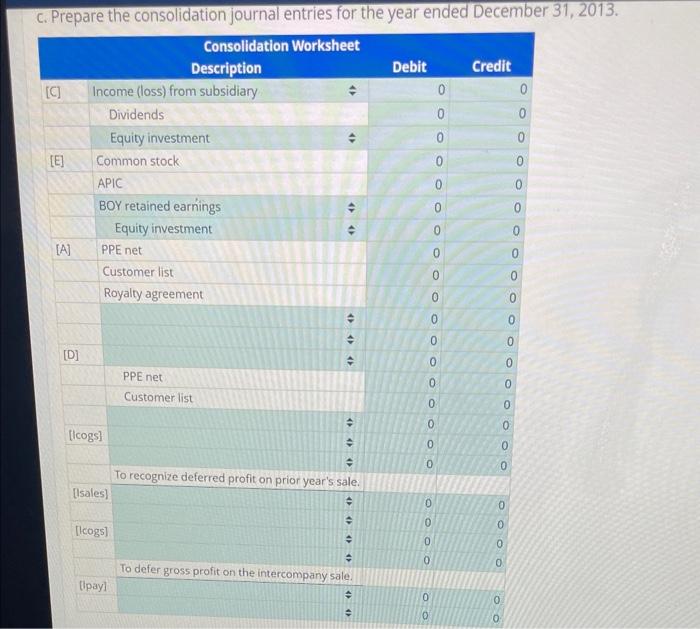

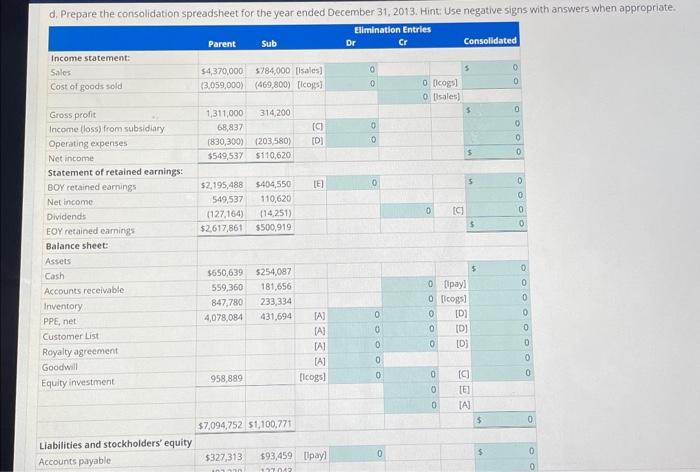

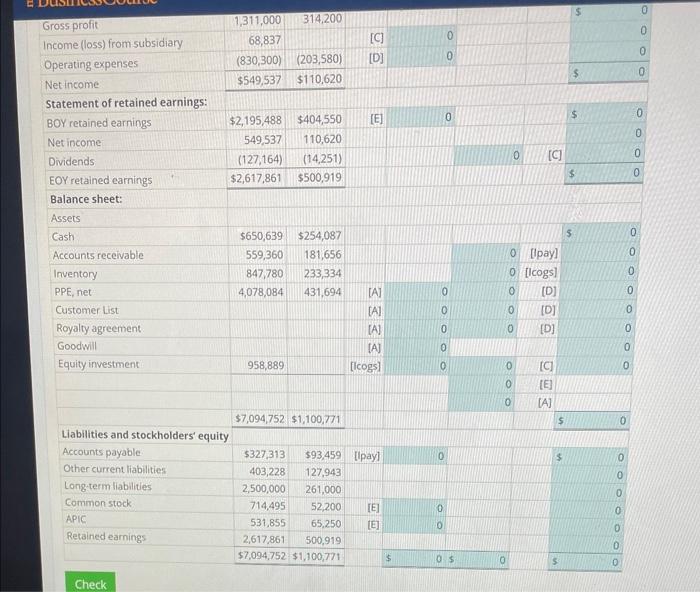

ionsolidation spreadsheet for continuous sale of inventory - Equity method issume that a parent company acquired a subsidiary on lanuary 1,2010. The purchase price was s500,000 million in excess of the subsidiarys book value of Stockholders Eputy on the icquisition date, and that excess was assigned to the following AAP assets: The AAP assets with a definite useful life have been amoitired as part of the pacents equity method accounting. The Goodwill asset has been sested annualy for impairment and tas not bem found to be ifnpaied Assume that the parent company selts inventory to is wholy owned subsidiary. The subsidiary ultimately, selis the mientery to customiers outside of the consoldated group. Ysu hwe compike the following data for the years ending 2012 and 2013 : The financial statements of the parent ond its subsidfary for the year ended becember 31, 2013, folow in part d. below a. Show the computation to yield the pre-consolidation $68,837 income (oss) from subsidiary reponted by the parent during 2013. Hink: Use negative sagns wch anowers ahen aporcprate b. Show the computation to yield the Equity investment balonce of 5958,889 reponed by the parent at Deceenber 31,2013 . fint use negmive signs with arsaers wheri atiprepniti Curtmanstock APiC Aetained eartings gor unumantized MN Bor deferred proth Incorne (oossi from nubyidiaty Dwidends Equity irroetement c. Prepare the consolidation journal entries for the year ended December 31, 2013. d. Prepare the consolidation spreadsheet for the year ended December 31, 2013. Hint: Use negative signs with answers when appropriate. ionsolidation spreadsheet for continuous sale of inventory - Equity method issume that a parent company acquired a subsidiary on lanuary 1,2010. The purchase price was s500,000 million in excess of the subsidiarys book value of Stockholders Eputy on the icquisition date, and that excess was assigned to the following AAP assets: The AAP assets with a definite useful life have been amoitired as part of the pacents equity method accounting. The Goodwill asset has been sested annualy for impairment and tas not bem found to be ifnpaied Assume that the parent company selts inventory to is wholy owned subsidiary. The subsidiary ultimately, selis the mientery to customiers outside of the consoldated group. Ysu hwe compike the following data for the years ending 2012 and 2013 : The financial statements of the parent ond its subsidfary for the year ended becember 31, 2013, folow in part d. below a. Show the computation to yield the pre-consolidation $68,837 income (oss) from subsidiary reponted by the parent during 2013. Hink: Use negative sagns wch anowers ahen aporcprate b. Show the computation to yield the Equity investment balonce of 5958,889 reponed by the parent at Deceenber 31,2013 . fint use negmive signs with arsaers wheri atiprepniti Curtmanstock APiC Aetained eartings gor unumantized MN Bor deferred proth Incorne (oossi from nubyidiaty Dwidends Equity irroetement c. Prepare the consolidation journal entries for the year ended December 31, 2013. d. Prepare the consolidation spreadsheet for the year ended December 31, 2013. Hint: Use negative signs with answers when appropriate