Question

Assume that ABC Custom Parts. Inc. has completed its 2020 fiscal year with the following actual results. Detailed information about the companys budgeted performance is

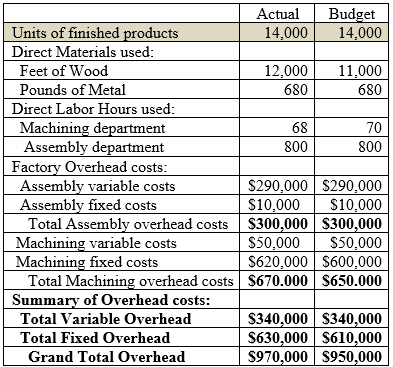

Assume that ABC Custom Parts. Inc. has completed its 2020 fiscal year with the following actual results. Detailed information about the companys budgeted performance is also provided in the table below for your convenience. The actual cost paid for metal was $110 per pound, not the $100 per pound expected. The cost paid for wood was the same as planned ($5.00 per foot). Assembly workers were paid at the expected rate ($15 per hour). Machining workers were paid $32 per hour instead of the expected $30 per hour.

1. Calculate the labor rate variances for the assembly department and the machining department. Suggest one likely cause.

2. calculate and identify one likely cause for the fixed overhead variance.

3.. If the actual units produced were 15,000 instead of the 14,000 shown in the table above and all other data in the table remained the same, discuss how that would affect your answers to in a-d. You do not necessarily need to redo your calculations, rather discuss how they would change (i.e., increase or decrease; big change, small change, no change).

Actual Budget Units of finished products 14,000 14,000 Direct Materials used: Feet of Wood 12,000 11,000 Pounds of Metal 680 680 Direct Labor Hours used: Machining department 68 70 Assembly department 800 800 Factory Overhead costs: Assembly variable costs $290,000 $290,000 Assembly fixed costs $10,000 $10,000 Total Assembly overhead costs $300,000 $300,000 Machining variable costs $50,000 $50,000 Machining fixed costs $620,000 $600,000 Total Machining overhead costs S670.000 $650.000 Summary of Overhead costs: Total Variable Overhead $340,000 $340,000 Total Fixed Overhead $630,000 $610,000 Grand Total Overhead $970,000 $950,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started