Answered step by step

Verified Expert Solution

Question

1 Approved Answer

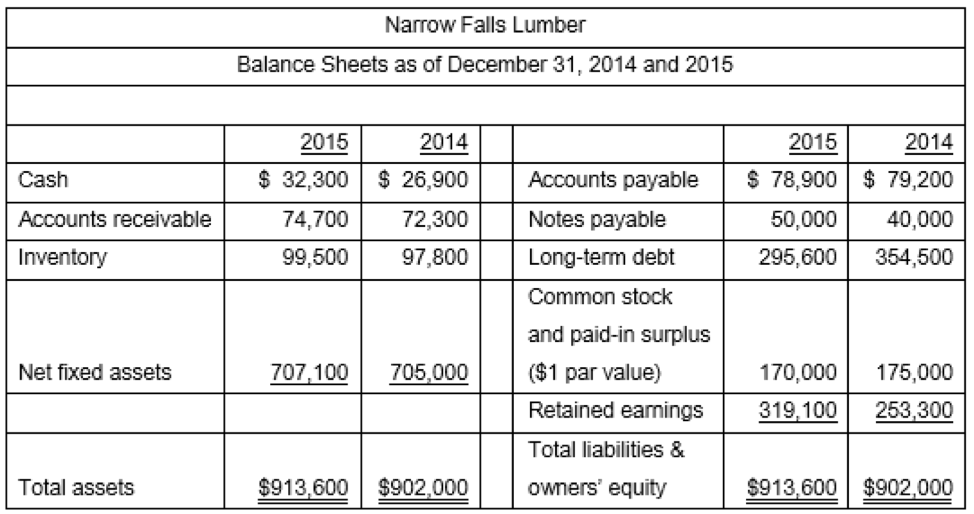

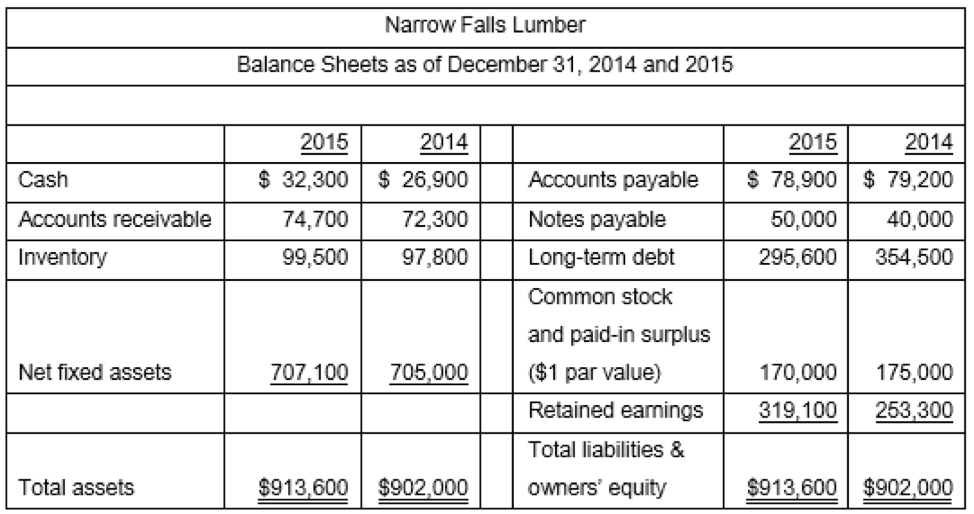

Assume that all costs, assets, and accounts payable change spontaneously with sales. For simplicitys sake, assume interest expense also changes spontaneously with sales (even though

Assume that all costs, assets, and accounts payable change spontaneously with sales. For simplicitys sake, assume interest expense also changes spontaneously with sales (even though you know if may not). The tax rate and dividend payout ratios remain constant. If the firms managers project a firm growth rate of 15 percent for next year, what will be the amount of external financing needed to support this level of growth?

Group of answer choices

$49,535

$68,211

$10,406

$13,909

$32,408

Narrow Falls Lumber Balance Sheets as of December 31, 2014 and 2015 2014 2015 $ 32,300 2014 $ 26,900 Cash Accounts receivable Inventory 2015 $ 78,900 50,000 295,600 74,700 99,500 72,300 97,800 $ 79,200 40,000 354,500 Accounts payable Notes payable Long-term debt | Common stock and paid-in surplus ($1 par value) Retained earnings Total liabilities & owners' equity Net fixed assets 707,100 705,000 170,000 319,100 175,000 253,300 Total assets $913,600 $902,000 $913,600 $902,000 Narrow Falls Lumber Balance Sheets as of December 31, 2014 and 2015 2014 2015 $ 32,300 2014 $ 26,900 Cash Accounts receivable Inventory 2015 $ 78,900 50,000 295,600 74,700 99,500 72,300 97,800 $ 79,200 40,000 354,500 Accounts payable Notes payable Long-term debt | Common stock and paid-in surplus ($1 par value) Retained earnings Total liabilities & owners' equity Net fixed assets 707,100 705,000 170,000 319,100 175,000 253,300 Total assets $913,600 $902,000 $913,600 $902,000 Narrow Falls Lumber Balance Sheets as of December 31, 2014 and 2015 2014 2015 $ 32,300 2014 $ 26,900 Cash Accounts receivable Inventory 2015 $ 78,900 50,000 295,600 74,700 99,500 72,300 97,800 $ 79,200 40,000 354,500 Accounts payable Notes payable Long-term debt | Common stock and paid-in surplus ($1 par value) Retained earnings Total liabilities & owners' equity Net fixed assets 707,100 705,000 170,000 319,100 175,000 253,300 Total assets $913,600 $902,000 $913,600 $902,000 Narrow Falls Lumber Balance Sheets as of December 31, 2014 and 2015 2014 2015 $ 32,300 2014 $ 26,900 Cash Accounts receivable Inventory 2015 $ 78,900 50,000 295,600 74,700 99,500 72,300 97,800 $ 79,200 40,000 354,500 Accounts payable Notes payable Long-term debt | Common stock and paid-in surplus ($1 par value) Retained earnings Total liabilities & owners' equity Net fixed assets 707,100 705,000 170,000 319,100 175,000 253,300 Total assets $913,600 $902,000 $913,600 $902,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started