Answered step by step

Verified Expert Solution

Question

1 Approved Answer

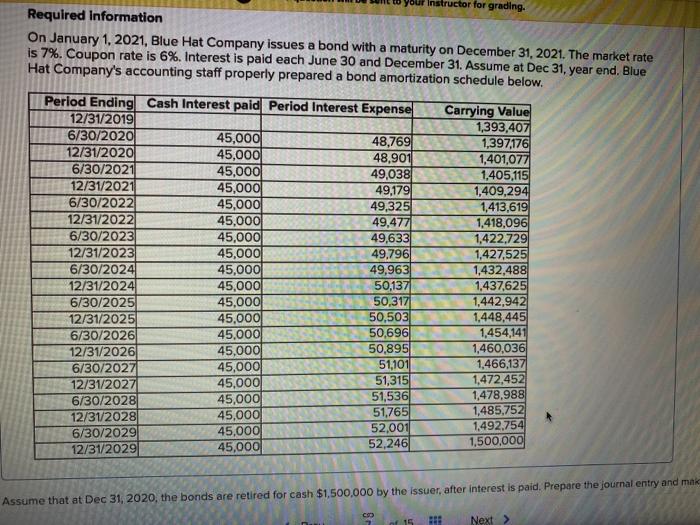

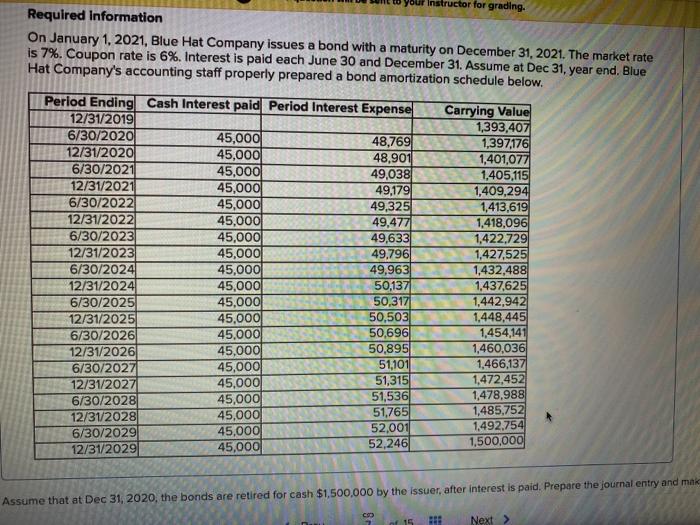

assume that at december 31,2020, the bonds are retired for cash 1,500,000 by the issuer, after interest is paid. prepare the jornal entry and make

assume that at december 31,2020, the bonds are retired for cash 1,500,000 by the issuer, after interest is paid. prepare the jornal entry and make sure to record either a gain or loss on bond redemption.

Instructor for grading. Required Information On January 1, 2021, Blue Hat Company issues a bond with a maturity on December 31, 2021. The market rate is 7%. Coupon rate is 6%. Interest is paid each June 30 and December 31. Assume at Dec 31, year end. Blue Hat Company's accounting staff properly prepared a bond amortization schedule below. Period Ending Cash Interest paid Period Interest Expense 12/31/2019 6/30/2020 45,000 48,769 12/31/2020 45,000 48.901 6/30/2021 45,000 49,038 12/31/2021 45,000 49,179 6/30/2022 45,000 49,325 12/31/2022 45,000 49,4771 6/30/2023 45,000 49,633 12/31/2023 45,000 49.796 6/30/2024 45,000 49,963 12/31/2024 45,000 50,137 6/30/20251 45,000 50,317 12/31/2025 45,000 50,503 6/30/2026 45.000 50,696 12/31/2026 45,000 50,895 6/30/2027 45,000 51,101 12/31/2027 45,000 51,3151 6/30/2028 45,000 51,536 12/31/2028 45,000 51,765 6/30/2029 45,000 52,001 12/31/2029 45,000 52,246 Carrying Value 1,393,407 1,397,176 1,401,077 1,405,115 1,409,294 1,413,619 1,418,096 1,422,729 1,427,525 1,432,488 1,437,625 1,442,942 1.448,445 1,454,141 1,460,036 1,466,137 1,472,452 1,478,988 1,485,752 1,492.754 1,500,000 Assume that at Dec 31, 2020, the bonds are retired for cash $1,500,000 by the issuer, after interest is paid. Prepare the journal entry and make 15 Next >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started