Answered step by step

Verified Expert Solution

Question

1 Approved Answer

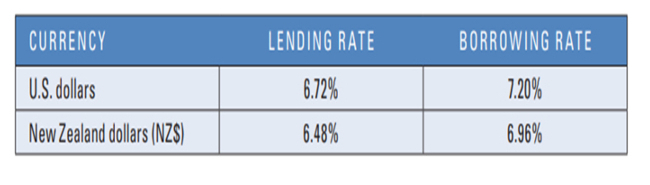

Assume that Carbondale Co . expects an exchange rate table [ [ CURRENCY , LENDING RATE,BORROWING RATE ] , [ U . S .

Assume that Carbondale Co expects an exchange rate tableCURRENCYLENDING RATE,BORROWING RATEUS dollars,of $ for the New Zealand dollar on day It can borrow New Zealand dollars, convert them to US dollars, and lend the US dollars out. On day it will close out these positions. Using the rates quoted in the previous example and assuming that the firm can borrow NZ$ million,

What steps should Carbondale take?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started