Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that a parent company sells inventory to its wholly owned subsidiary. The subsidiary, ulti- mately, sells the inventory to customers outside of the

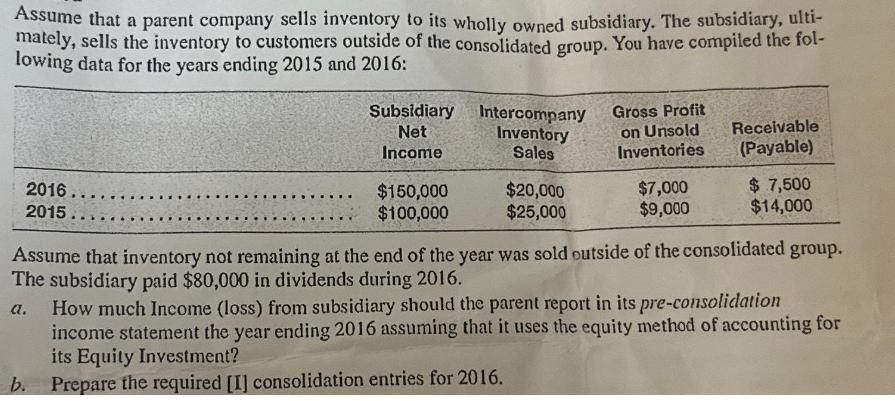

Assume that a parent company sells inventory to its wholly owned subsidiary. The subsidiary, ulti- mately, sells the inventory to customers outside of the consolidated group. You have compiled the fol- lowing data for the years ending 2015 and 2016: 2016.. 2015 .. Subsidiary Intercompany Net Income Inventory Sales Gross Profit on Unsold Inventories Receivable (Payable) $150,000 $100,000 $20,000 $7,000 $ 7,500 $25,000 $9,000 $14,000 Assume that inventory not remaining at the end of the year was sold outside of the consolidated group. The subsidiary paid $80,000 in dividends during 2016. a. How much Income (loss) from subsidiary should the parent report in its pre-consolidation income statement the year ending 2016 assuming that it uses the equity method of accounting for its Equity Investment? b. Prepare the required [I] consolidation entries for 2016.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started