Answered step by step

Verified Expert Solution

Question

1 Approved Answer

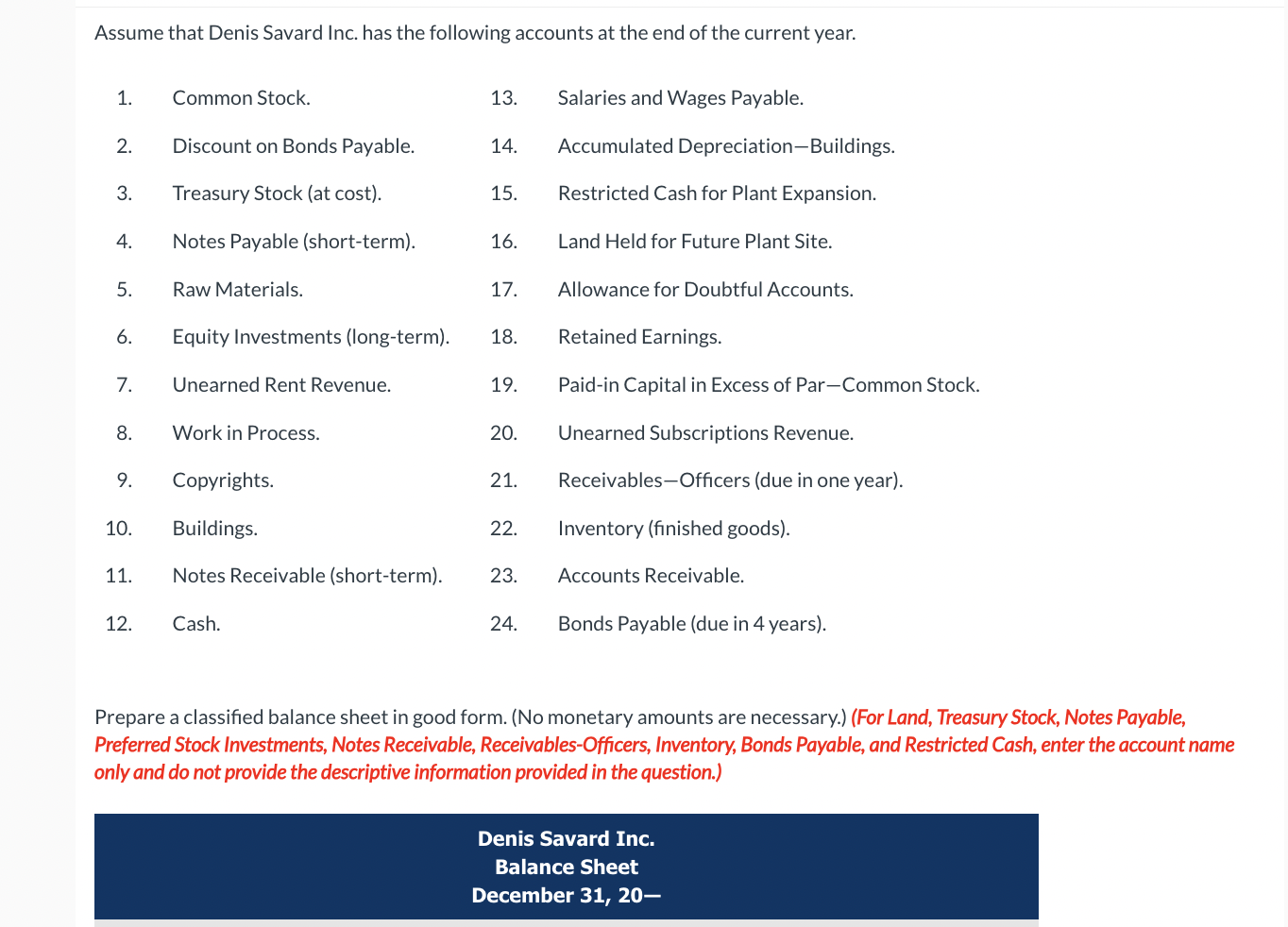

Assume that Denis Savard Inc. has the following accounts at the end of the current year. 1. Common Stock. 2. Discount on Bonds Payable. 3.

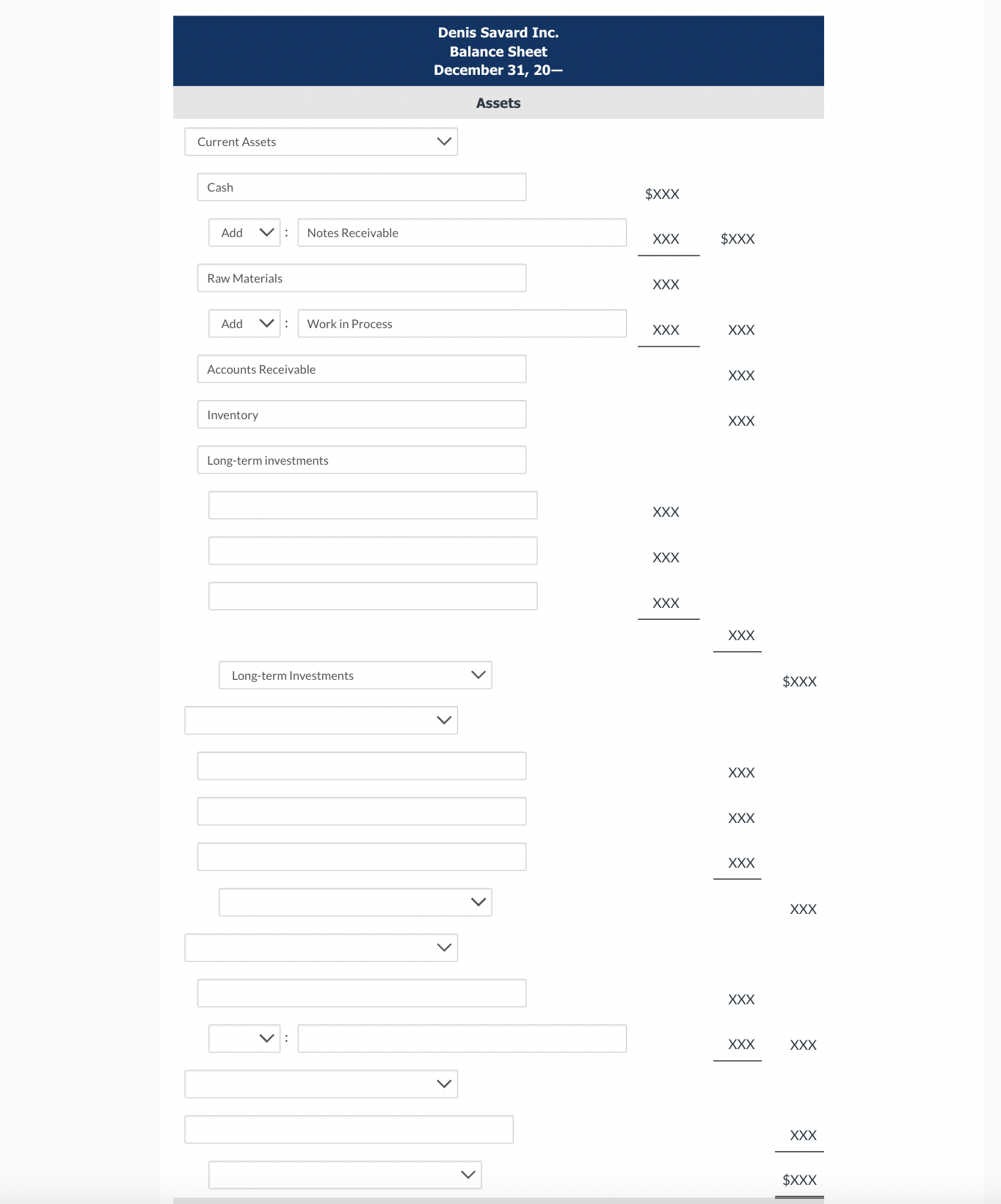

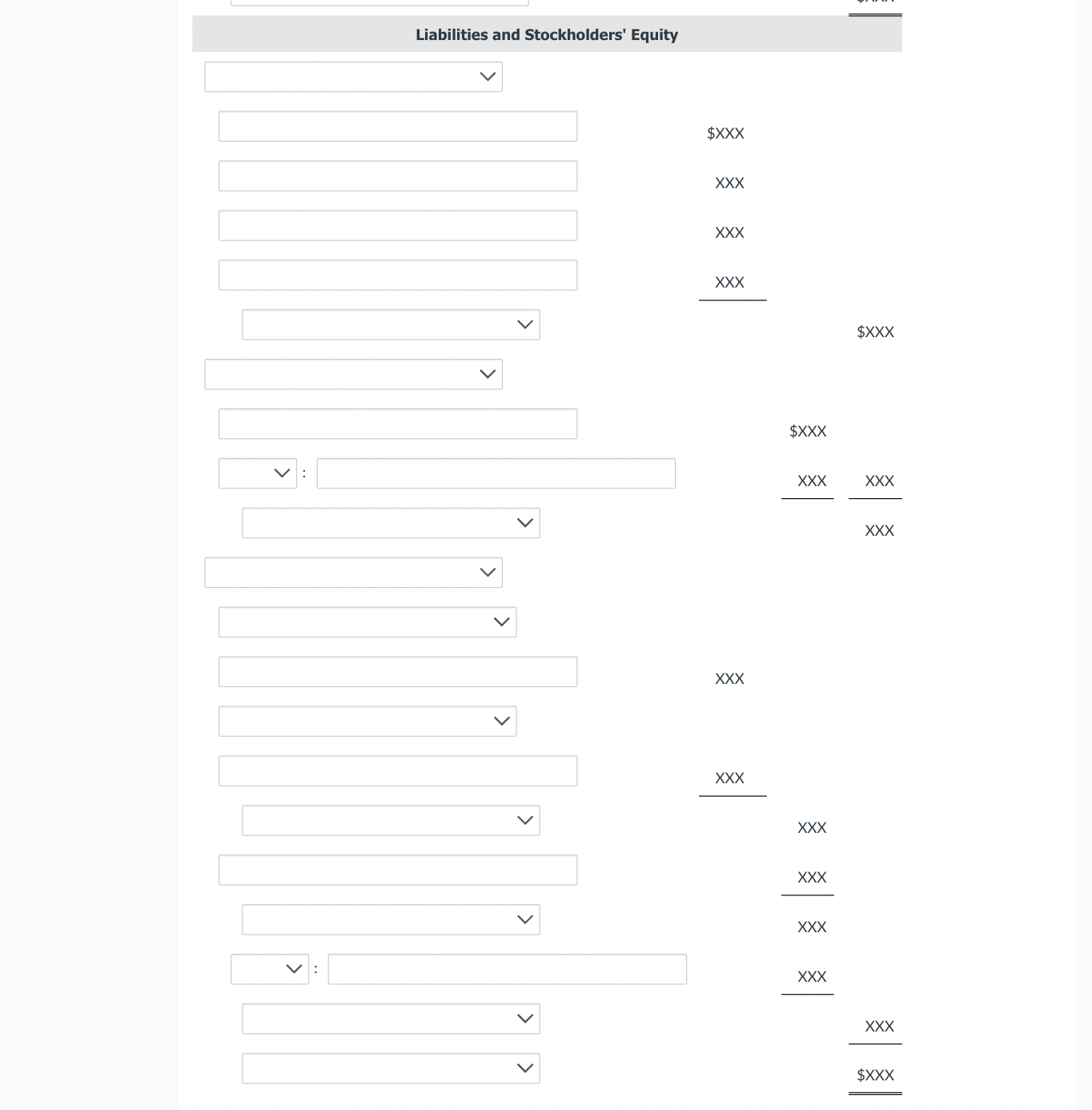

Assume that Denis Savard Inc. has the following accounts at the end of the current year. 1. Common Stock. 2. Discount on Bonds Payable. 3. Treasury Stock (at cost). 4. Notes Payable (short-term). 5. Raw Materials. 6. Equity Investments (long-term). 7. Unearned Rent Revenue. 8. Work in Process. 9. Copyrights. 10. Buildings. 11. Notes Receivable (short-term). 12. Cash. 13. Salaries and Wages Payable. 14. Accumulated Depreciation-Buildings. 15. Restricted Cash for Plant Expansion. 16. Land Held for Future Plant Site. 17. Allowance for Doubtful Accounts. 18. Retained Earnings. 19. Paid-in Capital in Excess of Par-Common Stock. 20. Unearned Subscriptions Revenue. 21. Receivables-Officers (due in one year). 22. Inventory (finished goods). 23. Accounts Receivable. 24. Bonds Payable (due in 4 years). Prepare a classified balance sheet in good form. (No monetary amounts are necessary.) (For Land, Treasury Stock, Notes Payable, Preferred Stock Investments, Notes Receivable, Receivables-Officers, Inventory, Bonds Payable, and Restricted Cash, enter the account name only and do not provide the descriptive information provided in the question.) Denis Savard Inc. Balance Sheet December 31, 20- Assets Current Assets Cash $XXX Add V : Notes Receivable Raw Materials XXX$XXX Raw Materials XXX Add V: Work in Process Accounts Receivable Inventory Long-term investments \begin{tabular}{l} XXX \\ XXX \\ XXXXXX \\ \hline \end{tabular} $XXX Long-term Investments XXX XXX XXX Liabilities and Stockholders' Equity \begin{tabular}{l} $XXX \\ XXX \\ XXX \\ XXX \\ \hline \end{tabular} $XXX $XXX xXXXXX XXX XXX xXX XXXXXX XXX XXX$XXX

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started