Answered step by step

Verified Expert Solution

Question

1 Approved Answer

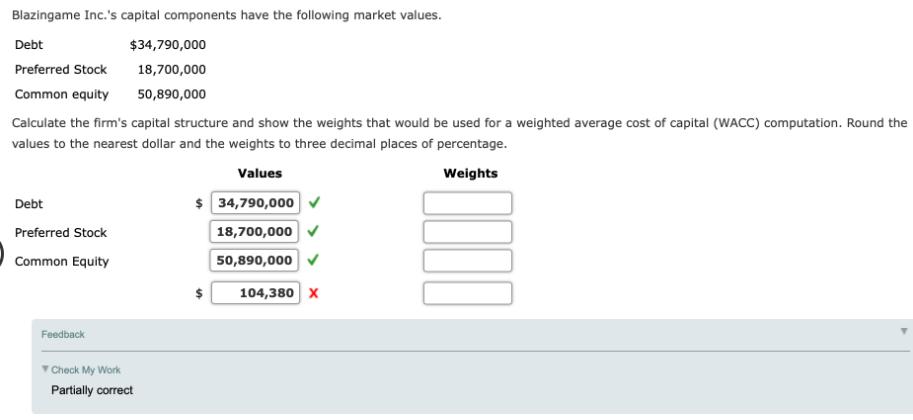

Blazingame Inc.'s capital components have the following market values. Debt Preferred Stock Common equity $34,790,000 18,700,000 50,890,000 Calculate the firm's capital structure and show

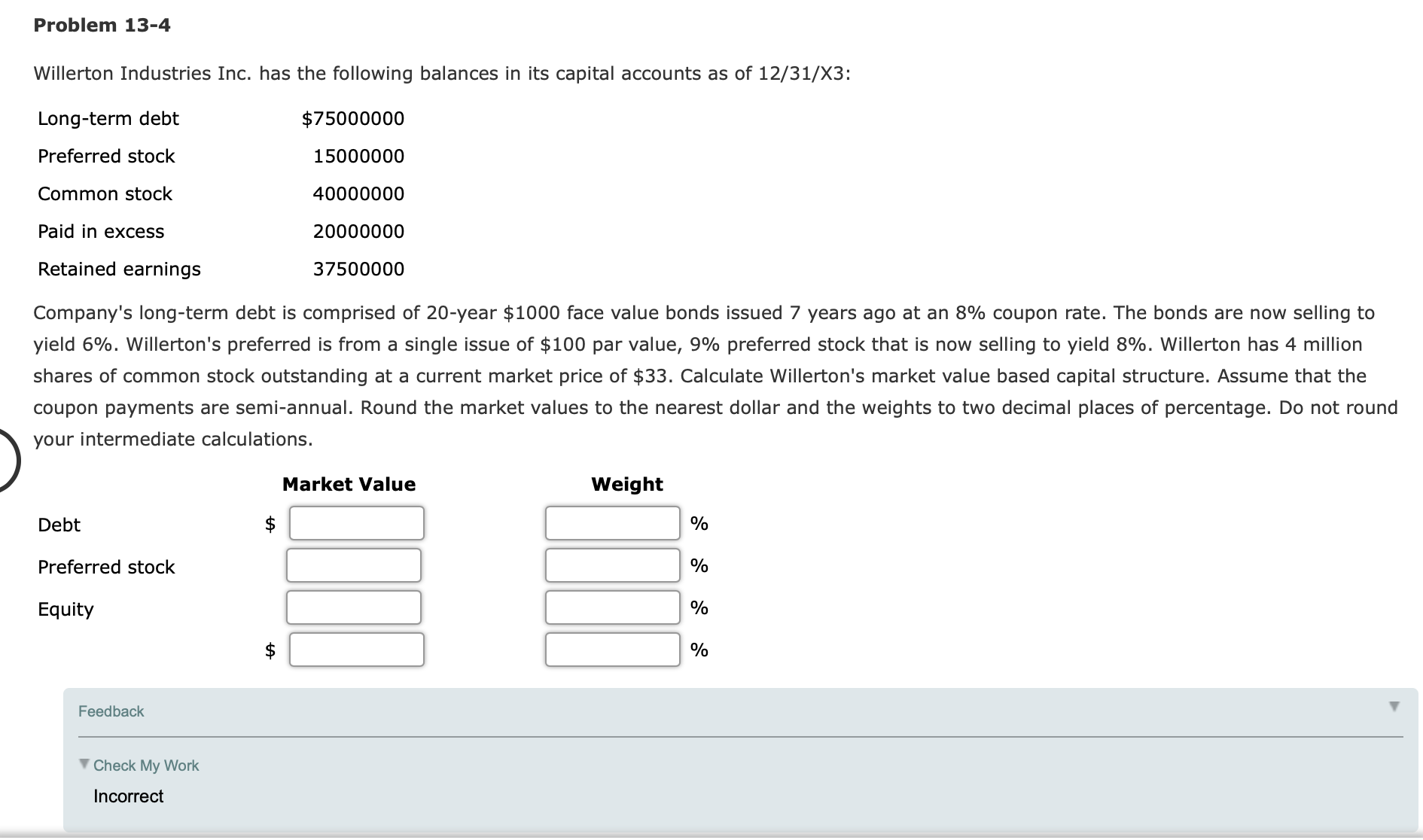

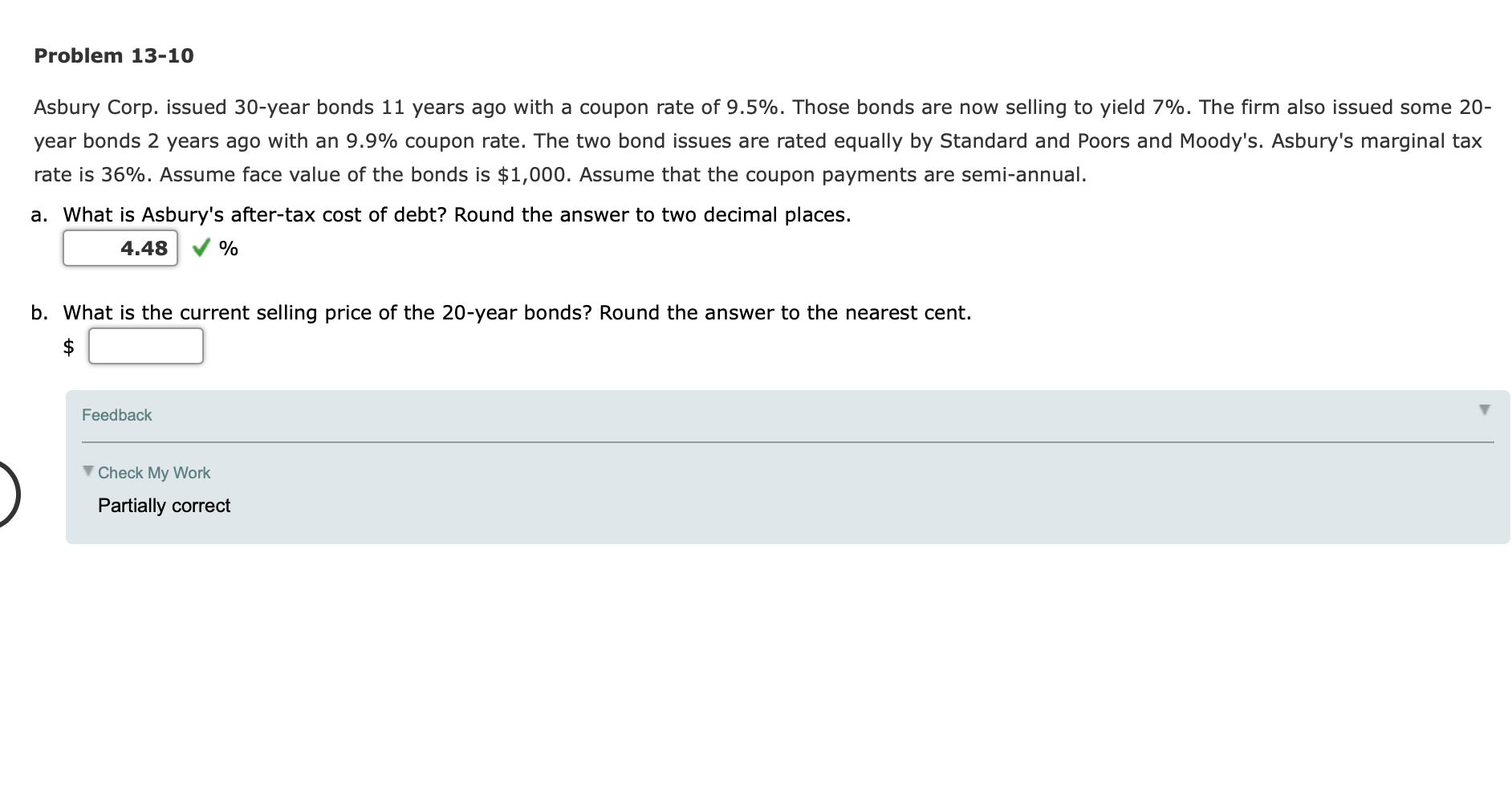

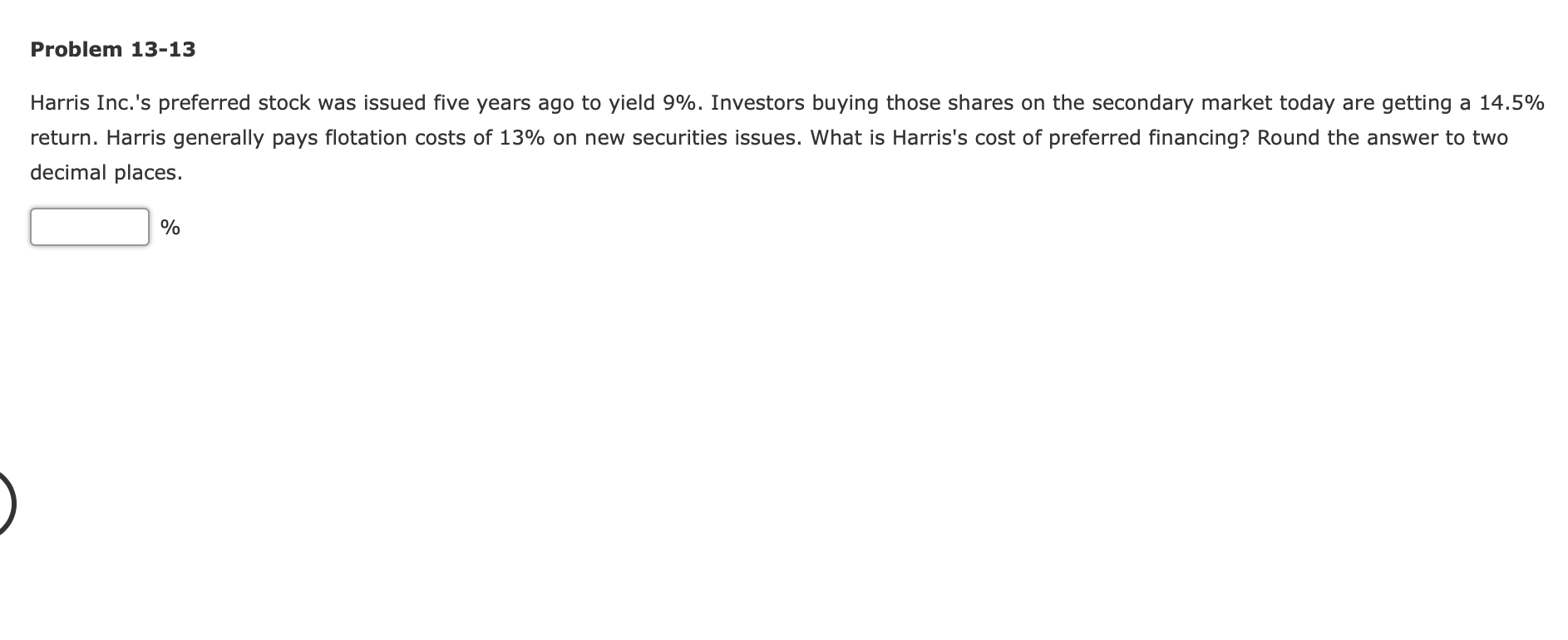

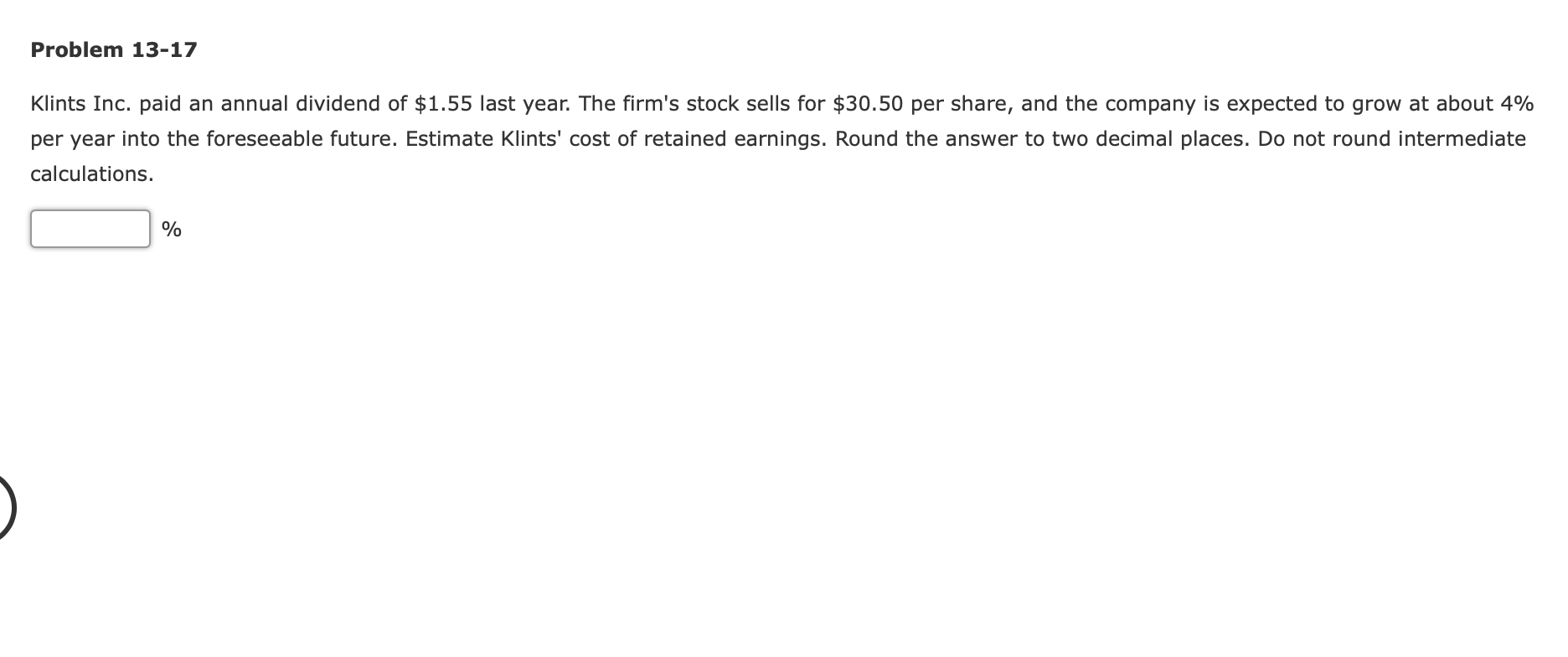

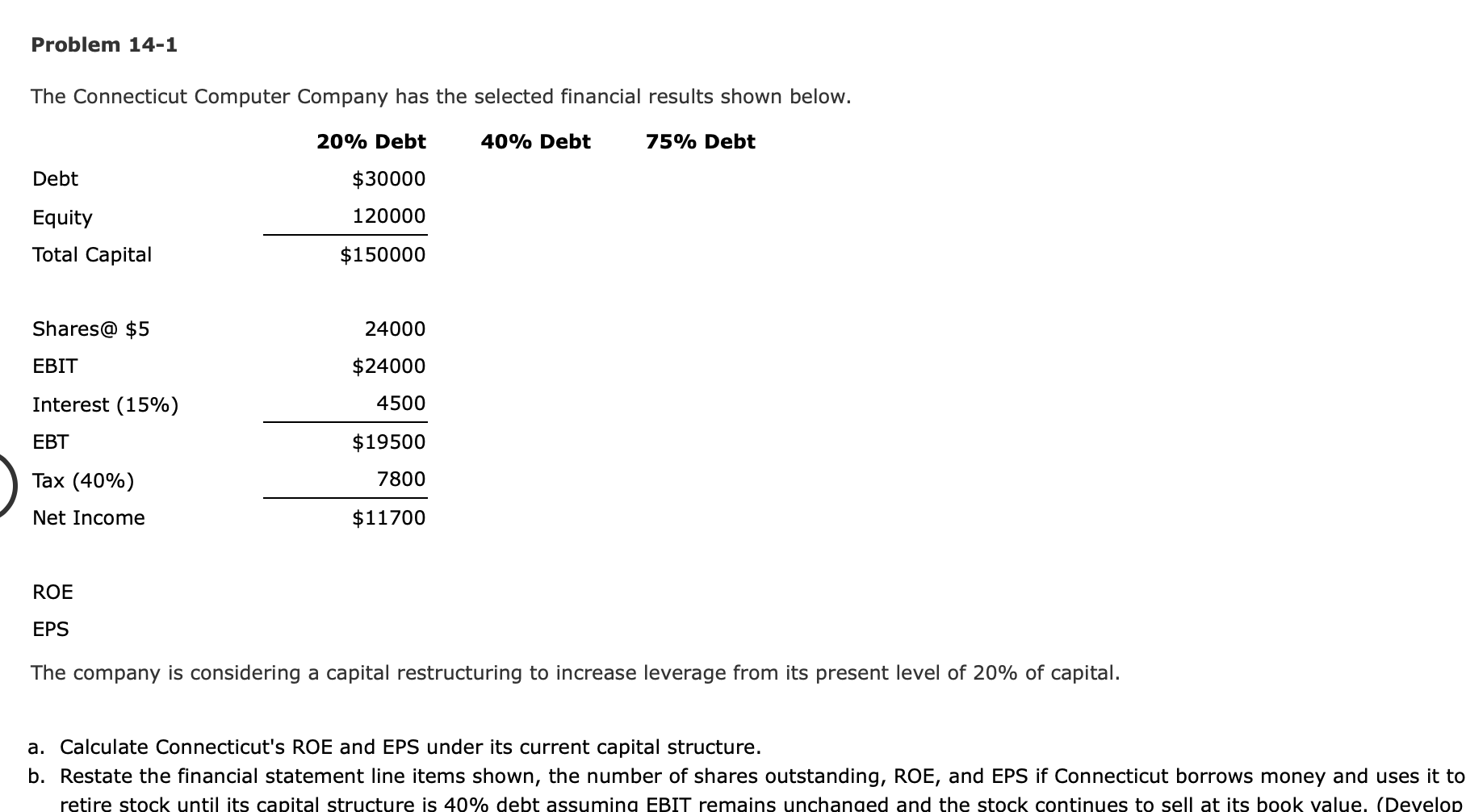

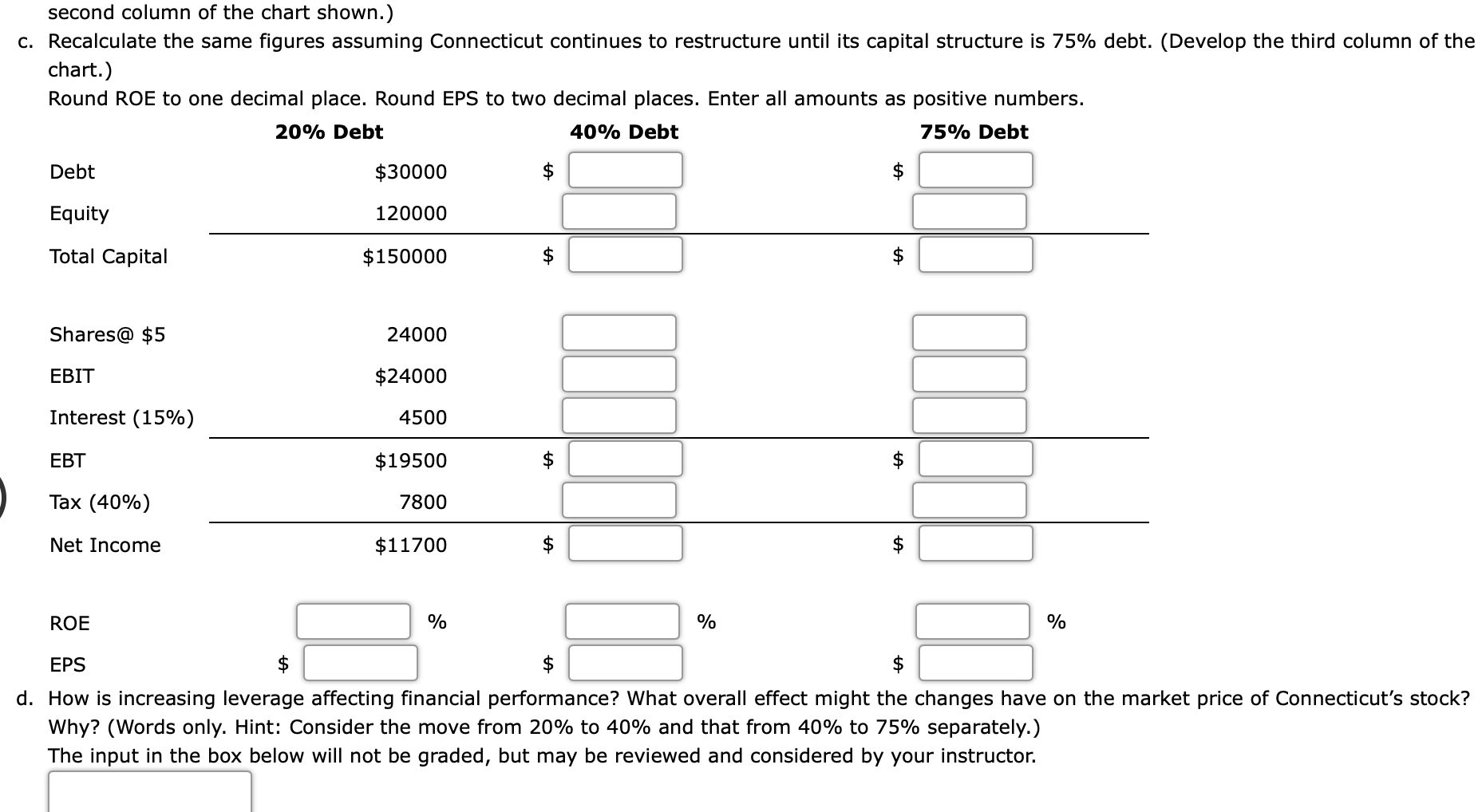

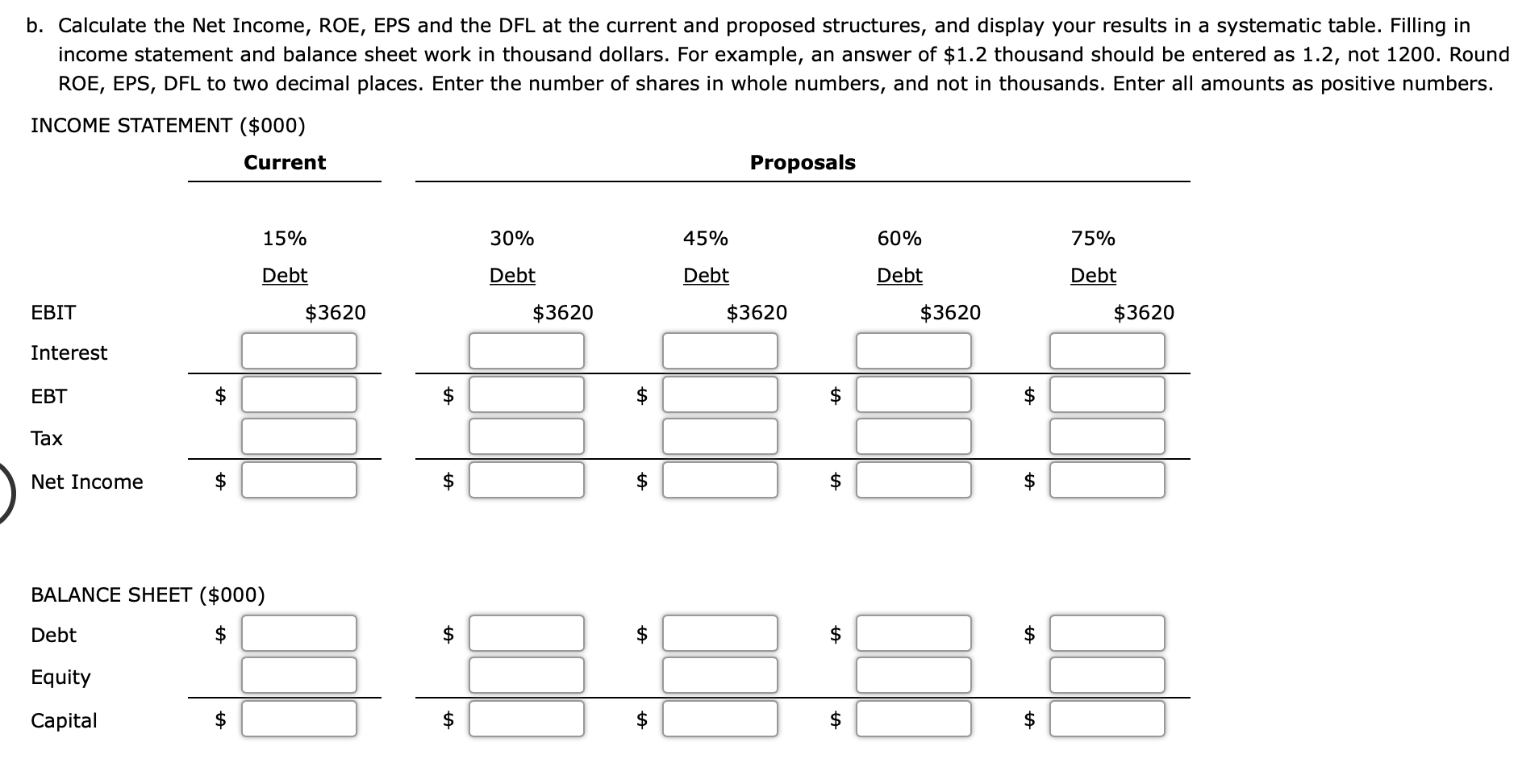

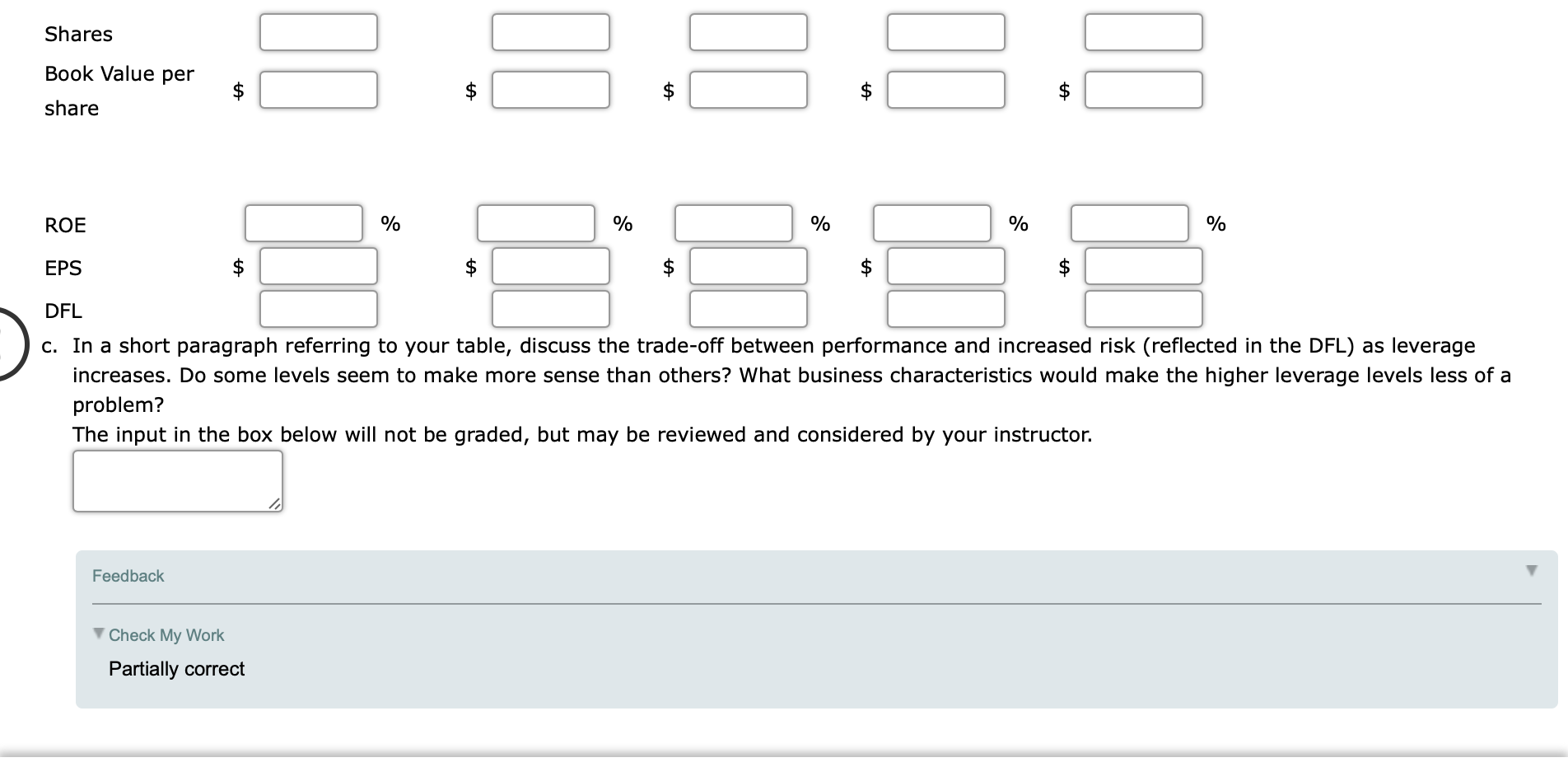

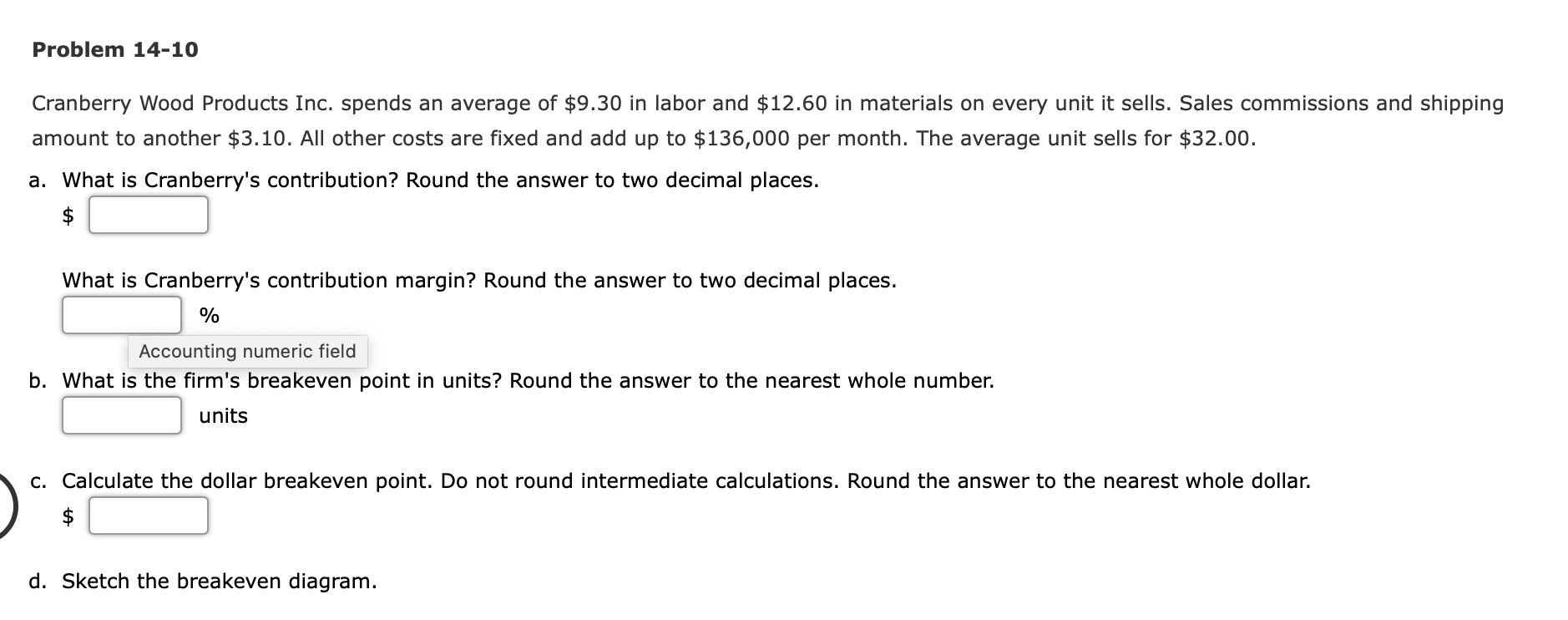

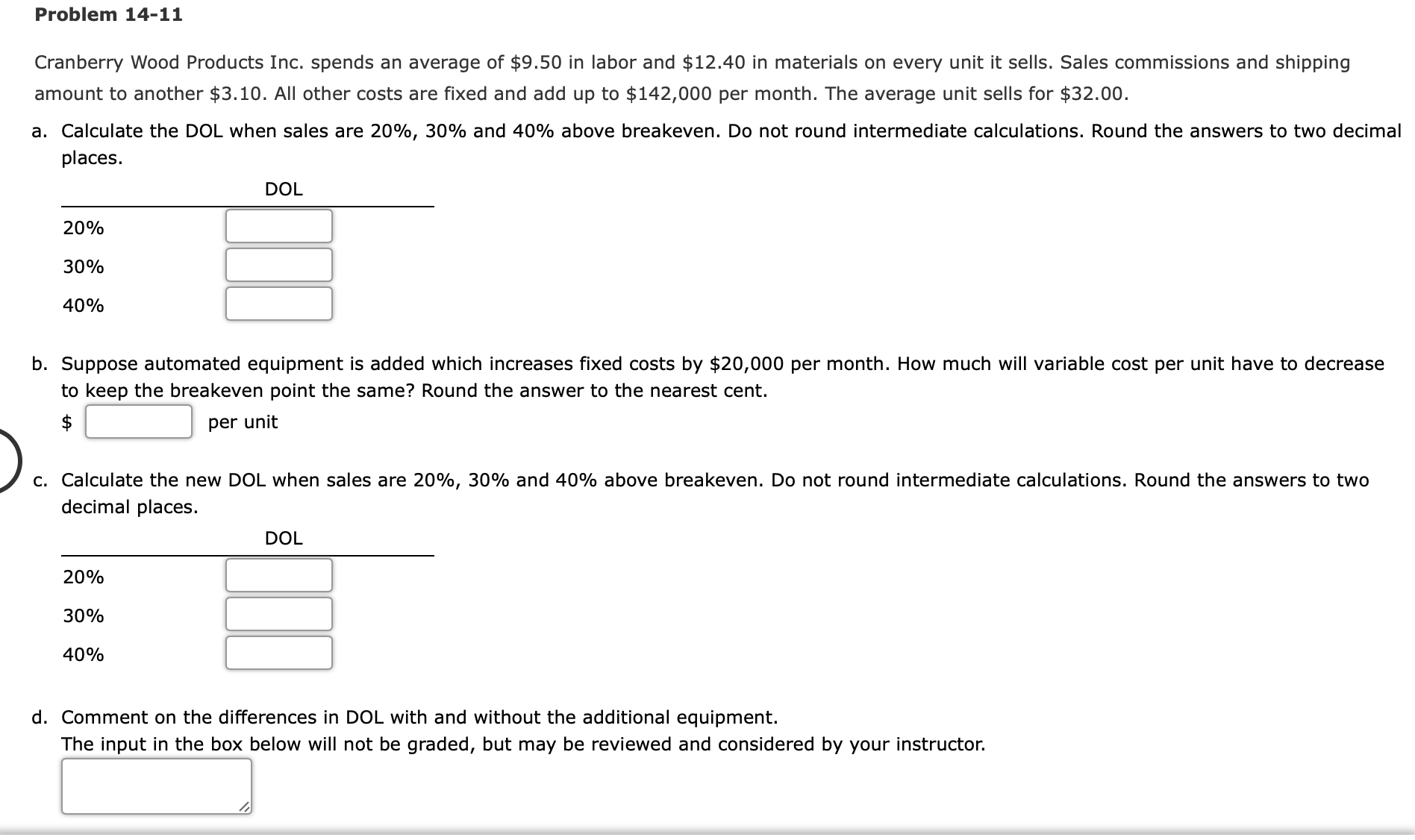

Blazingame Inc.'s capital components have the following market values. Debt Preferred Stock Common equity $34,790,000 18,700,000 50,890,000 Calculate the firm's capital structure and show the weights that would be used for a weighted average cost of capital (WACC) computation. Round the values to the nearest dollar and the weights to three decimal places of percentage. Debt Preferred Stock Common Equity Values $ 34,790,000 18,700,000 50,890,000 Weights Feedback Check My Work Partially correct 104,380 X Problem 13-4 Willerton Industries Inc. has the following balances in its capital accounts as of 12/31/X3: Long-term debt $75000000 Preferred stock 15000000 Common stock 40000000 Paid in excess Retained earnings 20000000 37500000 Company's long-term debt is comprised of 20-year $1000 face value bonds issued 7 years ago at an 8% coupon rate. The bonds are now selling to yield 6%. Willerton's preferred is from a single issue of $100 par value, 9% preferred stock that is now selling to yield 8%. Willerton has 4 million shares of common stock outstanding at a current market price of $33. Calculate Willerton's market value based capital structure. Assume that the coupon payments are semi-annual. Round the market values to the nearest dollar and the weights to two decimal places of percentage. Do not round your intermediate calculations. Debt Preferred stock Equity Feedback Check My Work Incorrect Market Value Weight % do do do do % % % Problem 13-10 Asbury Corp. issued 30-year bonds 11 years ago with a coupon rate of 9.5%. Those bonds are now selling to yield 7%. The firm also issued some 20- year bonds 2 years ago with an 9.9% coupon rate. The two bond issues are rated equally by Standard and Poors and Moody's. Asbury's marginal tax rate is 36%. Assume face value of the bonds is $1,000. Assume that the coupon payments are semi-annual. a. What is Asbury's after-tax cost of debt? Round the answer to two decimal places. 4.48 % b. What is the current selling price of the 20-year bonds? Round the answer to the nearest cent. $ Feedback Check My Work Partially correct Problem 13-13 Harris Inc.'s preferred stock was issued five years ago to yield 9%. Investors buying those shares on the secondary market today are getting a 14.5% return. Harris generally pays flotation costs of 13% on new securities issues. What is Harris's cost of preferred financing? Round the answer to two decimal places. % Problem 13-17 Klints Inc. paid an annual dividend of $1.55 last year. The firm's stock sells for $30.50 per share, and the company is expected to grow at about 4% per year into the foreseeable future. Estimate Klints' cost of retained earnings. Round the answer to two decimal places. Do not round intermediate calculations. % Problem 14-1 The Connecticut Computer Company has the selected financial results shown below. 20% Debt Debt Equity $30000 120000 Total Capital $150000 Shares@ $5 24000 EBIT $24000 Interest (15%) 4500 EBT $19500 Tax (40%) 7800 Net Income $11700 40% Debt 75% Debt ROE EPS The company is considering a capital restructuring to increase leverage from its present level of 20% of capital. a. Calculate Connecticut's ROE and EPS under its current capital structure. b. Restate the financial statement line items shown, the number of shares outstanding, ROE, and EPS if Connecticut borrows money and uses it to retire stock until its capital structure is 40% debt assuming EBIT remains unchanged and the stock continues to sell at its book value. (Develop second column of the chart shown.) c. Recalculate the same figures assuming Connecticut continues to restructure until its capital structure is 75% debt. (Develop the third column of the chart.) Round ROE to one decimal place. Round EPS to two decimal places. Enter all amounts as positive numbers. Debt Equity Total Capital 20% Debt $30000 120000 $150000 Shares@ $5 24000 EBIT $24000 Interest (15%) 4500 EBT $19500 7800 Tax (40%) Net Income $11700 ROE EPS % 40% Debt A % 75% Debt A A % d. How is increasing leverage affecting financial performance? What overall effect might the changes have on the market price of Connecticut's stock? Why? (Words only. Hint: Consider the move from 20% to 40% and that from 40% to 75% separately.) The input in the box below will not be graded, but may be reviewed and considered by your instructor. 75% Debt $3620 b. Calculate the Net Income, ROE, EPS and the DFL at the current and proposed structures, and display your results in a systematic table. Filling in income statement and balance sheet work in thousand dollars. For example, an answer of $1.2 thousand should be entered as 1.2, not 1200. Round ROE, EPS, DFL to two decimal places. Enter the number of shares in whole numbers, and not in thousands. Enter all amounts as positive numbers. INCOME STATEMENT ($000) Current EBIT Interest EBT 15% 30% Debt Debt $3620 $3620 Tax Net Income +A BALANCE SHEET ($000) Debt Equity Capital $ Proposals 60% Debt $3620 Debt $3620 45% +A +A +A +A +A A EA +A +A +A +A +A A +A Shares Book Value per $ $ share ROE EPS DFL $ $ $ % % % % % c. In a short paragraph referring to your table, discuss the trade-off between performance and increased risk (reflected in the DFL) as leverage increases. Do some levels seem to make more sense than others? What business characteristics would make the higher leverage levels less of a problem? The input in the box below will not be graded, but may be reviewed and considered by your instructor. Feedback Check My Work Partially correct Problem 14-10 Cranberry Wood Products Inc. spends an average of $9.30 in labor and $12.60 in materials on every unit it sells. Sales commissions and shipping amount to another $3.10. All other costs are fixed and add up to $136,000 per month. The average unit sells for $32.00. a. What is Cranberry's contribution? Round the answer to two decimal places. What is Cranberry's contribution margin? Round the answer to two decimal places. % Accounting numeric field b. What is the firm's breakeven point in units? Round the answer to the nearest whole number. units c. Calculate the dollar breakeven point. Do not round intermediate calculations. Round the answer to the nearest whole dollar. $ d. Sketch the breakeven diagram. Problem 14-11 Cranberry Wood Products Inc. spends an average of $9.50 in labor and $12.40 in materials on every unit it sells. Sales commissions and shipping amount to another $3.10. All other costs are fixed and add up to $142,000 per month. The average unit sells for $32.00. a. Calculate the DOL when sales are 20%, 30% and 40% above breakeven. Do not round intermediate calculations. Round the answers to two decimal places. 20% 30% 40% DOL b. Suppose automated equipment is added which increases fixed costs by $20,000 per month. How much will variable cost per unit have to decrease to keep the breakeven point the same? Round the answer to the nearest cent. per unit c. Calculate the new DOL when sales are 20%, 30% and 40% above breakeven. Do not round intermediate calculations. Round the answers to two decimal places. DOL 20% 30% 40% d. Comment on the differences in DOL with and without the additional equipment. The input in the box below will not be graded, but may be reviewed and considered by your instructor.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started