Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that after getting your Bachelor's degree in Higher College of Technology you wanted to pursue your Master's degree which University of Stanford is

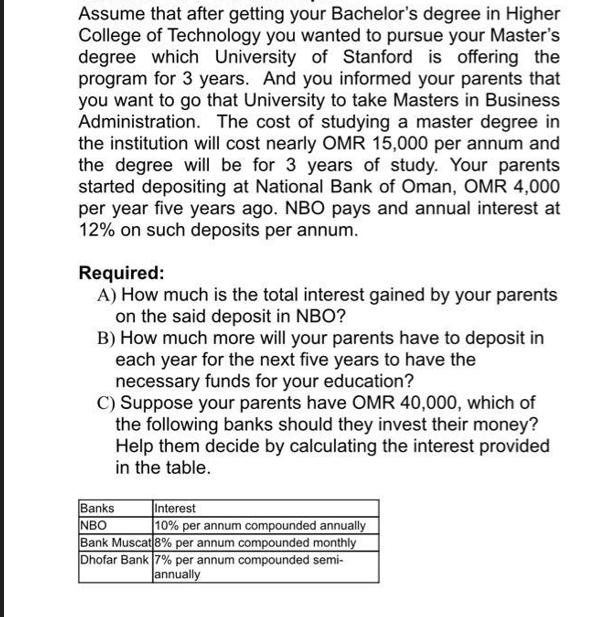

Assume that after getting your Bachelor's degree in Higher College of Technology you wanted to pursue your Master's degree which University of Stanford is offering the program for 3 years. And you informed your parents that you want to go that University to take Masters in Business Administration. The cost of studying a master degree in the institution will cost nearly OMR 15,000 per annum and the degree will be for 3 years of study. Your parents started depositing at National Bank of Oman, OMR 4,000 per year five years ago. NBO pays and annual interest at 12% on such deposits per annum. Required: A) How much is the total interest gained by your parents on the said deposit in NBO? B) How much more will your parents have to deposit in each year for the next five years to have the necessary funds for your education? C) Suppose your parents have OMR 40,000, which of the following banks should they invest their money? Help them decide by calculating the interest provided in the table. Banks NBO Interest 10% per annum compounded annually Bank Muscat 8% per annum compounded monthly Dhofar Bank 7% per annum compounded semi- annually

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution A Total Interest Gained by Parents We cant directly calculate the total interest for multiple years with a simple interest rate formula 12 We ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started