Question

Assume that an investor acquired a small retail property five years ago at a cost of $200,000. The Apex Center was 15 years old at

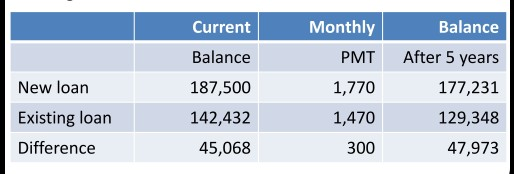

Assume that an investor acquired a small retail property five years ago at a cost of $200,000. The Apex Center was 15 years old at the time of purchase and was financed with a 75% mortgage made at 11% interest for 25 years. The investor uses straight line depreciation with 80% of the original price cost allocated to building and 20% to land. Assume at the time of purchase the property could be depreciated for 19 years. The marginal tax rate is 50% and the capital gain tax is 28%. The property could be sold for 250,000 today less the selling costs of 6%. If the property is sold at year 10 it would fetch 289,819 before selling costs of 6%. Assume the Apex center investor refinances at 10.5% for 25 years resulting in the following cash flows:

calculate the incremental cost of financing

Current Monthly New loan Existing loan Difference Balance 187,500 142,432 45,068 PMT 1,770 1,470 300 Balance After 5 years 177,231 129,348 47,973 Current Monthly New loan Existing loan Difference Balance 187,500 142,432 45,068 PMT 1,770 1,470 300 Balance After 5 years 177,231 129,348 47,973Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started