Question

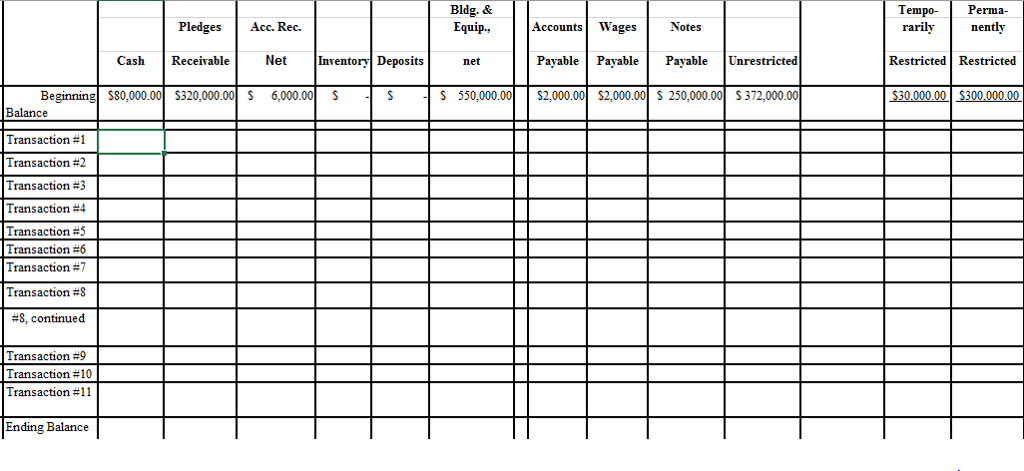

Assume that ANHC began the year with the following balances in their accounts: Record this information and the transactions as followed: Jan 2. New equiptment

Assume that ANHC began the year with the following balances in their accounts:

Record this information and the transactions as followed:

Jan 2. New equiptment with 10 year life for $80,000. No payment was made and the equiptment has not been delivered.

Jan 14. Received $100,000 payment on a pledge that had been made 3 years ago.

Feb 19. Bought $35,000 of books and posters that will be sold in the Center store. Only $20,000 was paid for the inventory on that date, the balance is owed to the suppliers/ ANHC expects to be able to sell the inventory for $60,000.

May 15. Paid a $30,000 deposit for the equiptment ordered Jan. 2.

July 12. Received the equiptment ordered on Jan. 2, and mailed a check for the balance due.

Dec 28. Admission fees for the year were $74,000. They were all collected.

Dec 28. ANHC paid its employees $68,000 of wages. Wage expense for the year is $73,000. The payment included the $2,000 wages payable balance outstanding from the previous year plus some payment for work done this year.

Dec 30. Book and poster sales for the year totaled $53,000. All but $3,000 of that amount has been collected. The entire $6,000 balance in accounts receivalbe from beginning of the year was also collected. The cost of the books and posters sold was $32,000.

Dec 31. ANHC makes a pyament of $134,000 on its long-term note. The amount includes interest expense of $7,000.

Dec 31. The Center building and equiptment are now one year older. The depreciation for the year is $60,000.

Dec 31. ANHC estimates that $1,000 of the receivables for book and poster sales made this year will never be collected.

Bldg. & Equip., Tempo- rarily nently Perma Pledges Acc. Rec. AccountsWages Notes Cash Receivable Net Inentory Deposits net Pavable Pavable Pavable Unrestricted Restricted Restricted Beginning80,000.00320,000.00 S 6,000.00 S S 550,000.00S2,000.00 $2,000.00 S 250,000.00S372,000.00 Balance Transaction #1 Transaction #2 Transaction #3 Transaction #4 Transaction #5 Transaction #6 Transaction #7 Transaction #8 #8, continued Transaction #9 Transaction #10 Transaction #11 Ending BalanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started