Question

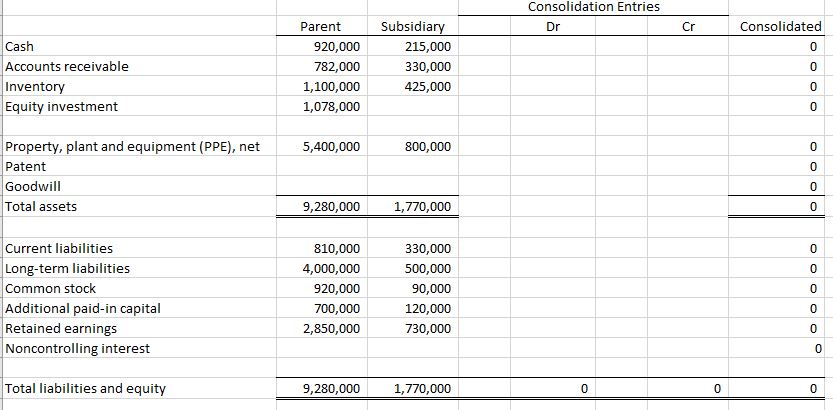

Assume that a parent company acquires a 70% interest in a subsidiary for a purchase price of $1,078,000. The excess of total fair value of

Assume that a parent company acquires a 70% interest in a subsidiary for a purchase price of $1,078,000. The excess of total fair value of controlling and noncontrolling interests over book value is assigned to; a building (PPE net) that is worth $100,000 more than book value, an unrecorded patent valued at $200,000 and goodwill valued at $300,000. Goodwill is assigned proportionately to the controlling and noncontrolling interests.

-Prepare the consolidated balance sheet at the date of acquisition by placing the appropriate entries in their respective debit/credit column cells.

-Indicate, in the blank column cell to the left of the debit and credit column cells if the entry is an [E] or [A] entry.

-SHOW THE EXCEL FORMULAS used to derive the Consolidated column amounts and totals.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started