Question

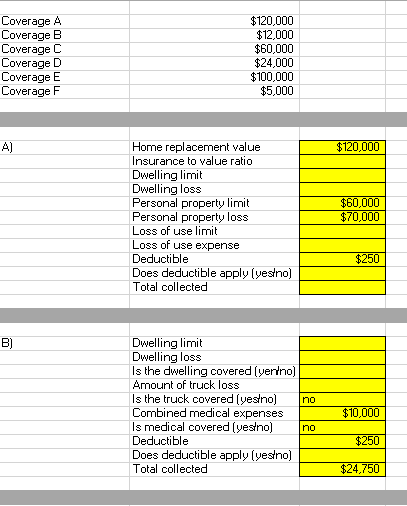

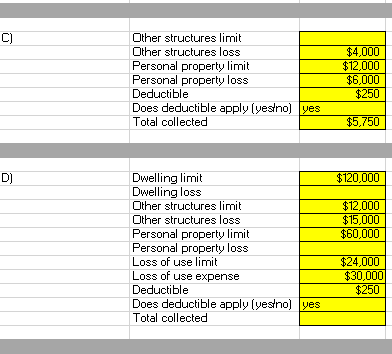

Assume that Bill Blanton owns a HO-3 policy for his home. The limits set in his policy are provided below: Type Coverage A Coverage B

Assume that Bill Blanton owns a HO-3 policy for his home. The limits set in his policy are provided below:

| Type | Coverage A | Coverage B | Coverage C | Coverage D | Coverage E | Coverage F |

| Limit | $120,000 | $12,000 | $60,000 | $24,000 | $100,000 | $5,000 |

A $250 deductible applies to Section 1, Coverages A, B, and/or C. The replacement cost of Bills home is $130,000, the contents are valued at $70,000, and the home is 30 percent depreciated. Compute the amount that Bill will collect in each of the following circumstances and assume that each event occurs separately. Note: a deductible will only apply if losses are less than the coverage limit.

- Bills house and all its contents are destroyed by a tornado. It takes six months to rebuild the home, and Bills additional living expenses amount to $10,000.

- A neighbors eight-year-old child accidentally releases the brakes on his familys pickup truck, sending it crashing into Bills home. Damage to the home amounts to $25,000. The truck is destroyed. Its ACV before the loss was $22,000. The child and Bill both suffer a broken arm. Medical expenses amount to $5,000 for each person.

- Bills unattached tool shed burns, destroying the shed (damage = $6,000) and the lawn-care equipment inside (damage = $4,000).

- Bill negligently starts a fire while cooking. His home, all the contents, and tool shed (value of $15,000) are a total loss. It costs Bill an additional $30,000 to live in a rental home while his house is being rebuilt.

Coverage A Coverage B Coverage C Coverage D Coverage E Coverage F $120,000 $12,000 $60.000 $24,000 $100,000 $5,000 A) $120,000 Home replacement value Insurance to value ratio Dwelling limit Dwelling loss Personal property limit Personal property loss Loss of limit Loss of use expense Deductible Does deductible apply (yeso) Total collected $60,000 $70,000 $250 B) no Dwelling limit Dwelling loss Is the dwelling covered (yerino) Amount of truck loss Is the truck covered (yesino) Combined medical expenses Is medical covered (yestno) Deductible Does deductible apply (yeso) Total collected $10,000 no $250 $24,750 C) Other structures limit Other structures loss Personal property limit Personal property loss Deductible Does deductible apply (yeso) yes Total collected $4,000 $12,000 $6,000 $250 $5,750 D) $120,000 $12,000 $15,000 $60,000 Dwelling limit Dwelling loss Other structures limit Other structures loss Personal property limit Personal property loss Loss of use limit Loss of use expense Deductible Does deductible apply (yesino) yes Total collected $24,000 $30,000 $250 Coverage A Coverage B Coverage C Coverage D Coverage E Coverage F $120,000 $12,000 $60.000 $24,000 $100,000 $5,000 A) $120,000 Home replacement value Insurance to value ratio Dwelling limit Dwelling loss Personal property limit Personal property loss Loss of limit Loss of use expense Deductible Does deductible apply (yeso) Total collected $60,000 $70,000 $250 B) no Dwelling limit Dwelling loss Is the dwelling covered (yerino) Amount of truck loss Is the truck covered (yesino) Combined medical expenses Is medical covered (yestno) Deductible Does deductible apply (yeso) Total collected $10,000 no $250 $24,750 C) Other structures limit Other structures loss Personal property limit Personal property loss Deductible Does deductible apply (yeso) yes Total collected $4,000 $12,000 $6,000 $250 $5,750 D) $120,000 $12,000 $15,000 $60,000 Dwelling limit Dwelling loss Other structures limit Other structures loss Personal property limit Personal property loss Loss of use limit Loss of use expense Deductible Does deductible apply (yesino) yes Total collected $24,000 $30,000 $250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started