Question

Assume that a parent company acquires its subsidiary on 1/1/xx, by exchanging 41,500 shares of its $1 par value common stock, with a market value

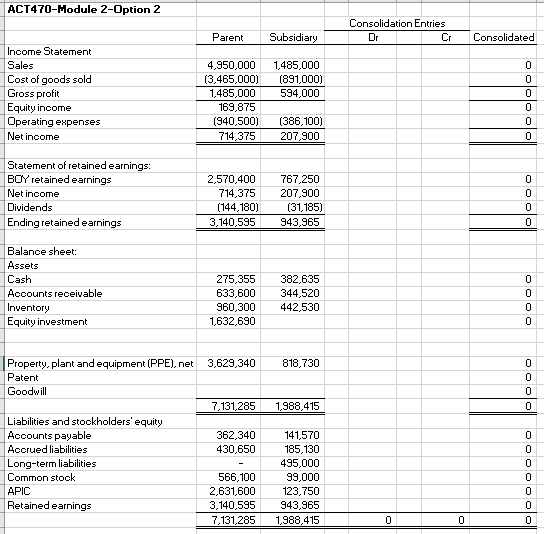

Assume that a parent company acquires its subsidiary on 1/1/xx, by exchanging 41,500 shares of its $1 par value common stock, with a market value on acquisition date of $36 per share, for all of the outstanding voting shares of the subsidiary. You have been charged with preparing the consolidation of these two entities at 12/31/xx.

On acquisition date (1/1/xx), all of the subsidiarys assets and liabilities had fair values equaling their book values except PPE assets are undervalued by $81,000 (depreciation =$5,400 per year), the subsidiary has an unrecorded patent with a fair value of $261,000 (amortization = $32,625 per year) and the parent records $162,000 of goodwill in the transaction.

Submission Requirements:

Using the ACT470_Mod02-Option02.xlsx Excel spreadsheet in the Module 2 folder:

- Prepare the consolidated balance sheet at 12/31/xx by placing the appropriate entries in their respective debit/credit column cells.

- Indicate, in the blank column cell to the left of the debit and credit column cells if the entry is a [C], [E] or [A] or [D] entry.

- Use Excel formulas to derive the Consolidated column amounts and totals.

- Using the Home key in Excel, go to the Styles area and highlight the [C], [E], [A] and [D]cell entries in different shades.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started