Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that, as a credit analyst , you are evaluating the company. Use the most appropriate ratios for the most recent year from the annual

Assume that, as a credit analyst, you are evaluating the company. Use the most appropriate ratios for the most recent year from the annual report and evaluate whether one should provide loan to this company. [Use at least 4 ratios].

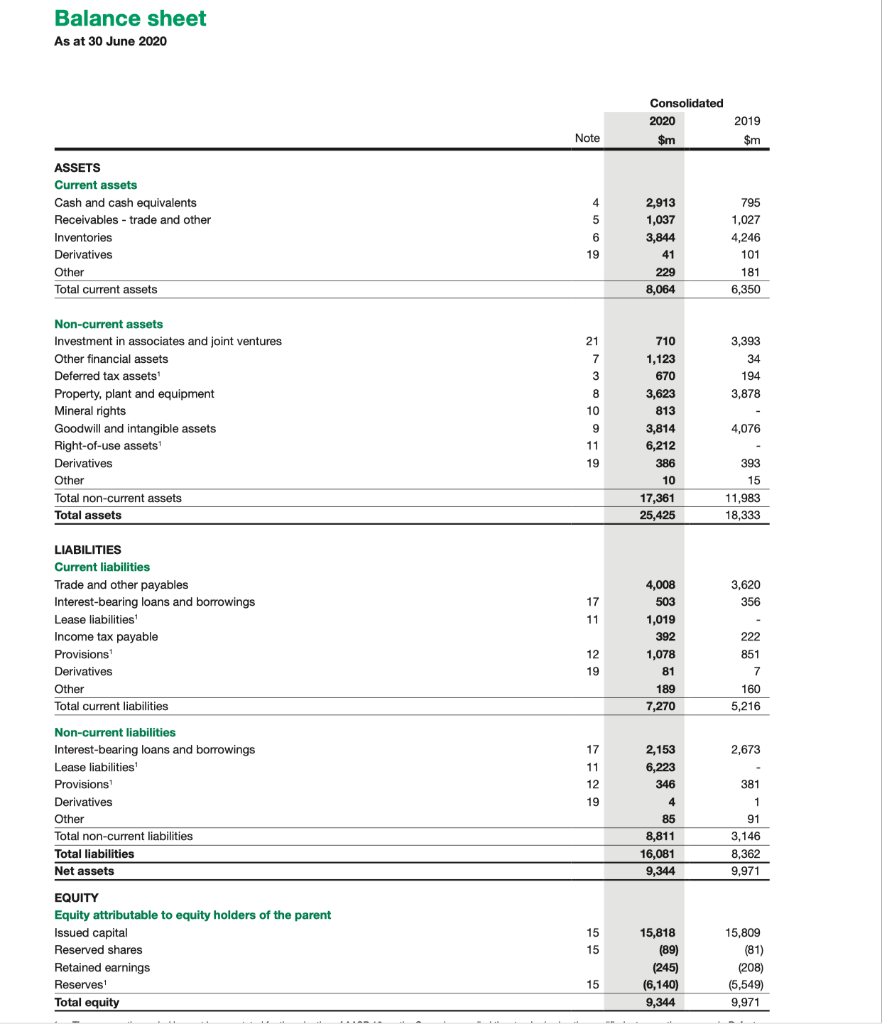

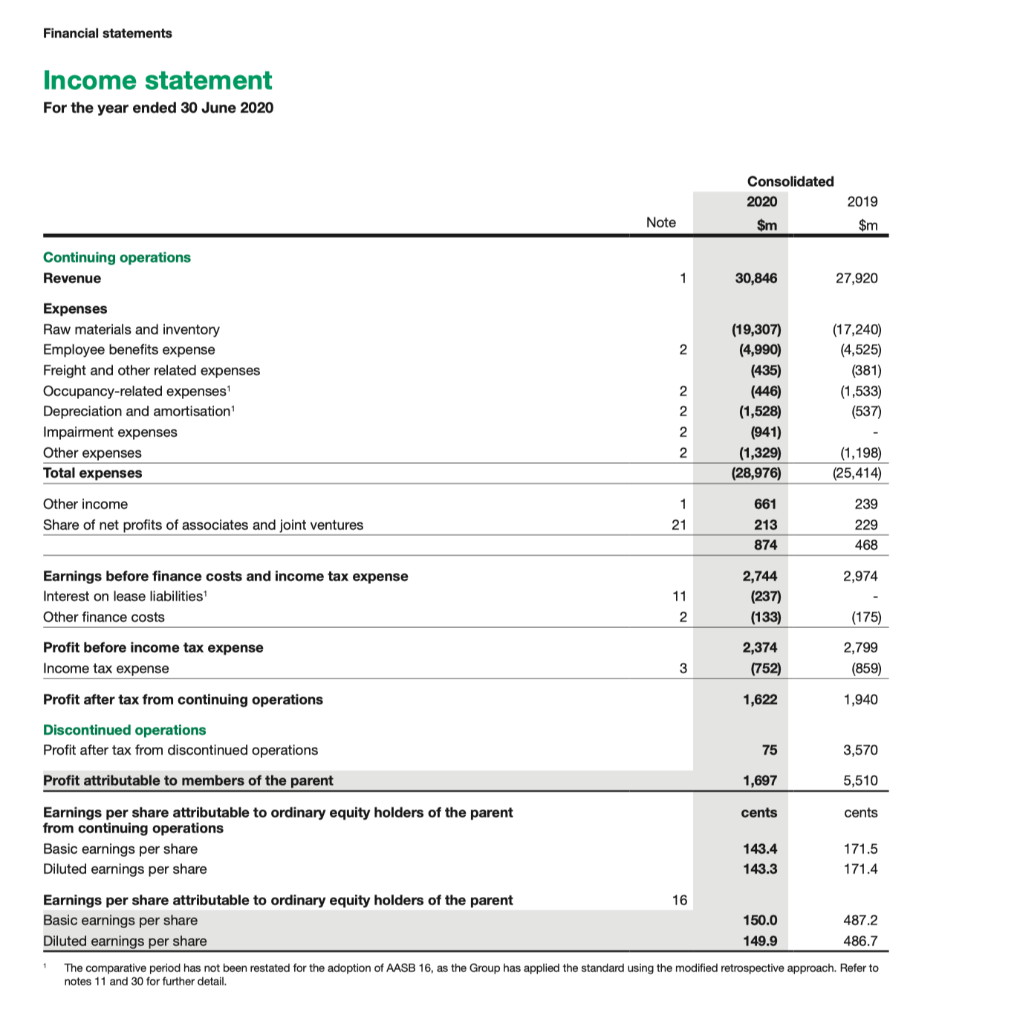

Balance sheet As at 30 June 2020 Consolidated 2020 $m Note 2019 $m ASSETS Current assets Cash and cash equivalents Receivables - trade and other Inventories Derivatives Other Total current assets 4 5 6 19 2,913 1,037 3,844 41 229 8,064 795 1,027 4,246 101 181 6,350 710 21 7 3 8 10 3,393 34 194 3,878 Non-current assets Investment in associates and joint ventures Other financial assets Deferred tax assets! Property, plant and equipment Mineral rights Goodwill and intangible assets Right-of-use assets Derivatives Other Total non-current assets Total assets 4,076 9 11 1,123 670 3,623 813 3,814 6,212 386 10 17,361 25,425 19 393 15 11,983 18,333 3,620 356 17 11 LIABILITIES Current liabilities Trade and other payables Interest-bearing loans and borrowings Lease liabilities Income tax payable Provisions Derivatives Other Total current liabilities 4,008 503 1,019 392 1,078 81 189 7,270 12 19 222 851 7 160 5,216 17 2,673 11 12 2,153 6,223 346 381 19 1 Non-current liabilities Interest-bearing loans and borrowings Lease liabilities Provisions Derivatives Other Total non-current liabilities Total liabilities Net assets EQUITY Equity attributable to equity holders of the parent Issued capital Reserved shares Retained earnings Reserves Total equity 4 85 8,811 16,081 9,344 91 3,146 8,362 9,971 15 15 15,818 (89) (245) (6,140) 9,344 15,809 (81) (208) (5,549) 9,971 15 Financial statements Income statement For the year ended 30 June 2020 Consolidated 2020 $m 2019 Note $m Continuing operations Revenue 1 30,846 27,920 2 Expenses Raw materials and inventory Employee benefits expense Freight and other related expenses Occupancy-related expenses Depreciation and amortisation Impairment expenses Other expenses Total expenses (19,307) (4,990) (435) (446) (1,528) (941) (1,329) (28,976) (17,240) (4,525) (381) (1,533) (537) 2 2 2 2 (1,198) (25,414) Other income Share of net profits of associates and joint ventures 1 21 661 213 874 239 229 468 2,744 2,974 Earnings before finance costs and income tax expense Interest on lease liabilities Other finance costs 11 (237) 2 (133) (175) Profit before income tax expense Income tax expense 2,374 (752) 2,799 (859) 3 1,622 1,940 Profit after tax from continuing operations Discontinued operations Profit after tax from discontinued operations 75 3,570 1,697 5,510 cents cents Profit attributable to members of the parent Earnings per share attributable to ordinary equity holders of the parent from continuing operations Basic earnings per share Diluted earnings per share Earnings per share attributable to ordinary equity holders of the parent Basic earnings per share Diluted earnings per share 143.4 143.3 171.5 171.4 16 487.2 150.0 149.9 486.7 The comparative period has not been restated for the adoption of AASB 16, as the Group has applied the standard using the modified retrospective approach. Refer to notes 11 and 30 for further detail

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started