Question

Assume that all potential ethical threats have been mitigated and your firm has accepted Magic Natural Ltd as an audit client. Consequently, Richard Craig has

Assume that all potential ethical threats have been mitigated and your firm has accepted Magic Natural Ltd as an audit client. Consequently, Richard Craig has asked you to plan for the audit of MN for the 2021 financial year. You need to perform a risk assessment outlining potential risks of material misstatement in this audit. Please note that the risk assessment is based on the information provided in the case study above as well as the company?s financial statements provided to you in the Excel file. Your risk assessment must cover the following:

a) Identify and analyze ten risk factors (conditions) that indicate a risk of material misstatement. (Please link the narratives of the company with financial statements when appropriate)

b) Explain which account and assertions might be misstated due to each risk factor.

c) Determine the audit strategies or procedures that may address the risk of material misstatement. Use the following format to present your answer

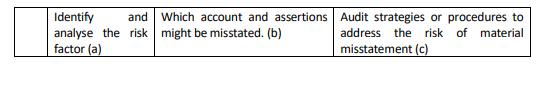

Use the following table format to present your answer from 1-10:

?

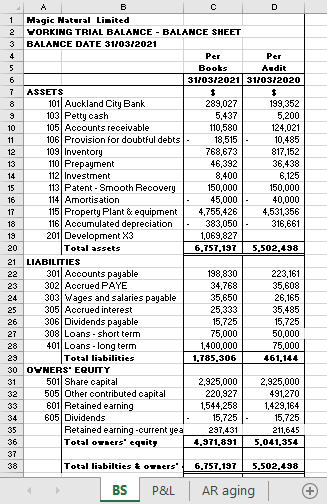

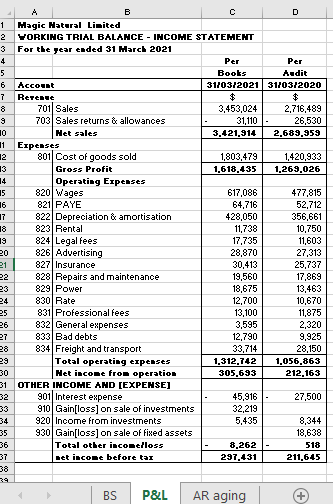

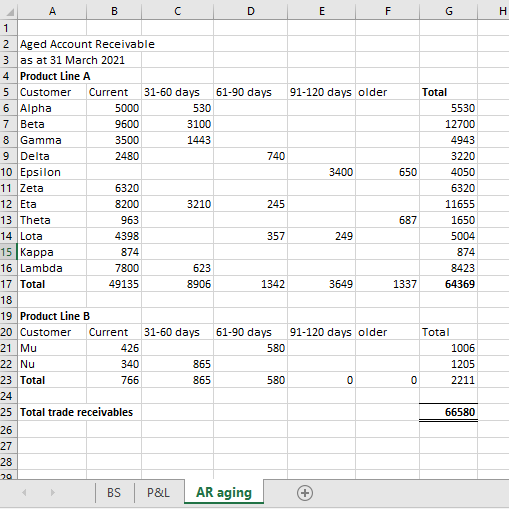

? Identify and Which account and assertions analyse the risk might be misstated. (b) factor (a) Audit strategies or procedures to address the risk of material misstatement (c) B 1 Magic Natural Limited 2 WORKING TRIAL BALANCE - BALANCE SHEET 3 BALANCE DATE 31/03/2021 4 5 6 7 ASSETS 8 9 *2=22-2=228583338538852335858 10 11 12 13 14 15 16 17 18 19 20 21 24 26 27 29 30 31 34 36 37 101 Auckland City Bank 103 Petty cash 105 Accounts receivable 106 Provision for doubtful debts 109 Inventory 110 Prepayment 112 Investment 113 Patent - Smooth Recovery 114 Amortisation 115 Property Plant & equipment 116 Accumulated depreciation 201 Development X3 Total assets LIABILITIES 301 Accounts payable Accrued PAYE 302 303 Wages and salaries payable 305 Accrued interest 306 Dividends payable 308 Loans-short term 401 Loans - long term Total liabilities OWNERS' EQUITY 501 Share capital Other contributed capital 505 601 Retained earning 605 Dividends Retained earning-current yea Total owners' equity Total liabilties & owners' C BS P&L Per Per Books Audit 31/03/2021 31/03/2020 $ $ 289,027 5,437 110,580 18,515 768,673 46,392 8,400 150,000 45,000 198,830 34,768 35,650 25,333 15,725 75,000 1,400,000 1,785,306 4,755,426 383,050 1,069,827 6,757,197 5,502,498 2,925,000 220,927 1,544,258 15,725- 297,431 4,971,891 D 6,757,197 199,352 5,200 124,021 10,485 817,152 36,438 6,125 150,000 40,000 4,531,356 316,661 AR aging 223,161 35,608 26,165 35,485 15,725 50,000 75,000 461,144 2,925,000 491,270 1,429,164 15,725 211,645 5,041,354 5,502,498 5 6 A 1 Magic Natural Limited 2 WORKING TRIAL BALANCE - INCOME STATEMENT 3 For the year ended 31 March 2021 4 7 8 9 10 1 12 13 14 15 16 17 18 20 21 22 23 24 25 26 27 29 30 31 32 33 34 35 36 37 38 Account Revenue 701 Sales 703 Sales returns & allowances Het sales Expenses B 801 Cost of goods sold Gross Profit Operating Expenses 820 Wages 821 PAYE 822 Depreciation & amortisation 823 Rental 824 Legal fees 826 Advertising 827 Insurance 828 Repairs and maintenance 829 Power 830 Rate 831 Professional fees 832 General expenses 833 Bad debts 834 Freight and transport Total operating expenses Het income from operation OTHER INCOME AND [EXPENSE] 901 Interest expense 910 Gain[loss] on sale of investments 920 Income from investments 930 Gain[loss] on sale of fixed assets Total other incomelloss net income before tax BS C P&L Per Books 31/03/2021 31/03/2020 $ $ 3,453,024 2,716,489 26,530 31,110 3,421,914 2,689,959 617,086 64,716 428,050 1,803,479 1,420,933 1,618,435 1,269,026 11,738 17,735 28,870 30,413 19,560 18,675 12,700 13,100 3,595 12,790 33,714 1,312,742 305,693 45,916 32,219 5,435 D 8,262 297,431 Per Audit AR aging 477,815 52,712 356,661 10,750 11,603 27,313 25,737 17,869 13,463 10,670 11,875 2,320 9,925 28,150 1,056,863 212,163 27,500 8,344 18,638 518 211,645 A B 1 2 Aged Account Receivable 3 as at 31 March 2021 4 Product Line A 5 Customer Current 6 Alpha 7 Beta 8 Gamma 9 Delta 10 Epsilon 11 Zeta 12 Eta 13 Theta 14 Lota 15 Kappa 16 Lambda 17 Total 18 19 Product Line B 20 Customer 21 Mu 22 Nu 23 Total 26 27 28 20 5000 9600 3500 2480 6320 8200 963 4398 874 7800 49135 426 340 766 24 25 Total trade receivables BS 31-60 days 530 3100 1443 3210 623 8906 D 865 865 61-90 days Current 31-60 days 61-90 days 580 740 P&L AR aging 245 357 1342 580 E 91-120 days older + 3400 249 3649 F 91-120 days older 0 650 687 1337 0 G Total 5530 12700 4943 3220 4050 6320 11655 1650 5004 874 8423 64369 Total 1006 1205 2211 66580 H

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution The following risk assessments ways are expressed in samples of risks of fabric statement ESOPs AICPA skilled Standards nd p 17 Risk of fabric statement CFI nd and playacting Audit Procedures ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started